Other parts of this series:

Insurance providers responded quickly to help customers early in the COVID-19 pandemic but now must contend with long-term challenges.

The COVID-19 pandemic is challenging insurance executives to radically change how their organizations conduct business. They’ve been forced to quickly roll out short-term solutions to meet the immediate needs of their customers. At the same time, they’ve had to take stock of the likely long-term effects of the pandemic.

Many traditional business models will no longer be effective in the wake of the social, economic and political upheaval triggered by the COVID-19 pandemic. However, the insurance industry has overcome many global crises in the past. It has repeatedly demonstrated its resilience and ingenuity and has often helped drive the recovery of economies around the world.

The initial short-term responses of the major insurers to the COVID-19 pandemic have highlighted their inherent resilience and adaptability. The pandemic has also given carriers plenty of opportunities to better serve their customers, their employees and their local communities. Key responses include:

- Home-bound workforce. Insurers quickly shifted their staff to working from home. In some cases, it put a big strain on their IT support teams and temporarily reduced response times. But all of them have been able to stabilize their remote-working environments. Significantly reduced sales and claims, particularly for high-volume P&C personal lines, eased the workload on staff and infrastructure during this transition.

- Customer relief. Many insurance firms are helping their customers weather the effects of the pandemic. Relief measures include generous settlements for workers’ compensation claims, reduced premiums for small businesses and rebates for motor insurance policyholders. All major US motor insurers have announced premium refunds for their customers. The value of these refunds totals as much as $2.5 billion. European insurers have tended to be more cautious. Many of them are exposed to rising risks in other lines of business.

- Social support. Many insurers have given donations to support health workers and hospitals or committed funds to national recovery initiatives. French insurers, for example, have to date donated €400 million to the national COVID-19 relief fund.

- Swift response. Many Asian insurers, particularly Chinese providers, have gone further than most of their counterparts elsewhere in the world in their swift response to the COVID-19 pandemic. Some, for example, have worked with government agencies to develop tracking apps to help contain the spread of the virus. AIA in Hong Kong, for instance, has introduced a COVID-19 alert service that’s linked to its AIA Connect mobile app. Many Chinese insurers quickly offered cover that was specifically tailored to meet the needs of customers during the pandemic. For example, China Life has introduced extended coronavirus cover for its life insurance customers. It provides a lump sum payment to meet medical costs as well as a further payment if the insured person dies.

Global premium revenue set to decline by €94 billion.

Despite their swift action, insurers will not be immune to the longer-term impact of the COVID-19 pandemic. They’re sure to be affected by the likely global economic recession and the resulting downturn in financial markets. Furthermore, they’ll also have to contend with big changes in consumer behavior. My discussions with insurance leaders have identified several major challenges.

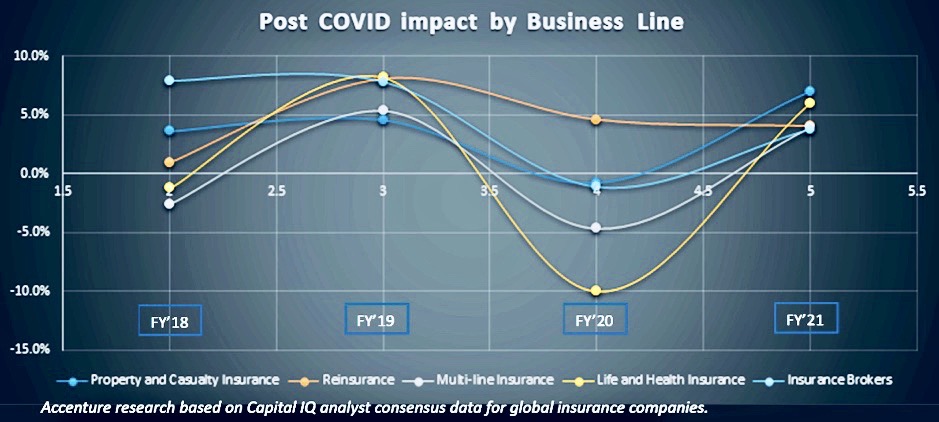

- Revenue slump. Global premium revenue looks set to decline by around five percent this year, about four percent (€94 billion) lower than expected at the beginning of 2020. In Europe, premium income is likely to contract by five to six percent (around €40 billion). Life and health cover will be most affected with global premium revenue likely to fall by about 10 percent (€78 billion) as new life sales almost came to a halt during the widespread confinement of people around the world.

- Market capitalization decline. Publicly listed insurers have seen their market capitalization plummet by as much as 35 percent because of the COVID-19 pandemic. Although stock markets around the world have recovered partially, insurers will probably have to endure lower valuations for a long time, straining their solvency ratios. All large insurers reported solvency ratio declines of more than 20 points at the end of Q1.

- Corporate image and customer confidence. Despite their prompt responses and financial commitments, insurers in many countries have lost the important “communications battle”. Companies in these nations are demanding that their insurers compensate them for losses caused by the pandemic’s interruption of their businesses. Some governments are backing these demands. This situation is often compounded by the different approaches adopted by mutual insurance companies, bancassurers and traditional insurance providers.

- Rising consumer and employee expectations. Consumers have flocked to online services as a result of the social restrictions prompted by the pandemic. Insurers will need to satisfy soaring demand for digital services and experiences or risk losing customers in droves. Similarly, many insurance employees will want to retain much of the flexibility and responsibility they’ve enjoyed during the pandemic lock-downs.

- Strained agents and brokers. The economic impact of the COVID-19 pandemic will be especially severe on small and medium-sized businesses. Many insurance brokers and intermediaries are likely to struggle as well, particularly those focused on hard-hit commercial insurance, travel insurance and workers’ compensation lines of business.

Despite these challenges, insurers have weathered the crisis better than many of their peers in other industries. They’ve emerged as a strong force that is likely to contribute substantially to the recovery of economies and societies in the wake of the COVID-19 pandemic. A big differentiator between insurers in future will be their ability to navigate the uncertain times ahead. Most important will be their capacity to identify and address key opportunities that emerge from this crisis.

In my next blog post, I will discuss some of these opportunities. I’ll highlight how insurers can better meet the needs of their customers, workers and communities. Until then, take some time to look at the links below. I think you’ll find them useful. If want to discuss this topic further, send me an email. I’d like to hear from you.

COVID-19: Navigating the human and business impact on insurance carriers