Other parts of this series:

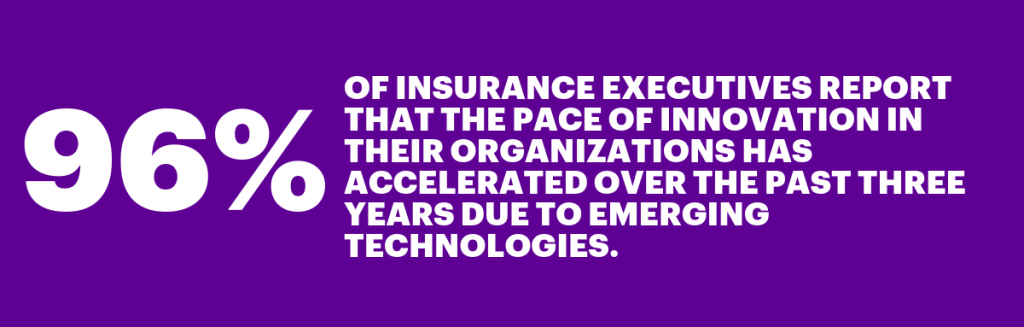

Five trends based on our latest global survey of business and IT executives, including 577 insurance executives.

Every year, the Technology Vision team partners with Accenture Research to identify the emerging technology trends that will have the greatest impact on insurers in the next three to five years. These trends are based on responses to a global survey of thousands of business and IT executives from around the world (including 577 insurance executives this year), as well as input from a wide variety of experts. The goal is to understand the likely future impact of technology in business.

For those carriers looking to do more than just digitize their core business, understanding these trends will help them choose which opportunities to pursue.

- DARQ Power

Distributed ledger technology, AI, Extended Reality and Quantum computing will be the next set of new technologies to spark a step change. Together, capitalizing on new mechanisms for transacting with trust and intelligence, they will enable insurers to reimagine the entire industry and its role in the world.

- Get to Know Me

Technology-driven interactions create a tech identity for every insurance customer—an identity that may require insurers to meet customers in different digital places in different ways (for example, as a shopper, an employee and a policyholder) and on different platforms. It will be the key to understanding the next generation of consumers, and to delivering individualized, experience-based relationships.

- Human+ Worker

Insurance workforces are becoming Human+. Each worker is empowered by their skills and knowledge plus a new set of tech-driven capabilities. Now, insurers must adapt technology strategies to support a new way of working in the post-digital age.

- Secure Us to Secure Me

Ecosystem-driven business connections increase insurers’ exposure to risks. Leaders recognize that just as they collaborate with entire ecosystems to deliver best-in-class products, services and experiences, security must join that effort as well.

- My Markets

Technology is creating a world of intensely-customized, on-demand and momentary experiences. Insurance companies must reinvent their organizations to find and capture momentary markets by assessing and delivering products for momentary risks.

Each of these trends is raising expectations, abilities and risks across the insurance industry, but for those insurers willing to adapt, they offer a clear path forward.

In my next post, I’ll look at DARQ technologies. What are they and how will they affect insurers?

In the meantime, to learn more, read Accenture Technology Vision for Insurance 2019.