Insurers have traditionally looked to develop new products and improve operational efficiency to remain competitive. While those remain important elements of any business model, the market is changing so fast those strategies alone will be insufficient to attract and retain future customers. Small and nimble insurtechs are disrupting the industry by developing or joining digital ecosystems, thereby threatening the market share of companies that are slow to respond.

Insurers are aware of this threat and are moving to develop their own ecosystems that extend beyond traditional insurance providers, leveraging their data as a strategy for developing partnerships that will produce long-term value and uncover new opportunities from existing and potential policyholders.

But ecosystems don’t just happen. For insurers, one of the best ways to become an ecosystem business is to adopt open insurance. As my colleague recently wrote, “Open data platforms enable insurers to develop ecosystem businesses and capitalize on their vast data resources.”

What is “open insurance?”

Accenture defines open insurance as:

The practice of insurers sharing and consuming data and services in order to create more appealing value propositions and new revenue streams. These data and services are exchanged with third parties both within and beyond the insurance industry and are made externally accessible and openly consumable by means of application programming interfaces (APIs). Where relevant, customers authorize their service providers to make their data accessible, in return for which they expect better, more personalized services and experiences.

The good news for life insurers is the technologies required to create an open insurance model already exist. These “ecosystem essentials” include an open digital insurance platform and cloud, underpinned by APIs—lots of APIs.

What’s needed is a business and technology strategy that connects insurers and policyholders to the platforms that deliver the value they cannot easily obtain elsewhere. In the case of Manulife, the strategy was threefold: (1) partners that could help them reach people who lie outside of its existing distribution channels, (2) partners that complement existing products and drive customer engagement and (3) partners that provide additional capabilities.

Shifting from “indemnify and pay” to “protect and prevent”

Our vision for the life and annuity industry is already developing in the property and casualty industry, where insurers connect policyholders to value-added products and services, such as monitoring devices that help prevent loss. The life and annuity industry must also shift from a traditional indemnification payment strategy to one of prevention. They must partner with policyholders throughout the policy lifecycle and provide them with more effective ways to promote longevity through healthier lifestyles that improve physical and mental wellbeing.

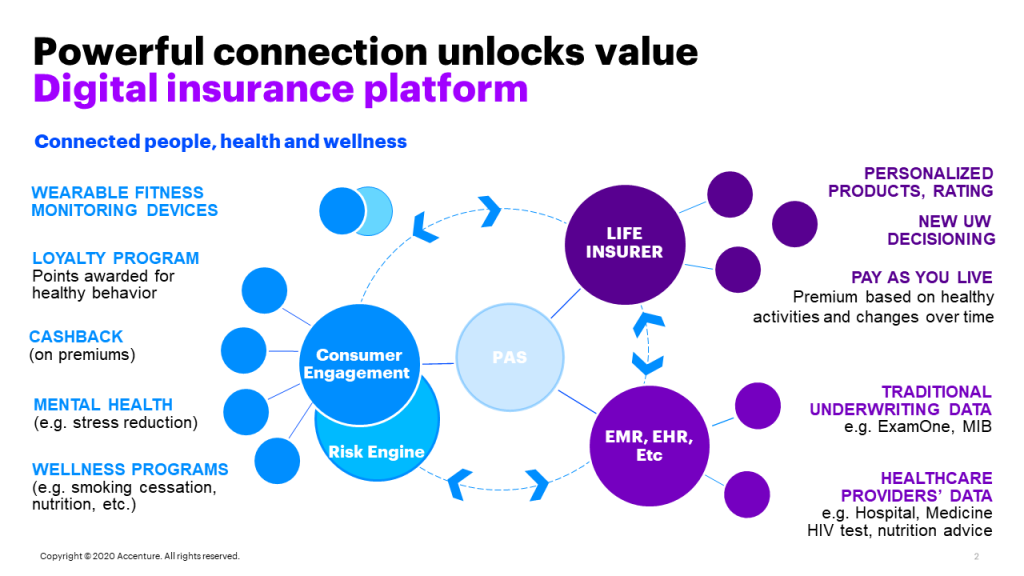

Cloud and connected systems, particularly in health and wellness, are the value-drivers for L&A carriers as well as the forces driving the shift from payment to protect-and-prevent. This growing ecosystem has the potential to complement insurers’ existing data troves with a virtuous cycle of real-time health and wellness data — and our research shows that consumers are eager to share data in exchange for an efficient, secure and more personalized experience.

The following diagram illustrates our vision for connecting the ecosystem dots to create a virtuous data cycle that provides deeper insights to help insurers better understand how to protect policyholders with preventive products and services that encourage wellbeing.

This isn’t just theoretical, pie-in-the-sky prognosticating. In our report, “Open Insurance, Unlocking Ecosystem Opportunities for Tomorrow’s Insurance Industry,” we found insurers expect to generate half of the revenue or more from ecosystems in the next five years.

Whether you’re looking for an opportunity at the intersection of health and wellness, or you’re interested in growing your business through other ways, ecosystem connectivity could profoundly affect your revenue over the next few years. Let’s talk about your plans to leverage ecosystems and help you provide greater lifetime value to policyholders.