We are used to talking about disruption as a force on the global insurance stage – or even as a way to bring cover to the billions of people in developing countries who remain uninsured.

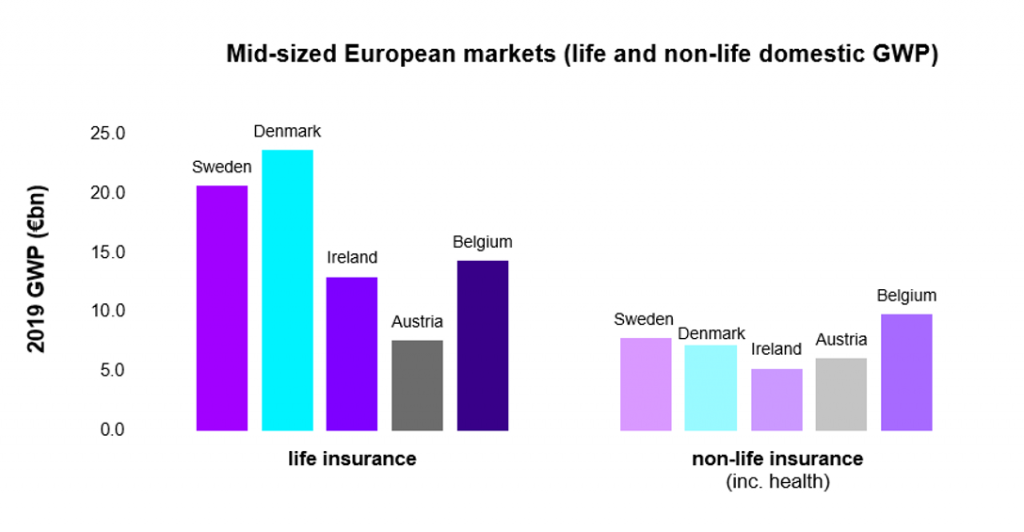

Here, however, we turn the telescope around, to look instead at what insurance disruption means for a mid-sized national market – in this case Ireland, comparable in the volume of its domestic premiums to markets like Belgium, Sweden and Austria:

Source: 2019 Solvency and Financial Condition Reports

So, has insurance disruption come to Irish shores, or are traditional barriers to entry sheltering it from change? Are Irish incumbents playing defence or offense? And how do they best shape their innovation efforts?

We answer these questions in today’s post, as well as in our accompanying report: Irish Insurance 2021 – Set the Disruption Agenda, developed with the support of Insurance Ireland. Ultimately, we believe Irish insurers have everything still to play for, and that their experiences and prospects can serve as a litmus test for similar markets both in Europe and further afield.

Technology Vision for Insurance 2021: We outline five emerging technology trends that will impact the insurance industry in 2021 and beyond.

LEARN MOREThe high-hanging fruit just got lower

Traditionally, mid-sized national markets like Ireland have been tougher nuts for would-be disruptors to crack.

They don’t offer the mature scale of the USA or the virgin opportunities of East Asian markets – meaning business must generally be won off entrenched competitors. At the same time, they require costly product localisation and adaptation, for example in the form of a physical salesforce or historical datasets covering customer behaviour and claim trends, as well as compliance with a new set of regulations.

However, these hurdles – technology, distribution and regulation – have fallen substantially in recent years, changing the disruptive calculus.

It is increasingly straightforward to spin up an insurance business. Much of the value chain can be replicated leveraging platforms, outsourcing and cloud technologies. Furthermore, digital distribution means having a high-street presence is no longer table stakes.

This evolution from large frontloaded costs to as-a-service approaches – far from unique to insurance – allows innovators to dip their toe into smaller markets in a way they couldn’t previously. And, in the European Union at least, regulatory convergence allows greater economies of scale on compliance costs, with disruptors able to aggregate multiple smaller territories courtesy of passporting rights.

Insurtech carriers looking to break into markets like Ireland face lower barriers to entry than ever before. Take Lemonade for example, which launched in Germany in 2019 with a cloud-based operating model, digital distribution and a right to sell across the EU. However, just because barriers are lower does not make them low, as our wider Insurtech trends bear out.

Boiling the frog

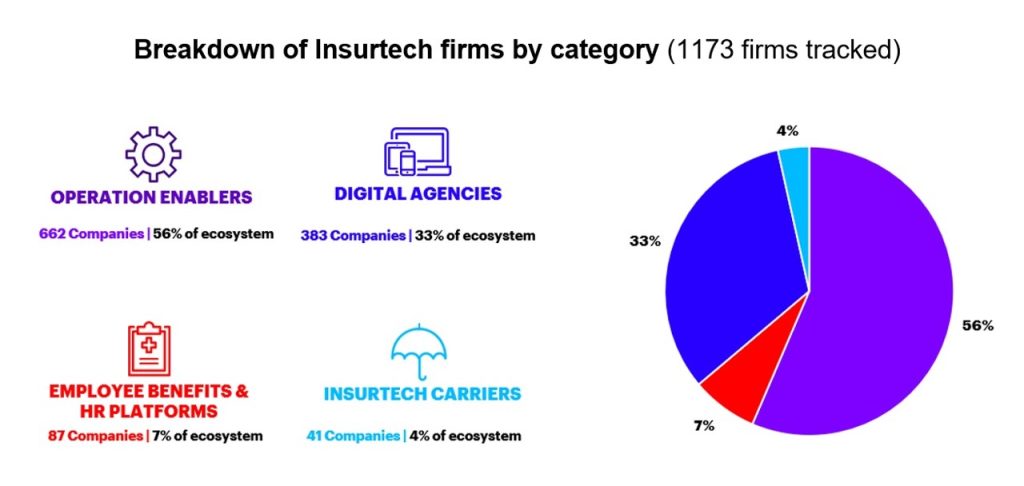

Despite massive valuations, Insurtech carriers are a thin slice of the overall Insurtech sector – only 41 globally, according to Accenture’s Insurtech Watchtower. Moreover, they appear years away from the sort of scale enjoyed by their incumbent competitors. Lemonade, for all its pan-European ambitions, still only sells in Germany, France and the Netherlands.

Source: Accenture Research Insurtech Watchtower 2020

This failure of start-up insurers, so far, to upend the industry underlies one of our key findings on the Irish market: disruption, according to those on the ground, is modest. However, this lack of obvious challengers must not lull incumbents into a false sense of security. There are various less obvious ways that disruption could yet catch them off balance.

One possible future sees start-up insurers cracking larger markets and then transferring the successful model to smaller ones, grafting themselves a market presence, rather than nurturing one up. Another possible future – indeed, one that we consider more likely – is what we have termed compressive disruption.

With 89% of Insurtechs in the “operational enabler” and “digital agency” categories –collaborating with incumbents rather than competing against them – it seems established players might well become the key vectors of disruptive innovation and that digital competition could easily heat up among them.

So, as leading companies seek competitive advantage through incremental innovations across the value chain, those that don’t follow suit will see their margins slowly compressed – and, with them, their ability to innovate their way out of trouble. Like the proverbial frog, laggards may slowly boil.

Become an innovation-ready business

Predicting the future of disruption in insurance is a fool’s game, as this is a book with many possible endings. Indeed, if the past 18 months have shown us anything, it’s that traditional narratives can be rewritten overnight. However, insurers can still boost their capacity to respond to the ever-changing narrative – or even to write their own.

The organisations that have thrived during Covid-19 are those that have been able to innovate at speed, retooling their products, services and ways of working. And this readiness to innovate as the situation demands will help them win again as we enter the “new normal”.

Being innovation-ready isn’t necessarily about having the biggest tech or innovation spending. Rather, it’s about having the right organisational and governance structures in place to support the innovation process end to end. We have identified three key areas:

- Innovation strategy: the majority of large corporations govern innovation centrally – generally under a Chief Innovation Officer or dedicated innovation committee.

- Innovation talent: firms don’t just need technologists, they need generalists and portfolio thinkers – to evaluate the business cases underlying different tech choices.

- Start-up engagement: if disruption is going to be a tech-driven tussle between incumbents, then better access to start-ups means better tools for your arsenal.

As we show in our report, Irish incumbents score better in some of these areas than others, so there are certainly ways they can boost their innovation readiness further. And now maybe just the right time to get serious about this, not just for Ireland’s insurers but for those in other national markets too.

Indeed, today’s lack of serious disruption creates a valuable window of opportunity for incumbents the world over. With no need to firefight, they can take a more considered approach to futureproof their businesses, guarding against disruptive threats and even earning the freedom to seize disruptive opportunities themselves.

So, far from being a time to sit back, the second half of 2021 is a chance for incumbents to get ahead, not necessarily by spending big but by building up their readiness for future innovation – for harder battles may lie ahead.

For the complete story on disruption and innovation in Ireland, read our full report. To get in touch or to discuss any of these ideas further, please reach out to John Morrissey on LinkedIn.