Other parts of this series:

Carriers such as Discovery, USAA and Ping An are building agile business models.

Times of uncertainty and challenge tend to separate visionaries from their more conventional counterparts. Visionaries stand out from the crowd because they recognize how their contexts are changing and move quickly to prepare for their new circumstances.

As digital disruption begins to shake up major industries across the world, visionary companies are starting to set themselves apart. They’re seizing the potential of new digital technologies to radically change their businesses. They’re becoming “living businesses” that can quickly roll out new products and swiftly ramp up the customer experience they deliver.

The insurance industry, as I mentioned in an earlier blog post, has so far experienced little real disruption. But it has begun and will certainly increase. Visionary insurers such as Discovery, USAA, and Ping An, among others, are already harnessing the huge potential of digital technologies. They’re building agile business models and launching ground-breaking customer offerings and ecosystems that are far removed from those of the conventional insurance industry. What’s more, these companies are already reaping healthy returns from their investments in digital innovation.

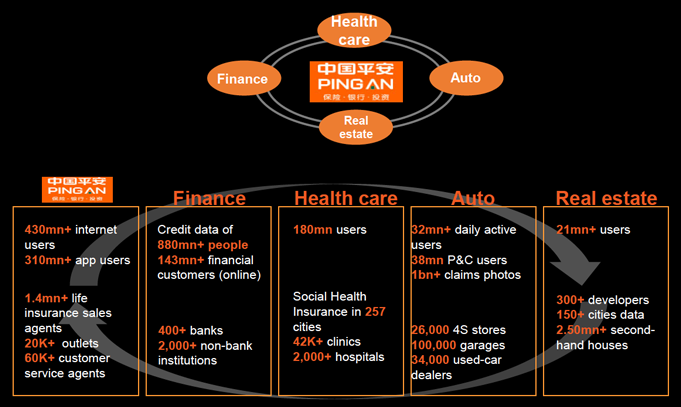

Ping An is probably the most impressive example of an insurer transforming itself into a living business. It’s leveraging five key technology enablers and building four powerful ecosystems while improving the efficiency of its core operations and streamlining its internal operations. The technology enablers at the heart of Ping An’s transformation are biometrics, big data, artificial intelligence, blockchain and cloud computing.

Ping An’s example shows clearly that the prospect of creating value out of ecosystems is more than just theory. However, our research reveals that only a small proportion of insurance providers are currently generating significant income from the new businesses they’ve created using digital technologies. Only 9% of the insurers we surveyed report that more than 75% their revenues come from businesses started in the past three years. Furthermore, only 42 percent of insurance companies are confident that they have sufficient investment capacity to grow their traditional core businesses.

We found that visionary companies that quickly embrace emerging digital technologies and use them to radically change how they conduct business are far better prepared for the future than those that hold back. These progressive organizations know the importance of becoming agile living businesses that continuously adapt to the evolving needs of their customers.

Visionary companies tend to recognize two important facets of digital disruption that their more cautious counterparts often overlook.

- First, they understand that digital disruption is going to be far more powerful than most companies realize. Not only will it change traditional markets, but it will also create many completely new business opportunities that cut cross conventional industry sectors. In an environment where information is no longer a scarce resource but an abundant commodity, visionary companies will thrive by collaborating in dynamic ecosystems that create and share value.

- Second, visionary companies realize that digital disruption is already eroding the revenues and profits of most traditional businesses. Many companies are looking out for sudden digital advances that could quickly threaten their businesses. Such “big-bang” disruption does sometimes happen. But more dangerous and insidious is “compressive” disruption. This is the slow, inexorable squeeze on cashflow and profits that occurs as competitors become more relevant, appealing and efficient through their increasing use of digital technologies. It often goes unnoticed because almost all the incumbents in an industry are affected.

In my next blog post, I’ll discuss a vital requirement for companies wishing to become living businesses – courage. Until then, have a look at these links. I think you’ll find them very helpful.

Disruption need not be an enigma