Highlights

- The global market for blockchain in insurance is expected to grow from $64.5 million in 2018 to $1.39 billion by 2023—a compound annual growth rate of 84.9 percent.

- In the Accenture Technology Vision 2019 survey, more than 80 percent of insurance executives reported that their organizations have adopted distributed ledger technology across one or more business units, or are piloting or planning to pilot the technology.

- The analysis of two use cases identified between $99 million and $277 million in annual savings for personal auto insurance carriers in the US alone by the third year of use.

Questions answered in this ultimate guide:

- What is blockchain?

- How does blockchain work?

- How can blockchain benefit the insurance industry?

- How can blockchain help insurers get the basics right?

- How can blockchain help carriers innovate?

- A glimpse at blockchain’s real value

- A surge of investments in distributed ledger technology (DLT)

- How is blockchain technology being implemented in insurance?

- How can consortia help the insurance industry develop blockchain capabilities?

- Beyond proofs of concept

- Models for successful DLT collaboration across the insurance ecosystem

What is blockchain?

Blockchain is a distributed database system in which transactions and records can be signed, exchanged and verified without the control of a central party. This secure, open means of conducting business transactions creates a level of transparency, security and trust not previously possible. This technology is poised to revolutionize operations across a multitude of sectors, enabling additional stakeholders—such as brokers, vendors, reinsurers and ecosystem partners—to interact with each other. The result is a more connected ecosystem that ensures confidence in the security and accuracy of the data.

With its three fundamentals—trust, transparency and immutability—blockchain provides a single source of the truth that is updated in real or near-real time. This allows parties to maintain comprehensive asset, contract and data ownership records without having physical possession of them or relying on paper or intermediaries. For the financial services industry, this means outcomes are more certain because there is less room for contract interpretation or information discontinuities.

Blockchain can be combined with other technologies, notably smart contracts, to enable insurers to automate processes and develop innovative products that otherwise aren’t possible.

How does blockchain work?

Unlike a traditional centralized computer database system, blockchain is decentralized and its records are distributed and maintained on many different computers at once. The records are called a “distributed ledger” and users have controlled access to one shared copy of the ledger.

As information is added, each new “block” of information is “chained” to the previous one in a permanent, unbreakable sequence using advanced cryptography. Before new blocks can be added to the ledger, they must be confirmed by different computers in the system, and unique keys are required to access individual blocks. If someone tries to access a block of information without a proper key, the system rejects the attempt and leaves evidence of tampering.

The terms “blockchain” and “distributed ledger technology” (DLT) are sometimes used interchangeably, but they aren’t the same thing. That is, blockchain is a type of distributed ledger, but not every distributed ledger is a blockchain. Similarly, while blockchain enables cryptocurrency, it is much more than cryptocurrency. Later in this ultimate guide, we’ll look at some examples of how insurers have leveraged blockchain to their benefit.

How can blockchain benefit the insurance industry?

Providing a single source of truth allows friction in business processes to be drastically reduced, using solutions such as smart contracts to facilitate and automate DLT networks.

Data reconciliation is made easier, accuracy is improved, and time spent uncovering information is eliminated, allowing for transparency, efficiency gains and cost reductions throughout a value chain. What’s more, shared industry tasks and automation generate more seamless processes and lower total cycle times.

The aggregate improvements in speed and accuracy can also create more positive customer experiences. For example, shortening the claims cycle through improved efficiency could lead to higher customer satisfaction and retention, while faster and better access to data could enable smoother interaction between insurers and their customers. Reducing inefficiencies and costs throughout the value chain could, ultimately, even lead to lower premiums.

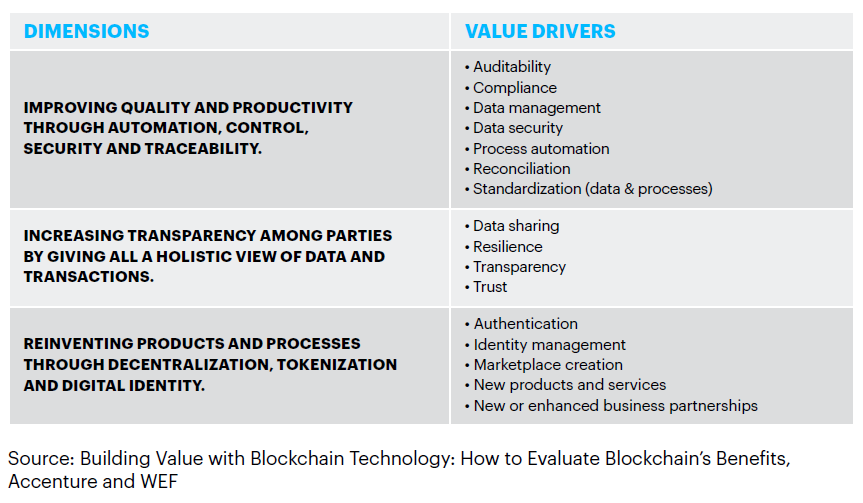

Accenture, in collaboration with the World Economic Forum, has created a new tool to identify the value of DLT:

How can blockchain help insurers get the basics right?

Within insurance, the claims and finance functions are high-value areas where blockchain could be beneficial, especially when you look at processes that need ongoing reconciliation with external parties. Consider how often Company A has a claim against Company B resulting in the exchange of money, typically in the form of a paper check or an electronic transaction. That could be completely automated using blockchain.

Presently, many insurers are applying a smart contract alongside blockchain, which is triggered when well-defined terms and conditions are met. By setting up an insurance contract that pays out under these circumstances, an insurer can process transactions with no human intervention and greatly enhanced customer service.

In other words, blockchain can help deliver on the digital opportunities that insurers must get right. These opportunities aren’t glamorous but they’re important: as I’ve said before, get them right and you won’t win—but get them wrong and you will lose. Blockchain can help insurers deliver on some brilliant basics. For example:

- Streamlined subrogation

- A more transparent claims process

- Using shared loss histories to obtain data-driven insights on prospective customers for more sophisticated pricing

- Supporting more efficient payments between insurers and third parties, especially during the claims process

Finally, several reinsurers have successfully used blockchain to streamline previously complex, manual processes.

How can blockchain help carriers innovate?

If the world is going to open up into extended ecosystems—and it will—then companies from different ecosystems need to come together to provide products and services. In order to transact they will need a means to reliably exchange information. That’s exactly where blockchain can make a difference, because what it doesn’t require is two people working off the same core system. In that respect, it’s like connective tissue between players in an ecosystem—players that don’t have to share the same onerous administration systems or massive pieces of architecture. It allows collaboration in a much easier format and, importantly, it offers a high level of security.

And there’s also trust. With blockchain, trust can be delegated to the ledger, enabling insurers to collaborate more freely. In combination with this delegation of trust, insurers can create microservices—typically in the form of APIs—to enable digital partnerships at scale. In the longer term, blockchain will be the glue within powerful ecosystems that offer radically new, customer-centric business models and products.

This video delves into the importance of frictionless business capabilities in establishing digital partnerships—and how blockchain and microservices can help insurers become more agile and overcome legacy systems:

Blockchain can also power new business models based on personalized, real-time risk assessment, rather than historical data and averaged pricing. It could, for example, enable P&C insurers to build more sophisticated usage-based insurance models in partnerships with auto manufacturers or makers of smart home devices. Other emerging customer-centric business models and products include:

- Peer-to-peer insurance

- Disintermediation

- Smart adjusting policies

- Self-insurance

- Smart-device insurance add-on

Further reading on how blockchain may change the insurance industry:

- Insurers need scale, and these technologies can help them achieve it

- Insurers are unblocking the blockchain and preparing for the future

- CB Insights: How blockchain could disrupt insurance

A glimpse of blockchain’s real value

Industry perceptions of blockchain are evolving. One of the biggest changes is that insurers are beginning to look beyond DLT as an isolated enterprise technology.

Instead, they are starting to understand where DLT’s true value lies—as a catalyst for business ecosystem transformation. In much the same way as cloud computing did before it, DLT will mature into a transformational technology over the next few years. In fact, it will be one of the foundational technologies of the next wave of industry disruption.

Now that most organizations have put in place the key technologies of the digital age—social, mobile, analytics and cloud (SMAC)—the next wave of digital technologies are beginning to emerge in the form of DLT, artificial intelligence (AI), extended reality and quantum computing (DARQ). Though at different stages of maturity, these four technologies will be the key drivers of what Accenture describes as a post-digital age.

Just as SMAC enabled new levels of collaboration and connectivity between insurance companies and individual people and organizations, DARQ—DLT in particular—promises to transform entire ecosystems, markets and value chains. Distributed ledgers will expand business networks by securely connecting industry participants with ease and at unprecedented scale.

To take advantage of DLT as a cornerstone for collaboration, insurance organizations should partner with others to create DLT propositions and platforms that create value for all members of their ecosystem or value chain. They have a limited window to be one of the organizations that shape the DLT platforms and solutions of the future.

A surge in DLT investments

We’re seeing a surge in industry investment in DLT and blockchain projects as insurers look to unlock the potential of the technology. According to one research report, the global market for blockchain in insurance is expected to grow from $64.5 million in 2018 to $1.39 billion by 2023—a compound annual growth rate of 84.9 percent.

Accenture research also points to eager adoption among carriers. In the Accenture Technology Vision 2019 survey, more than 80 percent of insurance executives reported that their organizations have adopted DLT across one or more business units, or are piloting or planning to pilot the technology.

Another Accenture study, conducted with the World Economic Forum, found that 65 percent of insurance executives agreed that their organization must adopt DLT to remain competitive.

How is blockchain technology being implemented in insurance?

Insurance organizations have experimented with blockchain and DLT for several years. Many insurtech companies are already experimenting with radical new products for the ever-evolving demands of the insurance customer in the digital age. But blockchain isn’t just for insurtechs; incumbent insurers, as well as reinsurers, are leveraging the technology to improve outcomes for both customer and carrier.

For example, Tokio Marine, a Japanese P&C insurer, tested blockchain for marine cargo insurance certificates. It reportedly reduced the time it took for a shipper to receive an insurance certificate by 85 percent.

Or consider how Allianz used blockchain and smart contracts to remove friction from a complex process. Catastrophe (cat) swaps and bonds are used to transfer specific risks, typically natural disaster risks, from an insurer to investors. Allianz successfully piloted the use of blockchain and smart contracts to accelerate the contract management process for cat swaps and bonds.

Insurers can unlock trapped value by combining blockchain with other technologies, too. Accenture has developed a blockchain-based proof of concept that leverages data from smart sensors to enable smart-vineyard insurance.

How can consortia help the insurance industry develop blockchain capabilities?

Founded in 2016 with backing from notable firms like AIG and AIA, and founding members like Allianz, Aegon and Swiss Re, B3i was an early insurance-focused consortium that aimed to develop blockchain solutions for the insurance industry. Early in 2018 the consortium announced its transition to a fully-fledged company based in Switzerland, a hub of blockchain technology. Similarly, the R3 consortium includes over 200 companies on six continents, with the aim of reducing friction in financial services transactions.

The Institutes is well-known as an insurance education and certification body, and Accenture is honored to be part of its RiskStream Collaborative™, a blockchain consortium for the risk management and insurance industry that was formerly known as The Institutes RiskBlock Alliance. Accenture will be the lead framework architect, responsible for building a production-grade platform to develop and implement blockchain use cases.

At a time when the industry is under pressure from disruption, the RiskStream Collaborative can help carriers find ways to streamline processes, reduce their portfolio of risk, create greater efficiencies and be more cost effective within ecosystems. However, that’s just the tip of the iceberg. Ultimately, blockchain could help carriers find new value chains and new ways to develop the technology to create new revenue streams and operating models.

The RiskStream Collaborative has identified over 40 blockchain use cases that address core digital capabilities, as well as innovation. For example, the consortium is ready to implement and test products to streamline first notice of loss, proof of insurance and subrogation, as well as develop new products like parametric claims processes based on smart contracts.

Learn more about the RiskStream Collaborative.

Learn more about Accenture’s role with the RiskStream Collaborative.

Beyond proofs of concept

Numerous insurance projects are moving beyond proof of value and entering or nearing production—The Institutes RiskStream Collaborative (as covered in the above chapter), Blockchain Insurance Industry Initiative (B3i), and Insurwave are some examples. Over the next two years, these initiatives will refine their products while even more DLT insurance projects can be expected to go into production.

The RiskStream Collaborative has selected two initial use cases for development: proof of insurance and first notice of loss. The consortium’s analysis of these use cases has identified between $99 million and $277 million in annual savings for personal auto insurance carriers in the US alone by the third year of use.

Several factors are converging to accelerate industry adoption of DLT. The first of these is the growing maturity of software platforms such as R3 Corda and Hyperledger Fabric, which are now ready to support production-grade DLT solutions. Secondly, carriers are looking to DLT as a means to unlock efficiencies against a backdrop of slow or flat industry growth forecasts.

The final—and arguably most important—reason is that industry players are embracing collaboration and partnerships as the best opportunity to unlock the value of DLT. Because they believe DLT could potentially shift the cost curve through revenue growth and cost reduction, they are urging partners, customers and others in their ecosystems to align behind the technology.

Models for successful DLT collaboration across the insurance ecosystem

DLT is a team sport. That means its real value will come not just from the technology but also come from the ability of insurance companies across complex ecosystems to align behind shared economic incentives and robust governance structures.

It is only by working together to determine how their market may benefit from an industry-wide solution, and how to share the costs of ideation and development, that insurance organizations can uncover the true value of DLT. Two major models are emerging for this form of cross-industry collaboration:

Market leader

This model sees an actor that is a predominant driver of network activity leading the development and deployment of the DLT solution. Such an organization is in a powerful position to maintain and drive efficiencies across the network, which may include its business partners and customers.

One example is a blockchain-based solution developed by Accenture and Zurich Benelux to help the insurer’s customers in Benelux manage surety bonds. The solution includes an easy-to-use dashboard that enables customers to quickly check the status of their bonds, get detailed bond history records, complete new bond requests and view bond forecasts.

The vision is to enable additional stakeholders—such as notaries, brokers, reinsurers and co-surety partners in the insurance market—to interact with each other, creating a more-connected ecosystem while ensuring confidence in the security and accuracy of the data.

Peer networks

This model sees organizations—often competitors in a similar industry—come together to realize efficiency and value gains at a market-wide level. The Institutes RiskStream Collaborative and B3i are examples of insurance consortiums bringing together players to realize value from DLT.

These two consortiums show that the model can be flexible enough to accommodate the needs of large and small players alike. The initial emphasis is on creating a step change in efficiency for the entire value chain or market, rather than driving competitive advantage for one participant. As more parties come on board, the benefits to all will multiply.

Conclusion

Whether seeking to lead a new consortium or to build a network with their peers, insurance organizations must establish a structure and incentives that ensure fair and positive outcomes for all stakeholders. Their governance structures and technology stacks should be designed for the long haul. Companies should leverage or build technology that can scale well and efficiently bring together small and large businesses behind a common set of interests.

Whichever route an insurer decides to take, now is the time to act. As with the World Wide Web and cloud computing before it, DLT promises to bring radical change to how entire industries operate. Insurance organizations must take a stance on how they expect DLT to impact their business and the wider industry. By understanding the technology and its applications, they can assess the challenges and benefits that loom on the horizon.

To discuss how Accenture can help you respond to the opportunities presented by DLT, please get in touch.

To learn more, we recommend exploring these resources:

Dear Jim, a beautiful written post. You have explained blockchain/DLT in very simple language which a layman can understand.

It shows that you understand the subject thoroughly and must be highly knowledgeable and qualified. Thank you indeed.