Discover why insurers should be pursing hyper-relevance, plus two things they’ll need to become hyper-relevant.

Leading insurers know that customer expectations are evolving and that the experiences companies deliver must evolve as well. Our research shows that 73 percent of CEOs recognize they need to provide products, services and experiences that are more meaningful to their customers. Some of them are already preparing for the next generation of personalization—what we call hyper-relevance.

What do we mean by hyper-relevance?

- Hyper-relevance is dynamic, constantly changing and always in action. Today, personalization is frequently delivered via a one-to-one relationship during the buying process or in response to a change in circumstances that the customer identifies to the insurer or an agent. It is often episodic and time-lagged. Hyper-relevance, however, is like today’s digital consumers. It is “always on.”

- Hyper-relevant experiences address customers’ needs. Hyper-relevant insurers do not focus solely on a customer’s preferences, or on relatively fixed attributes such as their gender or age. Instead, they consider the evolving context in which customers make decisions and purchase products and services.

- Hyper-relevance is made possible by digital technologies. Connected devices, digital engagement, predictive analytics, artificial intelligence (AI) and machine learning make it possible for insurers to achieve new levels of insight. And they enable new services and touch points that respond and evolve in real-time to a customer’s changing circumstances.

Insurers need two things from their customers to deliver hyper-relevant services and experiences at speed and at scale: data and trust.

To design hyper-relevant experiences, insurers need to look further afield than the traditional data they gather from customer website visits, social media posts or previous-purchase histories. In addition, they need to gain a deep understanding of their customers’ motivations and contexts—information that is much more personal in nature and often transmitted via devices connected to the Internet of Things. For example:

- Smart real-time health data from wearable biometric technologies.

- Driving-behavior data from connected sensors in customers’ automobiles.

- Smart-home data from devices such as smoke detectors and water leak detectors.

But in order to gain access to this level of personal data, insurers must secure their customers’ trust. It takes time to build trust, but just seconds or even a single false step to destroy it. Insurers can counter that risk by constantly presenting themselves as trustworthy, keeping their promises and offering clear value in exchange.

As the number of interactions and amount of data insurers have with their customers increase, and as machines and digital assistants play a larger role in capturing data and delivering services, there’s a greater chance that something will happen to cause trust to erode. Leading insurers are taking preventive action by updating their data privacy and security practices, and regulatory agencies and governments around the world are stepping in to ensure that insurers safeguard customer data.

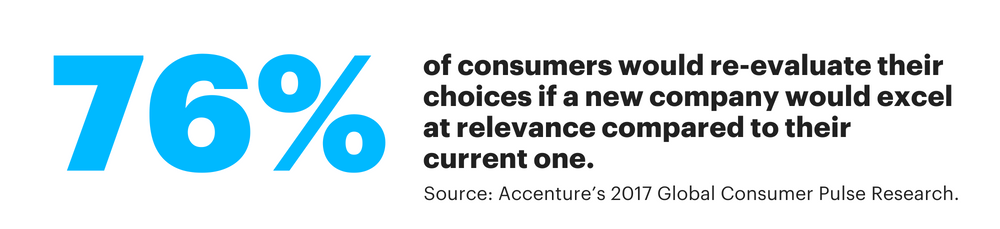

The good news is that customers are no longer surprised by companies’ interest in their lives. Nearly one-third of consumers expect companies they engage with to know more about them. And two-thirds are willing to share personal information with companies. But there’s a catch. They will only do so in exchange for something with perceived value. And if that value exchange—or the trust on which it is based—is broken, customers will walk away.

In my next post, we’ll look at where the value is for insurers in hyper-relevance.

In the meantime, to learn more, read the report: Put Your Trust in Hyper-Relevance.