Other parts of this series:

Diversity is talked about a lot in today’s business world: equal pay, the board of director diversity, hiring diversity, promotions, etc. Every element of a business is analyzed to determine if and where types of bias could be present. Some bias is more visible, while other bias requires putting a microscope on company culture and employees’ unconscious bias.

Insurance is not immune to these trends, though insurance is also an industry less in the public eye. There haven’t been any large scandals or customer protests against carriers, for example. Is this because we just haven’t made it into the spotlight yet, or that things are good enough to satisfy the current employee and customer base?

It’s important to analyze how diversity is talked about. More specifically, is the discussion of diversity in insurance companies truly transparent and meaningful, or is it overly promoting and market-focused? Throughout this series, I will focus on data and examples to dive into diversity in the insurance industry.

The Current Conversation on Diversity in Insurance

A quick Google search of “diversity in the insurance industry” will show just how often the topic is written about and discussed. Pages and pages of statistics, opinion pieces and future predictions analyze the importance of diversity in insurance. But what exactly do all of these articles, reports and surveys really tell us?

In many ways, this level of discussion is hugely positive. Action is often predicated on thorough discussion and analysis. Also, by talking about diversity in insurance, we can see gaps in understanding and help make the conversation mainstream, which can open up doors and make employees feel more comfortable being upfront and honest about diversity.

When “Talk” Becomes a Problem

The insurance industry is still in the early stages of openly discussing its diversity problem. Only four years ago, insurance CEOs signed a commitment statement at the Business Insurance Diversity & Inclusion Institute Leadership Conference to affirm their dedication to increasing diversity at their companies.

This is a great sentiment, but it’s only as powerful as the follow-up actions that make it a reality. Notably, the commitment statement does not outline a timeframe for increasing diversity nor does it give a foundational benchmark, although it does establish a yearly check-in on progress.

Now, insurance executives are naturally going to look at diversity from a business perspective. While diversity used to be viewed as a societal good (and it is, of course), more data is coming out that highlights diversity as a pathway towards innovation and revenue. According to the Harvard Business Review, companies with two-dimensional diversity are 45% more likely to report market share growth and 70% more likely to report that the company captured a new market. In insurance specifically, companies in the top quartile for racial and ethnic diversity in leadership are 32% more likely to outperform their peers on profitability, while companies in the top quartile for gender diversity are 21% more likely to see above-average profitability.

Clearly, the data supports both an empathetic and financial motivation to push for increased diversity in insurance. So how is the industry doing so far?

Actions Haven’t Trickled Up Yet

The insurance industry has seen some progress in diversity over the years, but it’s been disjointed.

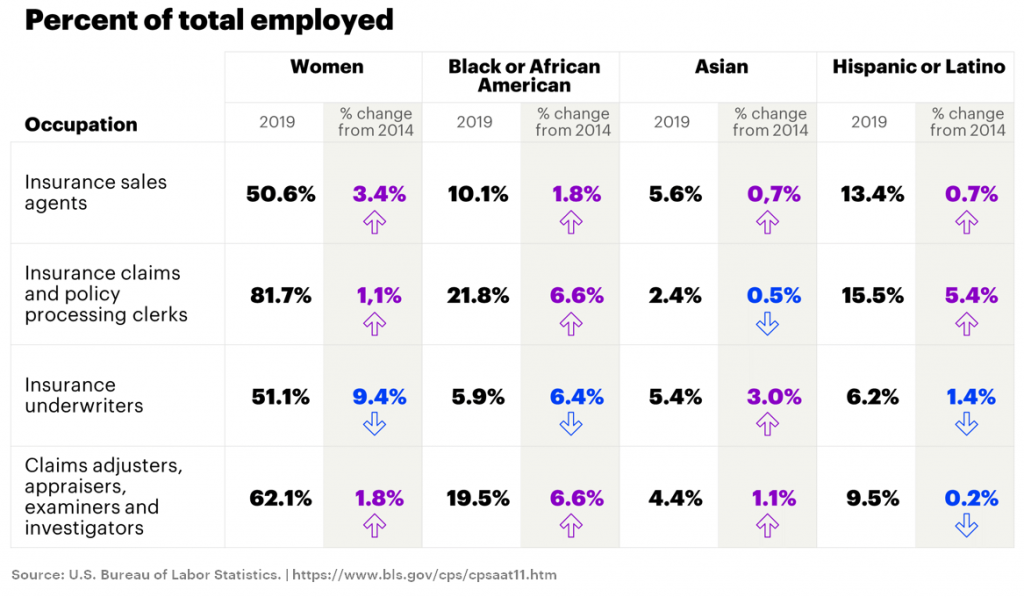

The table below compares diversity in insurance in 2014 versus 2019, compiled using data from the U.S. Bureau of Labor Statistics. Unfortunately, “actuaries” didn’t have a diversity breakdown, so I didn’t include that occupation.

Source: https://www.bls.gov/cps/cpsaat11.htm

Overall, increases over the 5-year span outnumbered decreases, which is a good sign. But it’s important we dig deeper into individual occupations.

- Insurance sales agents: The diversity breakdown has largely stayed the same for this occupation, though women had a slight 3.6% increase.

- Insurance claims and policy processing clerks: Increased diversity for clerks is a double-edged sword. On one hand, it’s great that insurance companies are bringing in more diverse hires in general. But diversity hires in administrative roles can’t make as large of an impact on culture or decision making. The high increases for Black or African American (6.6%) and Hispanic or Latino (5.4%) are concerning that maybe executives are simply trying to increase their diversity numbers for a good PR story and not actually affecting change.

- Insurance underwriters: This is a very disappointing story. Underwriters are major decision-makers in the industry, and there have been drastic decreases in diversity here. Almost 10% fewer women in 2019 than in 2014. Black or African Americans had a similarly appalling 6.4% decrease.

- Claims adjusters, appraisers, examiners and investigators: The star of this occupation is the 6.6% increase in Black and African Americans. This is particularly important when compared to their decrease as underwriters because adjusters are similarly important decision-makers. Outside of this demographic, however, the story is largely flat.

With a couple exceptions, the overall story this data tells is that administrative positions are where most of the diversity hires are happening in insurance. As an industry, we need to ask ourselves: What biases are causing us to avoid diversity in decision-making positions?

According to Insurance Journal, even though women make up 60% of the insurance workforce, they only hold 19% of board of director seats and only 11% of named executive officer positions. Only 1% of insurance organizations have a female CEO.

Likewise, a Reuters analysis showed only three out of 168 senior executives of the top 10 U.S. insurers are Black. Among the 119 board members of the same companies, only 13 are Black.

In my next blog post, I will highlight good and bad examples of diversity in the industry and discuss the importance of transparency.