Other parts of this series:

It took a global pandemic to accelerate digital transformation in the life and annuity industry. COVID-19 prompted major changes in the way we live and work, thrusting consumers of all ages and digital abilities online, like it or not.

But the pandemic isn’t the only driver of change in the industry. Consumer behavior had already been changing, and research shows a deep shift in their values, which are now more keenly focused on health, safety and financial security.

These circumstances converged to give life and annuity carriers a unique opportunity to reinvent their digital insurance businesses. Consumers now operate in the digital space more than ever, so carriers must meet them there. They will need to use rich data and digital technologies to provide fast and easy online transactions, new and improved products and services, and improved product distribution and services. They will need to move from a transactional business model to a relational one that cultivates valuable and lasting relationships.

This digital shift among consumers is here to stay. Younger generations, generally more digital-savvy and accepting of technology in their daily lives, were making the shift before the pandemic. While retention rates across the industry still hover around 85 percent, our research shows that more Millennials and younger consumers say they intend to switch insurers in the next 12 months. Their acceptance of, and preference for, digital channels make it easier for them to decide to switch to digital insurance competitors, including new insurtech entrants.

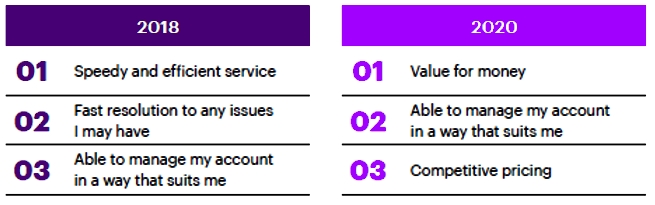

Accenture Research shows consumers expect more for their money and wish to be in control of their information. Three ways COVID-19 is changing insurance, Accenture 2020

Identifying customer needs, giving them what they want

Under the old way of doing business, it would be difficult if not impossible to meet the new demands of digital insurance consumers. Traditional demographic data simply could not provide the insights necessary to create new insurance products specific to their wants and needs. But in this new digital reality, insurers can gather vast amounts of data never before available to them through the internet of things, such as fitness-tracking devices. Consumers are also indicating a willingness to trade personal data for more personalized products and services. This immense amount of data, when processed by artificial intelligence, can provide the clearest and most detailed profiles of consumers ever.

Accenture surveyed nearly 50,000 consumers across 28 global markets. Our research found that Millennial and younger consumers aged 18 – 34 expressed greater interest in digital offerings that help them make safer, healthier, and more sustainable choices. And nearly 60 percent of consumers over 55 said they would share significant data for personalized services that help them prevent injury and loss, a 24 percent increase from two years ago.

Leading insurers are leveraging this customer data and investing in a better digital customer experience to differentiate themselves and win consumer trust and loyalty. Moreover, our research shows digital investments pay off in revenue growth, with leaders seeing 13 percent more premium and annuity revenue than their trailing counterparts (Source: Where’s the payback on digital innovation in insurance).

Guide insurance customers to safety and well-being – Insurance Consumer Study 2021

Learn moreGoing forward, successful insurers will use digital technologies to create a 360-degree view of their customers. They will meet in a digital insurance marketplace deeply informed by rich data and powered by artificial intelligence, identifying individual customer needs at a granular level and providing products and services specifically tailored to them.

The new digital customer experience will go far beyond the digitization of paper forms. It will be an entirely new process with automation to improve intake and evidence gathering. It will employ predictive risk models to enable fluidless underwriting, that shortens claim decisions to hours, instead of weeks or months. It will employ video to welcome new policyholders with the same warmth and personalization of a face-to-face meeting.

Good for consumers, good for business

Digital capabilities combined with data analytics will help your company cultivate healthy, long-term customer relationships, potentially increasing lifetime customer value and opportunity through relevant offers. Whether your digital strategy is to build or buy differentiating capabilities, today’s cloud-based digital insurance platforms provide the flexibility to do both. As a result, insurers not only improve long-term customer experience and increase lifetime value but also decrease short-term operating costs. Learn how customer experience can differentiate your insurance business and drive profitable new opportunity. Let’s have a conversation.