Other parts of this series:

Insurers understand the need for digital innovation – many have had digital transformation strategies in place for several years. However, since the coronavirus pandemic, the race to digital has taken on more urgency. With fewer in-person channels, insurers are faced with the need to make faster and more impactful innovation investments to deliver digital experiences that satisfy consumers’ rising expectations. With a prolonged economic downturn looming on the horizon, insurers need to find ways to reduce costs and improve efficiencies. In this series, I will look at what this means for European insurers.

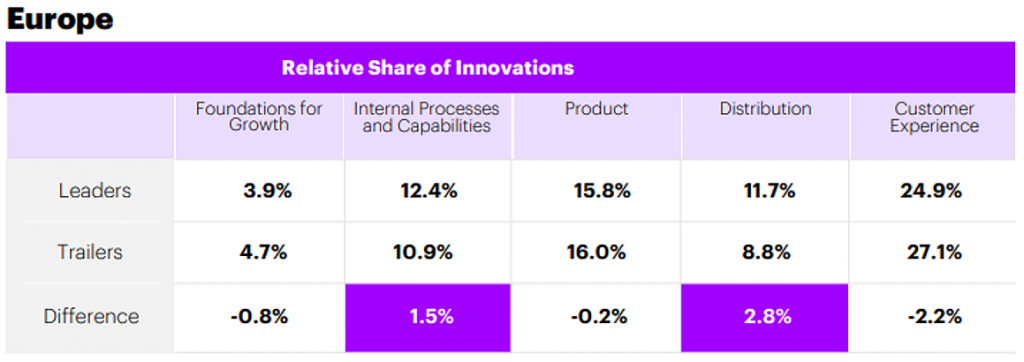

As analyzed in Accenture’s recently published Digital Innovation Payback Report, insurance companies worldwide are placing massive bets on digital innovation as they strive to contain operating costs, improve customer engagement and reinvent their businesses. While our analysis of insurers innovations and financial metrics shows a variance from region to region, it appears that customer-facing innovation is critical.

Where’s the payback on digital innovation in insurance for the European market? We looked at the innovations of the following leading insurers in European countries.

In Europe, insurers are continuing to benefit from innovation in distribution. Zurich Spain alliance, for example, is actively seeking further distribution channels as part of its innovation strategy.

Insurance Revenue Landscape 2025:Our report examines 4 key areas of innovation that offer revenue opportunities for insurers over the next 5 years.

Learn moreThis distribution focus mirrors our research in other regions, which shows that while market conditions and innovation strategies differ across regions of the world, distribution nearly always emerges on top. Why? Because customer experience and distribution innovations extend market reach, streamline customer-facing and internal workflows, reduce overall costs and drive growth.

However, while there is a continued advantage of innovation in distribution for European markets, the correlation with higher performance is weaker than in other markets. Europe is also the only market in which customer experience innovation is not showing positive returns, and investments in internal efficiencies are showing only a slight positive correlation with higher performance. This may be explained by the fragmented distribution and tax system across countries.

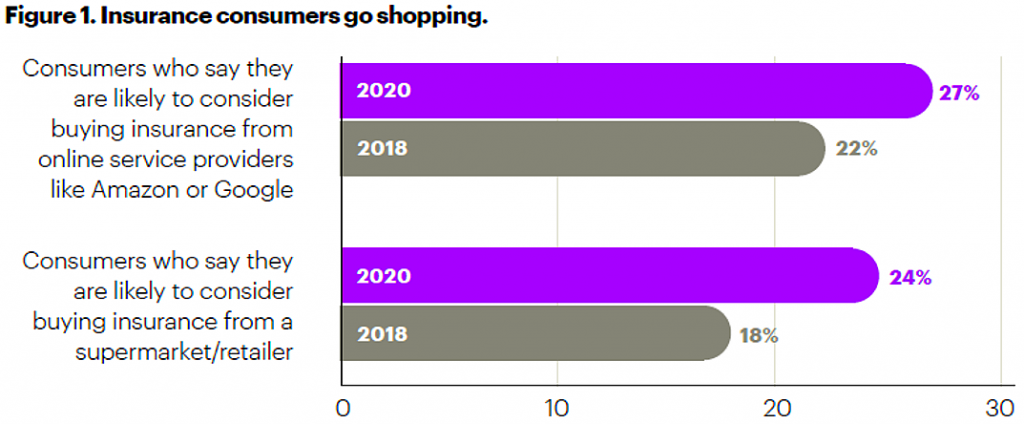

While distribution may be slow to generate returns for European insurers, they need to persist. Distribution is a battleground for insurers, which will only continue to intensify in 2021. Non-traditional players are also entering the competition for customers, with distribution innovations that are more convenient for them. Accenture’s Consumer Survey 2021 shows that consumers are exploring different insurance providers, based on their unique needs.

While we may be at a stage where digital innovation payback seems smaller in relation to the effort and resources required to invest in innovation, European insurers mustn’t be disheartened. Digital value insurance will continue to show exponential returns over time, as established players use this shift in focus to concentrate on what truly matters to their customers. If they stop now, market share will decrease and increasingly discerning customers will become more difficult to reach.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.