Other parts of this series:

- Top insurance innovators shine despite COVID-19 cloud

- COVID-19 prompts insurers to boost healthcare innovation

- The 2021 Efma-Accenture Innovation in Insurance Awards ultimate entry guide

- Innovating in insurance – one (digital) step at a time

- Innovating in insurance – high-tech meets reputational risk

- Innovation in Insurance: Platform-based portfolio protection

- Innovation in Insurance: SNACK’s bite-sized solutions

This year’s Efma-Accenture Innovation in Insurance Awards showed healthcare to be a key sector for insurers looking to strengthen their businesses after the COVID-19 pandemic.

The rapid response by insurers to the COVID-19 pandemic has shown them to be far more agile and innovative than many industry observers expected. Insurance providers quickly rolled out a host of solutions tailored to meet the fast-changing needs of their employees and customers.

Now, insurers need to maintain this momentum. They should accelerate their digital transformation initiatives. What’s more, they ought to develop products and services designed specifically for the new post-pandemic marketplace. The COVID-19 crisis, as I mentioned in a recent blog post, has changed forever our experience of being a customer, an employee, a citizen and a human being.

Healthcare, not surprisingly, has emerged as one of the critical sectors that insurers need to give more attention and serve in new ways. Already, many insurance providers are stepping up their investments in healthcare solutions. Research firm CB Insights estimates that equity funding of $US 14.6 billion was injected into healthcare start-ups during the first quarter of this year. Artificial intelligence (AI) applications for healthcare, infectious disease management solutions, life-support devices and mental health services are attracting substantial investments, says the researcher.

Healthcare has moved to the foreground of insurance innovation.

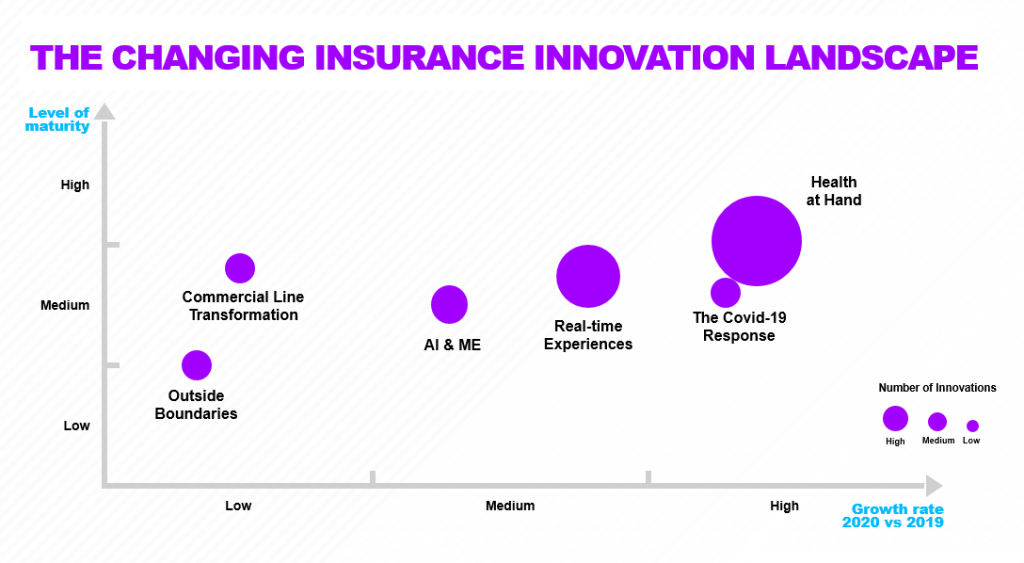

At the recent Efma-Accenture Innovation in Insurance Awards a slew of impressive healthcare solutions went on show. “Health-at-Hand” offerings, together with innovations developed in response to the COVID-19 pandemic, comprised the biggest bunch of the submissions at this year’s awards. A text analysis of the submission reports shows how much healthcare has moved to the foreground of insurance innovation in the past year (See illustration below).

Entrants submitted many COVID-19 solutions for this year’s awards. Often, they developed the solutions at short notice in just a few weeks. Three in particular, I thought, stood out as impressive innovations.

- COVID-19 Lifeband: This wearable device, developed by PZU in Poland, reduces the risk of hospital patients transferring the COVID-19 virus to medical staff. The device constantly monitors patients’ oxygen levels and pulse rates and alerts medical staff when they need to intervene. The Lifeband enables doctors to oversee the health of their patients without needing to come into close physical contact with them.

- COVID-19 Alert Service: AIA in Hong Kong added a COVID-19 alert service to its AIA Connect mobile app. The service, which was developed with Accenture within two weeks, enables registered users in Hong Kong or Macau to quickly receive Government warnings about the virus.

- Online Doctor’s Visit: Argentinian insurer San Cristóbal rolled out a tele-health service across its web and app platforms in less than two weeks. The service went live just before the country entered a mandatory lockdown. The Online Doctor’s Visit service provides the insurer’s customers with access to medical help, through a video call, at no extra cost.

Many healthcare solutions use AI to assess customer needs.

There were plenty of standout “Health-at-Hand” solutions that impressed me at this year’s awards. Many of them were linked to service-provider networks and delivered tele-consultation capabilities. Often, they use AI to assess customer needs or circumstances. Here are three innovations that I think are especially good.

- Emma: This virtual health assistant developed by AXA Asia in Hong Kong is both intelligent and empathetic. It guides customers and prospects, who are using the company’s website, mobile app or chat service, across AXA’s integrated health, wealth and lifestyle platform and answers a wide range of queries about product offerings and general wellness concerns. This innovative solution, which works seamlessly across different communications channels, will soon be available on the Tencent WeChat social media service in China.

- Health Services Ecosystem: Generali Welion has rolled out an extensive digital ecosystem to provide its customers with affordable, high-quality healthcare services. It submitted no less than four different components of the ecosystem at this year’s award. They comprised a tele-consultation service that gives customers 24-hour access to doctors; a tele-medicine facility that manages healthcare provided by medical specialists; a scheduling service that alerts patients about forthcoming appointments and treatments; and a pharmaceutical home-delivery facility.

- Multicare: Developed by Fidelidade in Portugal, the Multicare tele-health service uses voice and video technologies to provide the company’s customers with remote consultations with doctors as well as advice and guidance that encourages healthy lifestyles and prevents chronic illnesses. The Multicare service also offers customers a remote symptom-checker that uses artificial intelligence to identify a range of medical conditions, including COVID-19.

In my next blog post, I’ll discuss some of the impressive real-time solutions on show at the Efma-Accenture Innovation in Insurance Awards. I will also highlight a few of the interesting partnerships that are helping carriers expand their businesses beyond the boundaries of traditional insurance. For further information about the awards click on the link below. Don’t forget, now’s the time to get your insurance innovations ready for next year’s awards.

Efma-Accenture Innovation in Insurance Awards

Disclaimer: This document is intended for general informational purposes only and does not take into account the reader’s specific circumstances, and may not reflect the most current developments. Accenture disclaims, to the fullest extent permitted by applicable law, any and all liability for the accuracy and completeness of the information in this presentation and for any acts or omissions made based on such information. Accenture does not provide legal, regulatory, audit, or tax advice. Readers are responsible for obtaining such advice from their own legal counsel or other licensed professionals.

This document may contain descriptive references to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.

Copyright © 2020 Accenture. All rights reserved. Accenture and its logo are registered trademarks.

It’s impressive to see how quickly insurers like San Cristóbal, AXA, and Fidelidade responded with scalable digital solutions such as telemedicine, AI-based symptom checkers, and virtual health assistants. These initiatives not only showcase technological agility but also reinforce the industry’s growing commitment to public health.