Other parts of this series:

Blockchain has received a lot of hype, but in this blog series I want to focus on an area of insurance where I see actual potential: ecosystem partnerships. As firms seek to join more ecosystems with partners ranging from brokers to repair shops and other service providers, insurers need to find a scalable way to manage all of those relationships and provide a seamless customer experience.

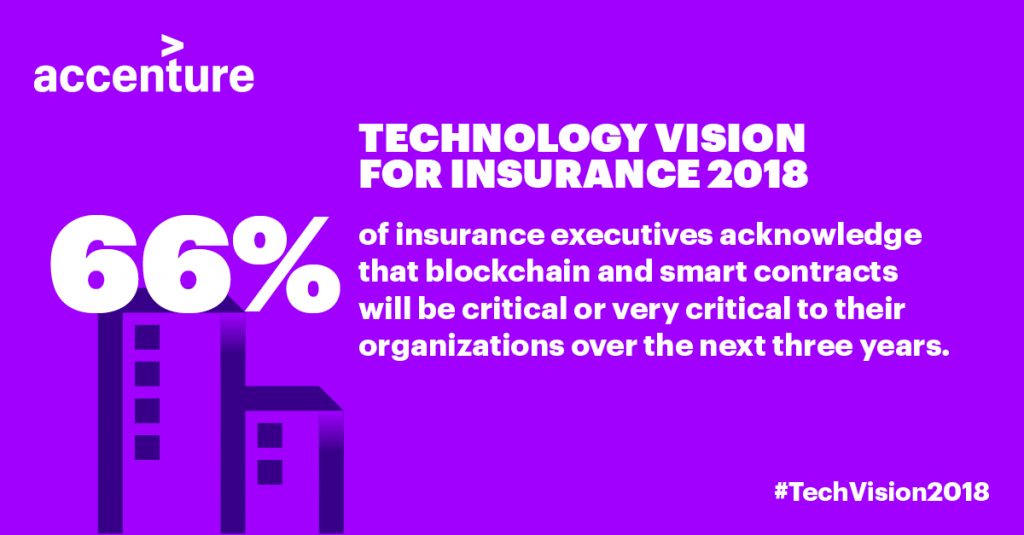

While some insurance executives are still unsure whether the regulatory risks associated with blockchain are worth the investment, others are already exploring this emerging technology and could leave the more risk-averse organizations wishing they had started earlier.

Insurance executives know that blockchain has game-changing implications for the industry. It could change the way insurers operate internally and with their partners and customers. What currently is a siloed, slow and error-prone approach to data management and service delivery could be automated with blockchain, driving efficiency. The immutability of blockchain, enabled by cryptography, can improve collaboration, security, and data reconciliation.

Smart contracts, which are essentially very sophisticated what-if scenarios that trigger specific actions, can act as a digital trust surrogate between organizations. This will make it possible for insurers to pursue new ecosystems and partners. The technology can facilitate consensus and verify authenticity without manual effort. Transactions become more transparent to all parties involved and data is visible in real-time.

Customers are demanding convenience, particularly with digital experiences. With blockchain, insurers can connect to ecosystems that work hard, but subtly in the background, reducing a customer’s need to coordinate between different services.

Many leading insurers are partnering with insurtech startups and other technology companies to explore the viability of blockchain.

AXA has launched fizzy, a blockchain-based platform for parametric insurance against delayed flights. Flight delay insurance purchases are recorded in the Ethereum blockchain and a smart contract connects the customer to global air traffic databases. When delays are longer than two hours, the customer receives automatic compensation. Sompo Japan Nippokoa Holdings Inc. is also trialling blockchain technology for parametric insurance products.

Allianz, Nephila Capital and blockchain startup Symbiont have successfully piloted a catastrophe swap using smart contract technology.

Hannover Re, China Re, Germany General Re (Gen Re) and Zhong An Technology have launched an intercompany trading platform to support blockchain’s use in the Chinese reinsurance market.

Tokio Marine & Nichido (TMNF), in partnership with Fukuoka City, have invented a way to share medical information on the blockchain. The Japanese P&C insurer has also successfully trialled a blockchain-based insurance policy for marine cargo insurance certificates.

Accenture has developed a proof-of-concept for a blockchain-based vineyard insurance service that leverages data from smart sensors.

These are only a handful of examples that show the innovation occurring around blockchain in the insurance industry right now. Frictionless partnerships, a concept I’ll dive into in my next post, are at the center of the solution. While customers may not be able to see what’s happening, they will benefit from the speed and convenience blockchain brings to ecosystem experiences.

Further reading: