Other parts of this series:

In the face of the COVID-19 pandemic, carriers need to hold fast to their commitment to building a sustainable future. They should transform themselves into sustainable insurers.

The COVID-19 pandemic has delivered an enormous challenge to insurers. They’ve had to scramble to support their customers, manage their businesses, and assess risk in new ways.

Amid this upheaval, it’s vital that insurers remain focused on their long-term goals. And no goal is more important than building a sustainable future. Calls for businesses to increase their support for sustainability are coming from all spheres of society – consumers, governments, researchers, and environmental agencies.

Already, many big insurers are stepping up their commitment to sustainability. They recognize how important it is for the future of their businesses. They especially grasp its implications for managing increasingly complex risks and developing new business solutions.

All insurance providers should strengthen their commitment to human, social, economic, and environmental sustainability. They need to transform themselves into “sustainable insurers”.

What’s a “sustainable insurer”?

Sustainable insurers put sustainability at the core of their corporate strategies. They consider how their actions affect the environment and local communities. They’re mindful of their impact on customers, business partners, shareholders, and employees. And they understand that a company should never sacrifice sustainability in pursuit of exponential growth.

Consumers are increasing concerned about their future.

Sustainable business principles are becoming increasing important for all organizations. Consumers, employees, investors, and regulators are all clamoring for change. We found, for example, that 62 percent of consumers want companies to take a public and passionate stand on social, cultural, and environmental issues.

Consumers are increasing concerned about their future. A startling 73 percent of the people believe we are more vulnerable today than five years ago. That’s the finding of the AXA Future Risks Report. An even higher proportion of risk specialists agree.

Carriers that become sustainable insurers will join the front ranks of companies working to make the world a better place. A better place for all its inhabitants. What’s more, they’re likely to become more successful businesses.

Sustainability is good for business.

Why is a commitment to sustainability good for business?

Demands on companies to tackle threats to sustainability will increase. Firms that start to address these concerns will endure less disruption and enjoy more support than those that are slow to change. Early-movers can also seize opportunities that emerge from rising concerns about sustainability.

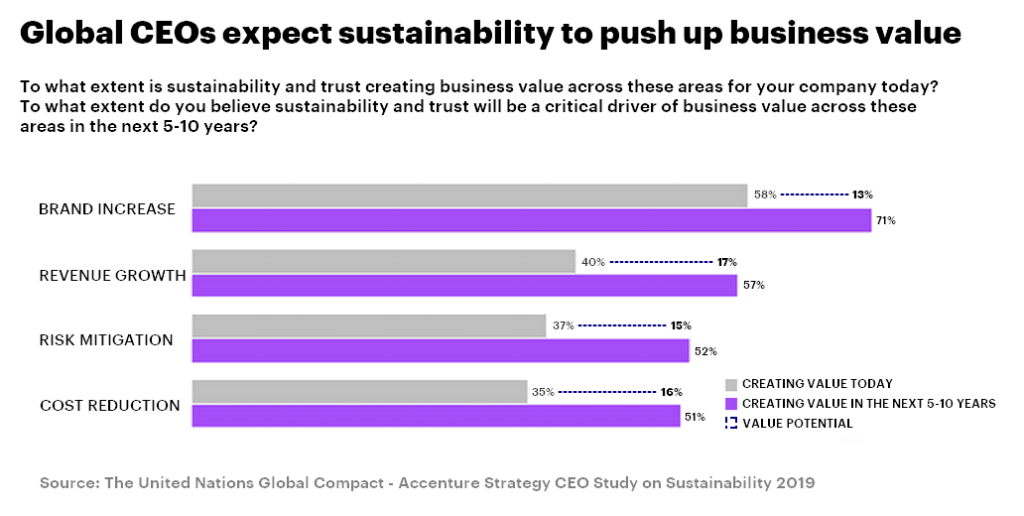

Our research with the United Nations Global Compact, found that 40 percent of CEOs believe that sustainable practices are already pushing up their revenues. And 35 percent say such practices are reducing costs. These CEOs expect further improvements in the next five years.

Smart companies are using “green” energy solutions to lower costs and lift profits. A shift to public cloud services, for example, can reduce energy consumption by up to 65 percent. It can cut carbon emissions by almost 85 percent. What’s more, investors buying assets that meet Environmental, Social and Governance (ESG) standards are enjoying good returns. Research firm Morningstar reports that most European ESG funds outperformed their traditional counterparts in the past 10 years.

Sustainable insurers can better manage risk.

For carriers, there’s another compelling reason to become sustainable insurers. They can better manage risk.

Sudden changes in climate, geo-political upheavals and demographic shifts are increasing the scale and complexity of risk management. Such risk drivers are often interconnected. Insurers that put sustainability at the heart of their corporate strategies can improve risk assessment and pricing.

Carriers such as AXA, Allianz, Zurich, and Generali have embarked on a variety of sustainability initiatives. One of the big challenges facing progressive insurers is the integration of sustainable practices across their organizations. Insurers that get this right will gain an edge on competitors.

Consumers will push insurers to up their commitment to sustainability.

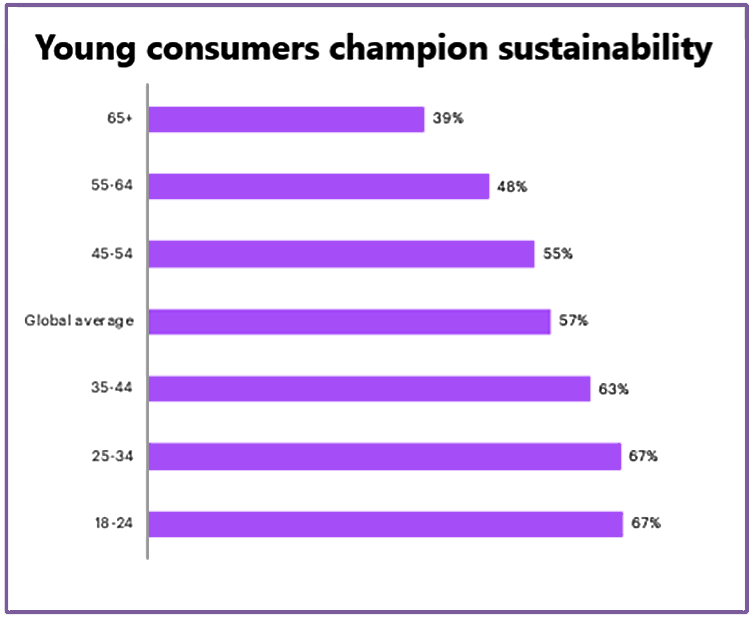

Consumers, particularly young consumers, will push insurers to up their commitment to sustainability. Our Financial Services Consumer Survey found that young consumers like digital experiences that encourage sustainable practices (See illustration below). A huge 67 percent of consumers between 18 and 24 years’ old considered such help appealing. By contrast, only 39 percent of people aged over 65 years’ old concurred. This generational divide shows itself across our research. In another study we found that 67 percent of people aged between 18 and 40 years are willing to pay a premium for sustainable products. Older people, aged 41 to 70 years, weren’t so keen. Only 39 percent would pay extra.

At Accenture, we recently increased our commitment to sustainability. We appointed a senior executive, Peter Lacy, to oversee our sustainability initiatives. We also set aggressive goals to reduce carbon emissions, curb waste, and better manage water resources. Accenture has also stepped up its work with clients to help them reach their sustainability goals. It has worked on more than 500 sustainability projects with over 200 organizations in the past decade.

Critical importance of sustainability ecosystems

In my next blog post, I’ll discuss why ecosystems are critical to carriers looking to transform themselves into sustainable insurers. Meanwhile, you can find lots of information about sustainable business practices at the links below. Or send me a message. I’d like to receive your comments or ideas about this important issue. Take care.

The Decade to Deliver: The UNGC-Accenture Strategy CEO Study on Sustainability.

Subscribe for more from Accenture Insurance.