Other parts of this series:

Progressive lenders have turned the threat of open banking regulations into a catalyst for business growth.

Carriers can learn valuable lessons about open insurance from their counterparts in banking.

Open banking rules, particularly PSD2 regulations in Europe, have forced banks to share their customer information. Some progressive lenders have turned this threat to their businesses into a big opportunity. They’re using data-sharing ecosystems to reach more customers and launch new products. They’re also teaming up with promising business partners and expanding into fresh markets.

So, what can insurers learn from open banking?

It’s unlikely that regulators will force insurers to go the same route as banks any time soon. Yet other forces, as I mentioned earlier in this blog series, are driving insurers to share more data. What are these disruptive forces? Let me recap. There’s growing demand among consumers for integrated, personalized data-rich services. There’s little doubt that this trend is prompting insurers to exchange data. Rising competition for tech firms offering insurance products is another factor. The most powerful force is the rise of expansive digital ecosystems. Many of these ecosystems include insurance offerings.

Banks lost the exclusive ownership of their customers’ payments data.

Let’s look at how banks changed when confronted with the demands of open banking. What was the biggest change? Banks no longer held exclusive rights to their customers’ payments data. Now, any organizations that had permission from the regulator could access this information. They could see consumption habits, buying power and the purchasing traits of account holders. This put much of the banks’ traditional business at risk. Not only payment services but deposits, credit cards, loans and wealth management were also vulnerable.

The arrival of open banking also attracted a swarm of fintech firms to the banking industry. Several big digital service providers also joined the fray. These newcomers homed in on the payments arena. They deployed innovative digital solutions that soon generated big revenues. The market capitalization of new payments businesses such as Square, Stripe, PayPal, Venmo and iZettle reached a high of more than US$300 billion. The payments businesses of the big banks have shrunk.

Once they’d got a foothold in the payments sector, tech businesses started disrupting other parts of the banking market. They customized their successful payments solutions to offer more innovative services. Square, for example, introduced payroll, point-of-sale, ecommerce and customer engagement services. Another fintech firm, Revolut quickly expanded its banking business. It grew from being a start-up disrupting the funds transfer business to become a full-service international bank. It achieved this in a mere four years.

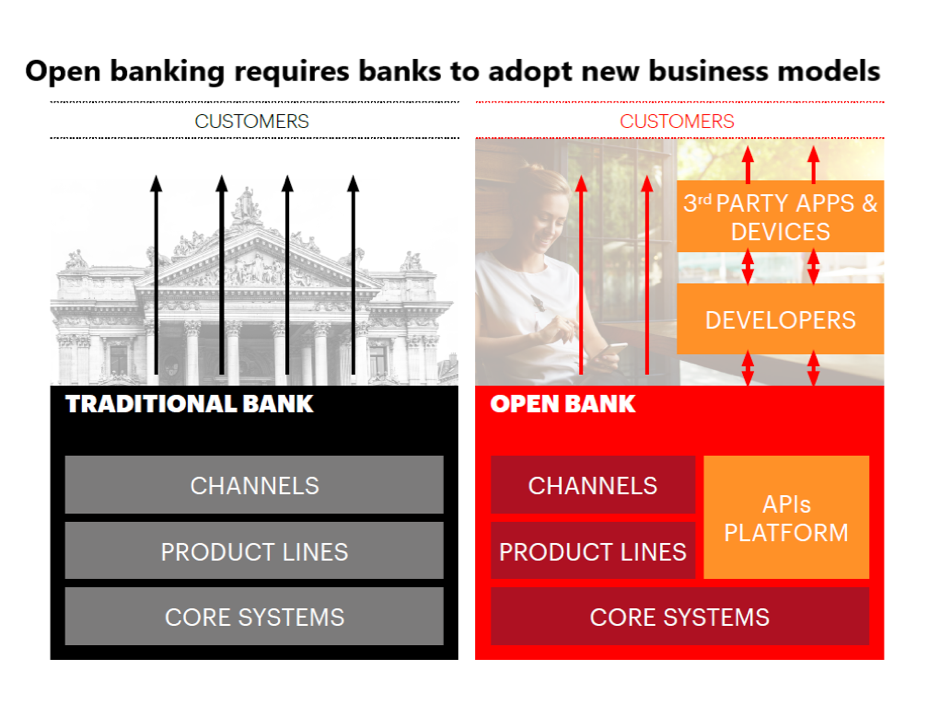

Companies that have thrived because of open banking all got the same thing right. They developed effective ecosystem strategies. Many of them have become impressive platform businesses. They’ve developed business models that connect people and processes with powerful platforms rich with application programming interfaces (APIs). They can then manage vast numbers of user interactions within and outside their organizations. The diagram below shows how these business models are very different from traditional banking practices.

Some banks have opted not to become platform businesses. They’ve chosen to stick to the basic requirements of the open banking rules. They give other organizations access to their customer information. Nothing more. They’ve in effect become data utilities.

Other banks have risen to the challenge. They see the huge opportunities that open banking has created. It has given access to vast amounts of high-quality customer data. RBS subsidiary NatWest, Bank of America and Santander are among the front runners. NatWest is using its technology platform to distribute an array of banking products. Bank of America has extended its distribution channels across third-party platforms. This enables the bank to reach a wider audience of consumers. Santander is using its technology platform to launch new data-driven services. These services stretch well beyond Santander’s traditional offerings.

Banks that wanted to adopt open banking business models had to settle some key questions. And they needed to answer them early. Whose platforms are they going to use to distribute their products? Will they stick to their own platforms? Will they use third-party facilities or collaborative ecosystems? Will they open their platforms to other users? Furthermore, banks had to choose whether to stay focused on traditional banking products. Or should they bolster their portfolio with new digital offerings that address some of the most important needs of their customers? Some bold banks have built business models around completely new products and services.

Four lessons that insurers can learn from the rise of open banking.

What lessons can insurers can learn from the banks’ response to open banking? Four lessons are especially important:

Customer expectations will continue to climb. Consumers are encountering powerful digital experiences in many facets of their lives. They’ll want their insurers to match or better these experiences. Insurance providers will need access to greater volumes of data from more sources. If they don’t, they won’t be able to meet their customers’ expectations.

The spread of digital technologies will pump up data flows. Digital technology now pervades every aspect of life. The arrival of the post-digital era has rocketed the amount of data available to insurers. There’s plenty more to come. Carriers shouldn’t underestimate the value of this critical resource. They should look closely at how they can capitalize on their unique but very often scattered internal data sets. Those insurers that neglect this opportunity risk falling far behind their competitors.

Intermediaries will need to adjust to their business strategies. The rise of open banking forced banks to find new ways to engage with customers and partners. Open insurance will put similar pressure on insurers. Brokers and other intermediaries are especially vulnerable. They need new business models that enable them to thrive in the ecosystem economy.

Industry disruption will increase in velocity and scale. The arrival of open banking exposed the banks’ payments activities to fierce disruption. Fintech firms and other industry newcomers seized much of this business. Disruption is now spreading to other sectors of the banking industry. New entrants to the payments business are using technology to expand their services. Open insurance will first disrupt product distribution and customer acquisition. It will spread to other sectors fast.

In my next blog post, I’ll discuss why APIs are so important to open insurance businesses. Until then, have a look at some of these links. They provide plenty of useful information about open insurance and ecosystem businesses. Otherwise, send me an email. I’d like to hear from you.

Open Insurance: Unlocking Ecosystem Opportunities for Tomorrow’s Insurance Industry.