Other parts of this series:

Choosing the right APIs is critical for carriers looking to transform themselves into open insurers.

Open banking triggered an explosion in the development of application programming interfaces (APIs). Open insurance could have a similar effect.

APIs are critical to the development of open insurance solutions. I can’t stress this enough. APIs enable insurers to build flexible, robust technology platforms. These platforms can consume and share vast volumes of data. They can also link insurers with legions of customers and many partners. Research firm Celent believes that insurers that fail to build APIs into their platforms won’t be competitive in five years. I think they’re right.

What are the business benefits of APIs? At the top of the list are big process improvements, greater efficiencies and faster innovation. Banks have used APIs to become more agile, reduce time to market and to grow their services. They’re better able to collaborate with partners and sign up new customers. Business initiatives that in the past took up to 24 months to launch can now get underway within weeks.

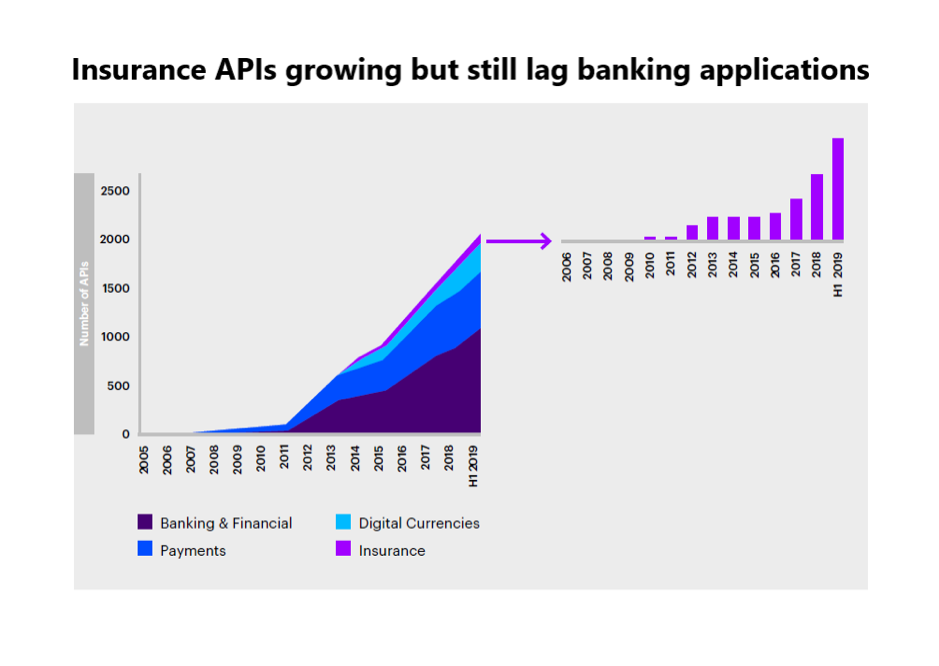

The volume of insurance APIs is rising fast.

The number of APIs available to insurers is a shadow of what’s on offer in the banking industry. The illustration below shows how far the insurance sector lags. It pulls together information from Accenture Research’s Insurance API Watch Tower and ProgrammableWeb. But, interest in insurance APIs is rising fast. Most, if not all, insurtech firms are using APIs in their open insurance initiatives. Lemonade, Cuvva and recent Aon acquisition CoverWallet are just a few examples of some of these agile companies that are using APIs to gain quick access to the insurance market. Big insurers are also beginning to incorporate APIs in at least some parts of their businesses. A few, such as La Parisienne in France, are transforming themselves into providers of open insurance APIs.

Nonetheless, most insurers still have a long way to go if they want to match the use of APIs by their counterparts in other financial services sectors. The illustration below, which draws on information Accenture Research’s Insurance API Watch Tower, shows just how far insurers lag.

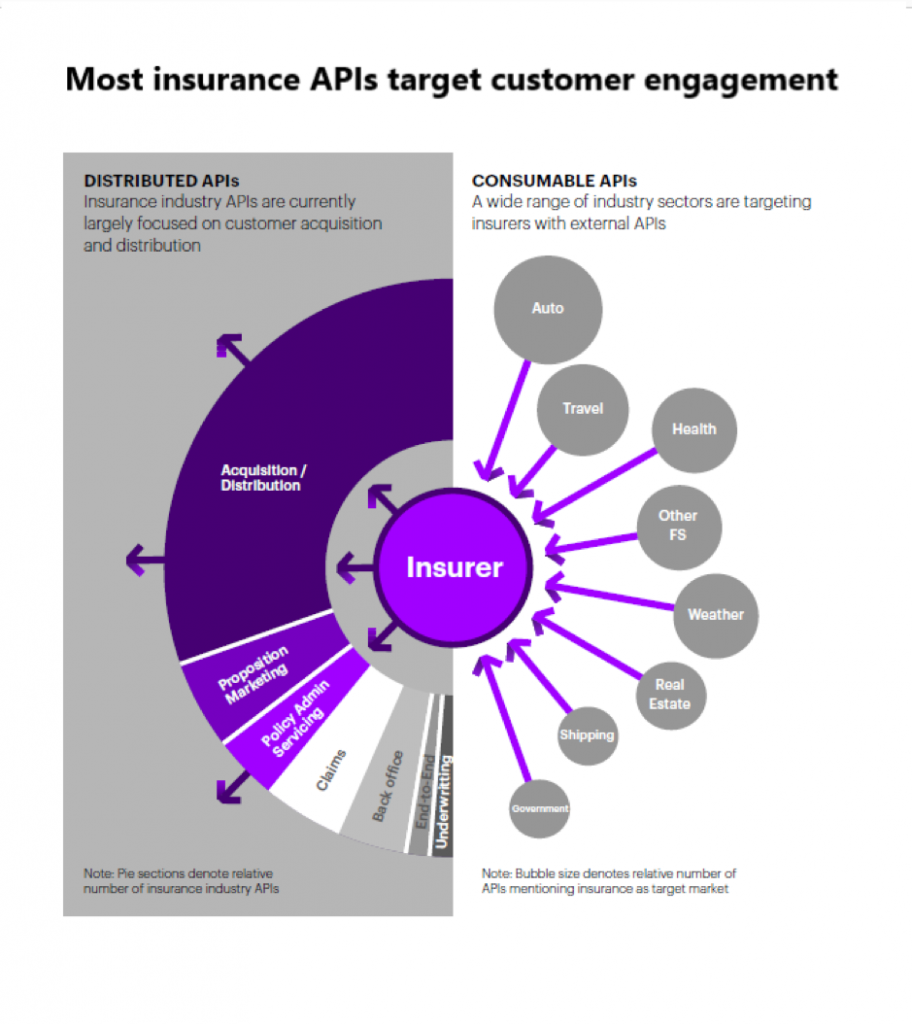

Most insurance APIs support customer acquisition or product distribution solutions. But it’s clear from my discussions with leaders in the insurance industry that many more applications are in the works. Look at the illustration below. Lots of companies will soon be able to connect to insurance data providers. Leading the pack are motor vehicle distributors, travel firms and healthcare providers. These firms will be able to bundle insurance products with their own offerings. They’ll offer all sorts of integrated services across different ecosystems.

Most insurance APIs support customer acquisition or product distribution solutions. But it’s clear from my discussions with leaders in the insurance industry that many more applications are in the works. Look at the illustration below. Lots of companies will soon be able to connect to insurance data providers. Leading the pack are motor vehicle distributors, travel firms and healthcare providers. These firms will be able to bundle insurance products with their own offerings. They’ll offer all sorts of integrated services across different ecosystems.  How should insurers respond? How will the surge in insurance APIs affect their open insurance plans? It’s essential that carriers that are eyeing open insurance devise an effective API strategy that’s closely aligned to, and re-enforces, their ecosystem strategies. They will need to be able to build, publish and consume APIs fast and on a big scale. An effective strategy should define how insurers select APIs. It should guide them when they’re considering whether to develop or source APIs. It should also set out how insurers will deploy and share their APIs.

How should insurers respond? How will the surge in insurance APIs affect their open insurance plans? It’s essential that carriers that are eyeing open insurance devise an effective API strategy that’s closely aligned to, and re-enforces, their ecosystem strategies. They will need to be able to build, publish and consume APIs fast and on a big scale. An effective strategy should define how insurers select APIs. It should guide them when they’re considering whether to develop or source APIs. It should also set out how insurers will deploy and share their APIs.

In my next blog post, I’ll discuss how carriers can connect their ecosystem and open insurance goals. Meanwhile, take a while to look at the links below. They provide lots of useful insights into open insurance and ecosystem businesses. Otherwise, send me an email. I’d like to hear from you.

Open Insurance: Unlocking Ecosystem Opportunities for Tomorrow’s Insurance Industry.