Other parts of this series:

Insurers eager to become data-powered companies need a comprehensive roadmap for the transformation journey.

Insurance providers that transform themselves into data-powered companies will outpace their traditional competitors. They’ll release value locked in their data by improving operating efficiencies and business agility. They’ll also be able to create value by using data to open an array of new revenue sources.

How can insurers become data-powered companies? Investing in key digital technologies to unleash data value is critical. Our research shows that the companies that are gaining the most competitive advantage from new technologies are almost all investing in cloud computing, big data analytics, real-time data, data lakes and artificial intelligence (AI). These technology leaders invest far more in innovation than their less progressive counterparts. They also adopt new technologies much quicker. This enables them to scale innovation across their organizations quickly. What’s more, they can adapt to sudden threats or opportunities (See Future Systems report).

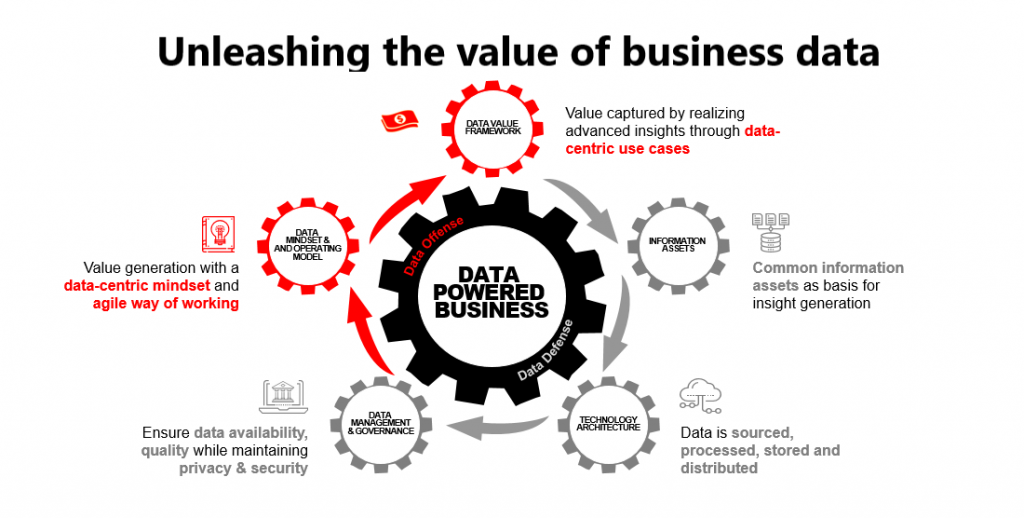

But ramping up investment in powerful cloud services and other digital technologies is not enough. Insurers eager to become data-powered companies need a comprehensive roadmap for this journey. It should span the data strategy (how to unlock value from data assets) and the data transformation process (how to build or buy capabilities). Finally, it should identify the business models that drive the data-powered company (how it will deliver value). The journey to becoming a data-powered company goes beyond monetizing data. It requires companies to build their businesses around data (See illustration).

Each insurer needs to draft a roadmap that addresses its unique circumstances. Nonetheless, there are some important steps that all carriers should consider.

Data strategy

• Identify and categorize data assets (e.g. customer behavior, demographics, risk profiles and telematics).

• Assess the quantity, quality, provenance, age and accessibility of the data.

• Aggregate data elements to rate the competitive value of the data.

• Identify potential providers of complementary third-party data.

Data transformation

• Combine AI technologies with data analytics, automated systems and human knowledge and ingenuity to create solutions to key business problems.

• Master critical data capabilities such as key-performance-indicator (KPI) reporting, fraud detection and customer risk profiling.

• Enhance organizational trust by implementing an integrated security framework. Also ensure compliance with corporate and regulatory data security, governance and privacy requirements.

• Develop application programming interfaces (APIs) to link data resources to start-ups, broker platforms, Internet of Things (IoT) networks and other service providers in an open enterprise ecosystem.

• Shift the mindset of leaders in the company by putting data at the core of all decision-making.

• Explore data-sharing agreements with business partners to encourage greater collaboration.

• Improve data quality and consistency to enable the swift sharing of business, consumer and market insights throughout the organization.

• Integrate data flows throughout the company to enhance decision-making.

In my next blog post, I’ll discuss some of the innovative business models that insurers have developed to unlock value trapped in their data. For more information about data monetization and data-powered companies click on these links.

Otherwise, send me an email. I’m keen to hear from you.

Accenture and M6: Monetizing big data

Subscribe for more from Accenture Insurance

Disclaimer: This document is intended for general informational purposes only and does not take into account the reader’s specific circumstances, and may not reflect the most current developments. Accenture disclaims, to the fullest extent permitted by applicable law, any and all liability for the accuracy and completeness of the information in this presentation and for any acts or omissions made based on such information. Accenture does not provide legal, regulatory, audit, or tax advice. Readers are responsible for obtaining such advice from their own legal counsel or other licensed professionals.

Disclaimer: This document makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.