Other parts of this series:

To wrap up our series on investment ideas for insurers for 2021, we’re going to present some ideas for reinsurers.

Reinsurers have been under pressure to be nimble for some time. The need to invest in agility will continue throughout 2021. With many sectors of the insurance market under premium pressure from the emerging economic crisis, carriers can expect increased quote volumes, pricing pressure, and the potential for related premium reduction.

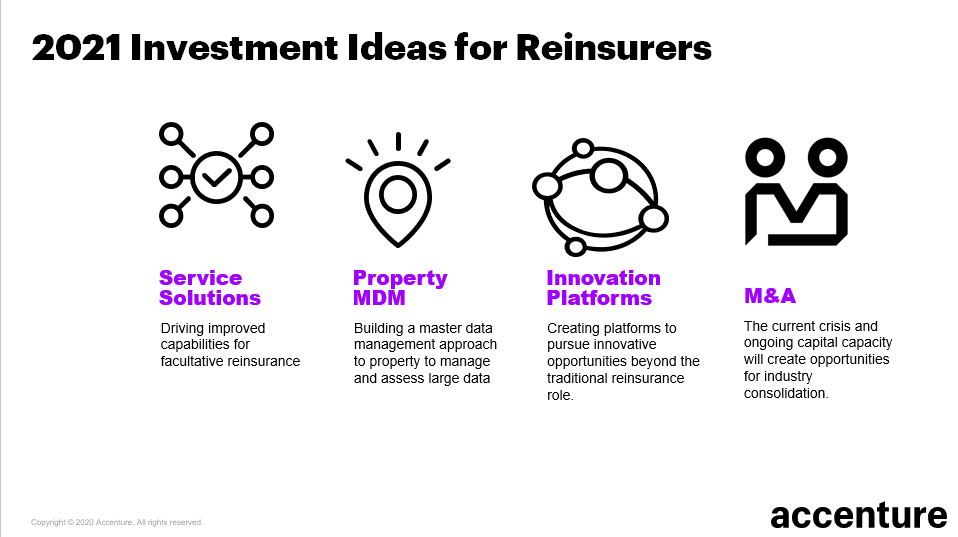

So how can reinsurers weather the storm and come out stronger? We see four key plays to consider.

Improve service solutions with partnerships and automation: As carriers look to become more effective and efficient in their underwriting processes and brokers look for higher quote volumes, the ability to quickly and efficiently deliver facultative quotes will be a source of competitive advantage. Improvements in these services can include developing connectivity with key platforms such as Duck Creek, Guidewire, and Majesco to reduce data entry by underwriters; and increased automation to allow for faster decisions.

Bolster property data management: Reinsurers lead the insurance industry in assessing and managing large-scale property risk thanks to their strong enterprise risk management capabilities. The ongoing explosion of new data sources and capabilities means 2021 provides opportunities to improve your property data management even more. Leading carriers are moving to big data platforms that can store, cleanse, and evaluate property data at the parcel, building, and tenant level. This nodal structure allows for ingestion of different types of data at different levels and for AI algorithms to be used to help determine the most accurate information. Merging this with new flood, weather, and other models can help carriers to take their data management to the next level.

Build innovative platforms to seize new opportunities: One of the more interesting trends in reinsurance has been the growing willingness to move beyond the traditional role of being a backstop to insurance carriers. Increasingly we see reinsurers willing to back start-ups or program key coverage. With emerging convergent opportunities created by super services and bundled solutions that include insurance, the upside of innovating is only going to grow. Reinsurers will need innovative platforms that will allow them to provide rating and pricing services to these groups to compete for these opportunities.

Mergers and acquisitions: The emerging economic distress is likely to accelerate the reinsurance consolidation we’ve seen. A “buyer’s market” is looming. If you’re in a good position to acquire, economic pressures may help drive down valuations and making certain targets more attractive. So consider whether or not acquisition should be part of your 2021 strategy.

We hope that this series has given you some investment ideas to consider as you plan for 2021. As 2020 has repeatedly demonstrated, change is inevitable. The winners will be the ones that can best adapt.

And of course if you need a partner to help think through or reach your goals, we’d love to hear from you.