Other parts of this series:

Moves by carriers to broaden their offerings beyond insurance are likely to be welcomed by consumers – if the price is right.

Reacting to rising competition in their traditional markets, many insurers are widening their sights. Carriers such as Allianz, AXA, Ping An and Zurich are launching an array of new services that stretch well beyond conventional insurance.

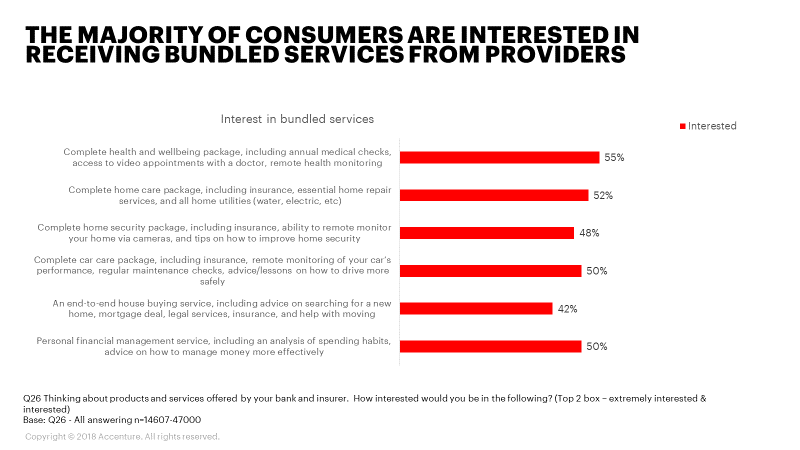

Our Global Financial Services Consumer Study shows there’s a strong demand for carriers’ “beyond-insurance” offerings. These offerings bundle traditional insurance propositions with value-added services that are frequently provided by eco-system partners. Around half the 47 000 consumers we canvassed around the world were interested in these new-generation products and services.

Consumers have evolved and new insurance trends have emerged in our Insurance Consumer Study 2021 report.

Insurance Consumer Study 2021 report." data-analytics-module-name="aib-series-block" data-analytics-component-name="aib-series-block" data-analytics-template-zone="series-block" data-analytics-link-type="navigation" data-analytics-content-class="Content" data-analytics-engagement="1">Read our latest researchAs shown in the illustration below, consumers expressed similar high-levels of interest across all major lines of insurance. They were keen, for example, on health insurance combined with wellness programs, home care packages and integrated motor cover that included car maintenance and driving coaching.

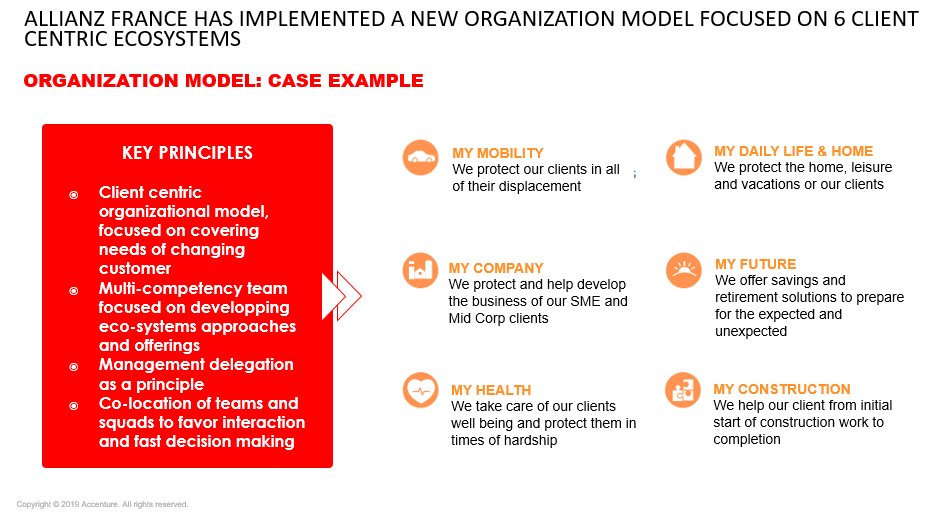

To meet consumer demand for such bundled services, insurers will need to expand their business models and hook into digital ecosystems that connect a spread of different product and service providers. This will require new approaches to product development and the building of organizational structures and systems as well as IT capabilities. One striking example of the impact of eco-system approaches on insurance product offerings is Allianz France. The company has reorganized its marketing, actuarial, legal and marketing teams since it embraced an eco-system strategy (See illustration).

Insurers will also need to up their marketing so that they reach the correct customers. While the majority of consumers are interested in new bundled offerings, significantly fewer are keen to pay for them. Only 35 percent of consumers were willing to pay for comprehensive wellness services, for instance. Fewer, just 34 percent, were keen on paying for a comprehensive home care package and just 30 percent would shell out for a bundled auto-cover offering.

It’s important to note that the consumers most likely to pay for bundled insurance products don’t conform to traditional marketing profiles. Conventional indicators such as age, education, income and employment are becoming less relevant in the highly-interconnected digital economy. New approaches to understanding customers are essential.

To better understand today’s insurance and banking customers we took a close look at how people perceive, and interact with, these organizations. In this research we grouped customers into four distinct “personas” – Pioneers, Pragmatists, Skeptics and Traditionalists.

Pioneers were, by far, the consumers most receptive to bundled, or integrated, propositions from their insurance company or bank. Around 80 percent expressed interest in these offerings and 60 percent were willing to pay for them. Pioneers tend to be tech-savvy, open to innovation and comfortable using mobile devices to engage with financial services providers. As I mentioned in my previous blog post, we identified nearly a quarter of the people we surveyed as Pioneers.

Better understanding of customers, and their specific needs and preferences, in order to personalize service offering at the right time, will enable insurers to meet the growing demand for bundled products and services. These personalized, integrated offerings will strengthen ties with customers while also generating new sources of revenue. The days of one-size-fits-all insurance products are fast coming to an end and new data and intent-driven marketing approaches will need to be implemented. A good example of such new marketing approaches is the “Love Index” developed by my colleagues from Fjord in France.

In my next blog post, I’ll share further insights from our Global Financial Services Consumer Study and discuss some of its key findings on personalized insurance offerings. Until then, have a look at some of these links. I think you’ll find then useful.