Insurers must consider participating in ecosystems to disrupt, instead of being disrupted.

Highlights

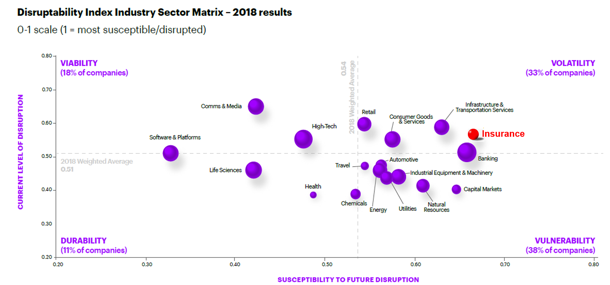

- Accenture analyzed 18 industries and found that although insurance is currently experiencing a moderate level of disruption, it is among those most susceptible to future disruption.

- It has been estimated that by 2022, carriers that are slow to respond to changes by agile, hyper-relevant competitors—we call them ‘living businesses’—could suffer market share erosion worth a total of US$198 billion worldwide over the next five years. They would also forfeit the opportunity to pursue new growth opportunities worth $177 billion.

- Ecosystems are a major cause of this wave of industry disruption. Rather than becoming victims of it, insurance companies can join existing ecosystems or design and execute their own to ensure they are the disruptors, rather than the disrupted.

Questions answered in this ultimate guide

- Why is the insurance industry vulnerable to disruption?

- Are new technologies a threat or an opportunity?

- How are insurtech companies disrupting the insurance playing field?

- How can insurers and insurtechs work harmoniously together?

- What is an ecosystem?

- What is the difference between a partnership and an ecosystem?

- How are ecosystems disrupting the insurance industry?

- If ecosystems are a major source of industry disruption, what are insurers waiting for?

- What can insurers bring to the table in an ecosystem?

- When it comes to ecosystems, where do insurers fall short?

- What questions should I ask when defining my ecosystem?

- How can my business be an attractive ecosystem partner?

- What makes an ecosystem master?

- How can insurers select the right ecosystem partner?

- What underpins a successful ecosystem?

- How can insurers play to win in the ecosystem?

- How can I practically integrate the customer in my ecosystem?

- What role does blockchain play within ecosystems?

- How can blockchain deliver new efficiencies for insurers?

- How can insurers use Accenture’s ‘wise pivot’ to benefit from ecosystems?

- Case study: the wise pivot in action.

Why is the insurance industry vulnerable to disruption?

Accenture’s analysis of 18 industries shows that the insurance industry is highly susceptible to future disruption. In 2013, when the first Disruptability Index study was conducted, insurance was experiencing a low level of disruption but ranked fourth in its susceptibility to future disruption. Today, as foreseen, the level of disruption has risen significantly. And this is just the beginning: the industry’s susceptibility has also escalated.

Why now? The insurance industry has one of the highest ratios of cost of labor to final price, meaning that there is a great deal of trapped value inside the insurance value chain.

Since 2013, Accenture research has predicted that every business, in insurance as well as elsewhere, will need to become a digital business. In an increasingly connected world, consumers manage most of their lives online. This means that their assets are online and they are accustomed to receiving online experiences tailored to them. They are going to expect that you know who they are, what they need and when they need it. They will set high standards for your service levels, and will demand that you are easy to transact with. Added to this is the fact that the nature of risk is changing, as is the way carriers tailor and serve insurance experiences for their customers.

The world is going to keep changing, and the model that insurers have executed for the past 20 years will probably not be the model that they are going to execute in the next 20 years. Disruption is likely to accelerate and intensify. Insurance executives, therefore, cannot afford to be complacent.

Are new technologies a threat or an opportunity?

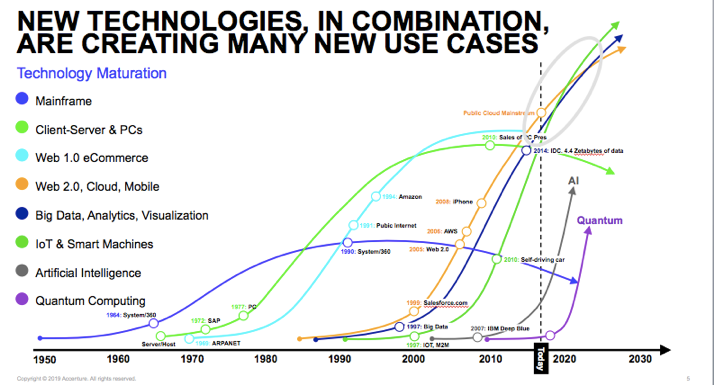

New technologies, from artificial intelligence to big data, are set to transform the insurance industry. This is no surprise, because the nature of insurance is data-, IT- and intelligence-intensive. The most fascinating (and potentially disruptive) developments lie at the intersection of new technologies, where they combine to offer new, integrated and diverse value propositions. This is illustrated clearly by the gray ellipse in the diagram below.

This is exciting for consumers, because it introduces the possibility of an end-to-end insurance proposition that covers everything from risk protection to risk advice and prevention, and a broader range of services. Then, there is the trend of insurtech companies plugging into existing insurance infrastructures, leveraging traditional carriers’ customer bases and data sets while offering them attractive new business efficiencies in the process. Insurance companies, old and new, are forging ecosystems in order to weather the potential disruption of the current and future market.

If insurers don’t innovate and embrace new technologies and ways of partnering with other stakeholders, these new technologies, in all their iterations, will become a force of disruption.

How are insurtech companies disrupting the insurance playing field?

There are many ways in which insurtechs are leveraging cutting-edge technologies to disrupt the current insurance environment. The examples of Extract and Flock demonstrate this disruption in action:

Xtract identified a challenge in the insurance industry. Claims were being processed through a drop-down menu with no visual input from the customer, leaving a claims handler with the responsibility of making an important, costly decision with insufficient information. Xtract uses intuitive AI to visually re-create insurance incidents, with the capability to drop them onto Google maps, to drop pins, and to click on the zone of damage to create a picture of what happened. In addition to this, it has launched a self-serve process so the policy holder can use their smartphone to re-create the incident in front of the claims handler. This takes about a minute and creates a single decision point. Based on previous trials with top-five insurers that are processing on average 300,000 claims a year, this technology could save more than $40 million annually by reducing third party intervention, phone calls and more.

Flock had the vision of quantifying complex risks in real time by ingesting real-time data from multiple sources, resulting in an immediate, granular understanding of those risks and the losses that might result. The business started in the drone industry, trying to understand real-time drone flight risk. For example, if a customer is flying a drone from A to B, they can enter relevant information relating to factors such as weather and location. Off the back of this, Flock built a risk analysis platform to quantify and price that risk.

These innovative data sets have given the company an edge against insurers that are struggling to price the risks of activities or assets that haven’t been around that long, with relatively little historical data. As a result, Flock prices its drone insurance by the minute, sells it by the hour, and gives customers the option of buying it over their mobile phones. The insurer has launched a range of flexible products that include liability insurance and enterprise cover for up to £25 million in damages, which is aimed at telematic fleets run by the world’s largest drone fleet owners like Atkins and the BBC. Since launching in 2018 the business has taken off, and today it helps thousands of customers fly safer and smarter. This success is allowing it to diversify into new spaces, tapping into a number of data-driven insurance and risk management products in the drone industry, from an on-demand insurance app for micro-SMEs, to an exposure-based enterprise product for the world’s largest drone fleets.

How can insurers and insurtechs work harmoniously together?

The emergence of large numbers of insurtechs offering a wide variety of solutions and capabilities is a genuine opportunity for incumbent insurers to innovate through collaboration. Start-ups often have a deficit of traditional insurance expertise, while carriers can benefit from different skill sets and mindsets, alternative ways of harnessing technology, and fresh perspectives on both new and existing market segments.

When given the capability, insurers are fantastic at unlocking the enormous amount of data they have at their disposal and capitalizing on their extensive market reach. This can enable start-ups to apply their technology to a degree that would have been impossible on their own. Insurers, therefore, can offer insurtechs the capability to bridge the gap between old and new.

What is an ecosystem?

The value of a successful ecosystem is greater than the combined value each of the players would be able to contribute—or leverage—on its own.

An ecosystem is a network of players, from either within or outside the industry, who work together to define, build and execute market-creating customer and consumer solutions. Successful ecosystems are defined by the depth and breadth of potential collaboration among the set of players. Each party delivers an important element or capability of the consumer solution. The power of the ecosystem lies in its complementary nature. No single player needs to own or operate all components of the solution. Together, the abilities of all parties in the ecosystem are amplified, allowing the value of the ecosystem to be greater than the combined value of all of the players on their own.

What is the difference between a partnership and an ecosystem?

A partnership describes a business in which the participants have a shared commercial interest. An ecosystem tells a broader story in which the stakeholders are connected with the aim not only of obtaining a commercial advantage, but also of disrupting the market by leveraging innovative experiences that are possible as a result of the partnership.

How are ecosystems disrupting the insurance industry?

In Accenture’s recent research, more than half of the insurance executives (51 percent) we surveyed said their companies are already starting to experience some form of disruption from competitors that have partners in other industries. This disruption is targeting the most critical points on the value chain. For example, insurers noted the highest levels of disruption in the areas of products and services (60 percent) and customer service (57 percent).

If insurers fail to create their own ecosystems, they run the risk of being limited to the role of a pure risk cover provider. Other players may then be in a better position to provide a more nuanced and valuable customer experience, to impose their brand, and to own the customer relationship.

While strategies for managing disruption differ from company to company, it is clear that if carriers proactively design or execute their own ecosystems, they can ensure that they are the disruptors and not the disrupted. Many insurers that have recognized this opportunity have already positioned themselves positively to capture value and tackle disruption head-on.

Ecosystems are a major source of industry disruption. What are insurers waiting for?

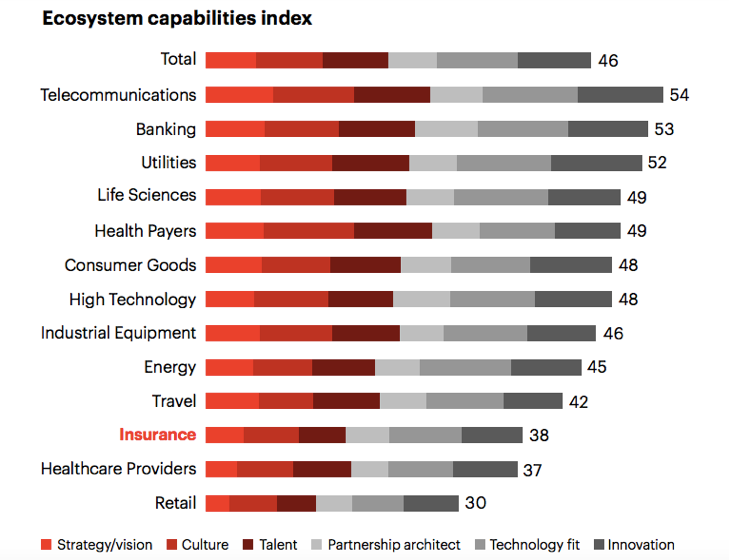

More than 4 out of 5 of the insurance executives we spoke to acknowledged that ecosystems are important to their strategy. Fifty-four percent said that they are actively seeking ecosystems. Out of all the industries Accenture surveyed, the level of interest registered by the insurance industry was the highest. However, while insurers may acknowledge the value of ecosystems as a catalyst for positive change, many are ill-equipped to implement an ecosystem strategy in their business.

Only 5% of insurers can be defined as ecosystem masters.

Ninety-seven percent of the insurers surveyed think they have what it takes to be an attractive ecosystem partner, yet their ambitions and capabilities don’t always line up. When we examined the attributes of companies excelling at ecosystems, only 5 percent of insurers could be defined as ‘ecosystem masters’. Overall, when it comes to the mastery of ecosystems, insurance ranks as the second lowest of all the industries examined.

What can insurers bring to the table in an ecosystem?

Insurers can be an important, worthy element of an ecosystem. Insurers have the data, distribution channels and innovation practices that many tech start-ups would envy. They have decades—often centuries—of industry experience and institutional knowledge of the complex regulatory environment. For these reasons, insurers are more than capable of turning disruption into an opportunity with the right partners.

The average insurance player has unmatched depth and richness of data at its disposal, allowing it to provide a highly personalized, targeted service. Insurers don’t only provide additional knowledge, but also regulatory capabilities that allow it to sell insurance across multiple geographies—something that a technology company, for example, does not have. It also brings longstanding relationships with customers, and a legacy of trust. By partnering with the right players, insurers can apply these abilities to boost the potential for frictionless business.

When it comes to ecosystems, where do insurers fall short?

If insurers are potentially such an asset to an ecosystem, where do they currently fall short? According to our research, the deficit lies in capability, culture, technology and resources. If these issues can be addressed, insurers will be able to exploit the ecosystem opportunity fully.

Insurance executives say technology is the most important thing to get right in an ecosystem. The internet of things, analytics, and other leading-edge technologies such as artificial intelligence, are transforming insurance—yet the industry as a whole is lagging in adoption. In fact, many carriers that have piloted siloed technology have not generated the expected value from these investments. The answer is to become more integrated. As insurance companies pursue market-leading ecosystems, they will not only need to carefully assess their readiness but close the gaps—cultural, technological and other— to ensure they are an effective ecosystem player and the type of partner others are seeking.

What questions should I ask when defining my ecosystem?

No matter how sophisticated a business is, its possession of the right ecosystem capabilities is not a given. You can assess your business’s readiness to participate in an ecosystem, as well as understand the goals and parameters of your ecosystem, by asking these questions:

- How can I create a better experience?

This question focuses on your customer interactions. How can you know more about your customer, what they value, what price they are willing to pay, how they want to transact with your business, and how they want to be serviced following that transaction? Most importantly, how can you discern a way to change that experience and do it at scale, now, in real time.

- How can I enhance the business judgment that I have?

This question challenges you to make choices that positively impact the risk that your business takes on, how you price your offering in the market, and how you can achieve this using the data and experience you have garnered in the past, as well as potential new sources of data.

How can my business be an attractive ecosystem partner?

Choosing to open your business up to ecosystem opportunities is not only about how other businesses can benefit you, but what strengths and capabilities your business brings to the table. The ecosystem might not care about your business, but if you listen to ecosystem partners and respond by offering capabilities they need, it will make you more attractive to investment. You can assess your business’s attractiveness and readiness to become an ecosystem partner or connection by asking yourself the following questions:

- What makes my business stand out in an ecosystem?

In other words, what does your business have to offer a potential ally in exchange for them partnering with you?

- Have my potential partners identified a specific need that my business can address?

If you listen to potential ecosystem partners, it is highly probable that they will bring a fresh idea that you haven’t thought of. This is because they see your business from a completely different angle, bringing new opportunities and ideas that could benefit all parties.

What is an ‘ecosystem master’?

In defining what it means to be an ecosystem master, Accenture looked for companies that are getting the following three things right:

- Aiming to disrupt the industry using ecosystems.

- Planning to lead as many ecosystems as possible.

- Targeting 5 percent or more growth through their ecosystem initiatives.

How can ecosystems help carriers to innovate?

If insurers invest the time, capabilities, technology and resources to strategically implement ecosystems in their businesses, they will reap rich rewards. Consider these examples:

South African health insurer Discovery has made great strides in its bid to realize the full potential of its Shared Value Insurance business model. The carrier has partnered with leading insurance groups around the world, each of which incorporates the Vitality platform into its business model. Not only has the Vitality platform been praised by its customers for its benefits, but Discovery is confident that by 2023 its ecosystem can help improve the health of 100 million people globally.

The Generali Group, based in Italy, introduced a home insurance policy that blends smart-home technology provided by Nest Labs (a Google-Alphabet group company) with its offering to further protect its clients’ homes. For example, Nest Protect’s technology detects smoke and carbon monoxide, and sends alerts to customers’ phones. This partnership creates added value for the customer, and reduces risk for Generali as an insurer. In a move to embrace the Internet of Things (IoT) and digital ecosystems, Generali:

- Launched Jeniot, a company that provides innovative IoT and connected insurance services in the areas ofurban mobility, the smart home, health and the connected working

- Created Welion, an integrated welfare company that specializes in the health ecosystem.

- Launched a campaign in Italy entitled ‘Call for Growth’, to drive partnerships with innovative start-ups from the sector.

Chinese insurer Ping An Insurance has also leveraged ecosystems as a key element of its strategy to become a single source for financial, health and life services. Through its majority share in Autohome, which dominates the online car sales market, it is able to mine valuable data and establish a foothold in the autonomous vehicle sector. The insurer’s property sales and investment ecosystem, Haofang, boasts dozens of real estate developers and more than 12 million participating consumers. Ping An is leveraging this network to create new revenue streams by providing distribution for its mortgages, wealth management and other related products. Finally, its Good Doctor platform connects a vast network of hospitals and has assembled a large team of doctors, 900 of whom are dedicated to providing 24/7 free online consultations to about 77 million patients. This ecosystem alone is worth an estimated US$480 million in annual revenue, which in 2018 increased by 78.7 percent over the previous year. Together, these platforms position the carrier perfectly for diverse and nuanced growth in the insurance space.

The true power of Ping An’s ecosystems is that while they cover diverse territory, they combine effectively to address a broad spectrum of customer needs and to realize the insurer’s over-arching objective.

How can insurers select the right ecosystem partner?

Although insurers may want a seat at the ecosystem table, they need to be intentional about selecting who joins them there. If an insurer is savvy about selecting and interacting with the right partners, it will be able to successfully collaborate outside of its core business, achieving economies of skill, scale and scope.

Skill—Insurers should look for partners that give them access to a wider range of skills, capabilities and technologies which they would not otherwise have had, such as customization, personalization and digital marketing.

Scale—The right ecosystem partners bring greater size and reach. For example, a partner with scale may have vast amounts of data that can be used to inform better customer insights and experiences. Some of the most successful ecosystems are effective data aggregators with a clear strategy on how to share and leverage data in the best interests of all parties.

Scope—Insurance companies should select ecosystem partners that help expand their customer value proposition. The right partner should, therefore, have capabilities that extend the variety of the carrier’s offering and introduce new services.

What underpins a successful ecosystem?

Many factors are important to the continued success of an ecosystem, but the foundational element of a great ecosystem is trust. Trust can make or break an ecosystem. A trust incident involving one player will affect the entire ecosystem. This seemingly ‘soft’ characteristic has a real financial impact. The Accenture Competitive Agility Index revealed that more than half (54 percent) of the 7,000 companies analyzed have experienced a material drop in trust at some point during the past two and half years. When a material drop in trust occurs, the average insurance company will experience a 2.6 percent drop in revenue growth and a 3 percent EBITDA growth decrease. Therefore, in the case of a $25 billion company, this equates to a $650 million decrease in revenue growth and a $750 million EBITDA growth decrease.

How can insurers play to win in the ecosystem?

It’s time for insurers to go all-in and build market-leading ecosystems with trusted partners. Here’s how:

- Shape the market play

Forward-thinking insurance companies will begin their ecosystem journey with a clear strategy defined by the following questions:

- What role do they want to play in customers’ lives?

- How bold will their aspiration be?

- What will be the market play?

Accenture has witnessed three major market plays in the insurance industry: Improving the existing value chain to reshape economics and experiences; end-to-end value chain disruption where insurers can look to monetize the potential of ecosystems through market adjacencies; and reinventing the highest-value aspects of the value chain, creating new ‘living business’ models that realize major revenue outside of their core businesses. With a firm strategic intention in place, winning insurers will define the vision, business case, priorities and roadmap for their market play(s). The roadmap should clearly outline how the ecosystem will incubate, launch and scale ecosystem propositions, products and services.

- Take a look in the mirror

Insurers can become successful ecosystem partners if they begin with an honest look at their own ecosystem capabilities. Carriers must examine their capabilities, culture and technology, identifying any gaps that need to be addressed or strengths to be leveraged in order to be an attractive ecosystem partner. This analysis should be informed by the company’s vision, strategy and future market priorities.

- Pick your partners

Leading insurers will pick the right ecosystem partners to support their market play. They will intentionally seek partners with the assets, domain expertise or technical capabilities to support their ecosystem strategy. This should be complemented by a foundation of trust, collaboration and customer focus, and should reinforce each other’s desired positioning. If partners have similar governance and security processes and standards, the combination will be differentiating and will breed trust.

How can I practically integrate the customer in my ecosystem?

Ecosystems can play a pivotal role for insurers that want to become more customer-centric. A dominant 91 percent of consumers whom Accenture surveyed said that the customer experience is important. In order to use your ecosystem to the benefit of your customers, you need to consider how often you currently talk to them, what you are telling them, and what channels you use to engage them.

The role of marketers has changed. The surface interaction with the customer is fueled by the dynamic, data-driven orchestration behind the scenes that leads to that connection. Through our experience, we have found that ecosystems can benefit customers when their interactions are supported by the right data. You need to understand how your customer interacts with your digital assets in order to customize and alter them, personalizing each touch point where possible. There are no shortcuts, but if you actively measure the good and the bad, you will be able to understand your customer and adapt your ecosystem accordingly.

What role does blockchain play within ecosystems?

Blockchain is getting better and showing capabilities we didn’t know about before. In the past six months, Accenture Digital has proven blockchain’s capabilities in scenarios that were not thought possible at the beginning of the year.

The use of blockchain architecture by the Australian Stock Exchange proved that we could process equities transactions in real time, at a volume that is required to support the stock exchange. In Singapore this year, for the first time, Accenture Digital proved that we could have four blockchains working together in cross transactions across blockchains, confirming that interoperable blockchains are possible. As insurers and their ecosystems become agile and start taking advantage of the digital tools available, the reality is that the tools are just going to keep improving. The impact of blockchain on ecosystems is only starting to be explored as we keep advancing and learning more.

An example of how blockchain can deliver new efficiencies for insurers

Accenture and Generali Employee Benefits (GEB) recently debuted a first-of-its-kind blockchain solution for the employee benefits industry. Blockchain technology is able to create a more connected ecosystem among stakeholders. This establishes a reliable, integrated channel to exchange information, which is specifically relevant to the insurance industry as blockchain’s capabilities streamline manual insurance processes. Participants in the reinsurance process for captive or pooling services are able to access the same data, in real time, across the business. Processing errors are reduced through techniques such as automated reconciliation and smart contracts, which are executed online and visible to all users of the blockchain. In 2018, two global customers of the Generali Group—one of which is Syngenta, a leading agriculture company—and local insurers in Spain, Switzerland and Serbia successfully demonstrated a prototype of this particular solution, illustrating its relevance to the market.

How can insurers use Accenture’s ‘wise pivot’ to benefit from ecosystems?

It is no secret that insurers need to transform in order to deliver results and set themselves up for the next wave of insurance. Ecosystems are the perfect vehicle for this, as collaboration enables businesses to adopt new processes, technologies, data or capabilities much faster than they would have on their own. As a business, you can add muscle in the areas you are trying to grow, expand your geographic reach, and disrupt or defend your market. Ultimately, to become an attractive ecosystem partner and embrace innovation, you need a strategic pivot to the new. The benefits go both ways, as the right ecosystem will serve as a catalyst for your business’s wise pivot, and allow you to generate value through innovation.

Insurers need to drive strong and continual action. Transformation is an ongoing journey that requires agility and constant innovation.

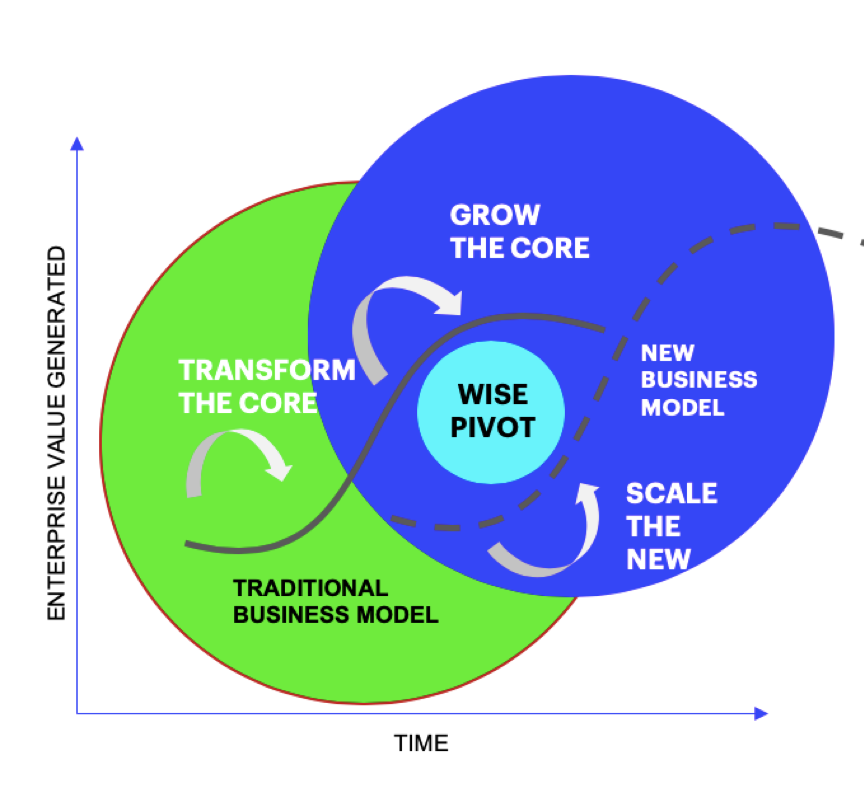

Our ‘wise pivot’ model suggests a four-pronged approach. First, transform the core of the business to drive up investment capacity. Second, grow the core business to sustain the fuel for growth. Third, scale the new business as you identify and expand new growth areas at pace. And fourth, pivot wisely by optimizing investment dollars and capital over time, and shifting to new business models and initiatives at the right time.

A successful wise pivot should be supported by a new approach to organizational change, which we call the rotation to the new. With this strategy in place, you will be well positioned to transform and grow your current business, while scaling new businesses in parallel.

Case Study: The Wise Pivot in action

At our recent Digital Insurer Network meeting, Mike Sutcliff, the Group Chief Executive of Accenture Digital, shared the common characteristics of businesses that have successfully pivoted toward the new. They achieved this through taking the following steps:

- First, the senior leadership team agreed on the business objective for their efforts. This underpinned all pilot and prototype work within the organization. This was a direct top-down effort rooted in a specific view of why the business was integrating new technology and how this should be done.

- The integration of technology and the running of the business occurred in parallel. The people who scaled successfully didn’t remove them from the core business, and segment the new and the old. They gave the team piloting the new technology or approach the power, if the pilot worked, to scale it within the business. That personal connection and individual accountability made a big difference.

- The leadership’s teams invested in the foundation and infrastructure that were required to enable the scale to occur before the pilots were finished.

These businesses were all willing to test, fail, learn and move quickly, all of which was underpinned by strategic-thinking and support from management.

Conclusion

To avoid value degradation and ensure relevance for the future, insurers need to become disruptors before they are disrupted themselves. And in today’s competitive business landscape, they cannot and need not go it alone. If carriers focus sharply on the needs of the customer and select the right set of ecosystem partners to meet these needs, they will benefit from the unique combination of capabilities, data, customers and industry knowledge that will drive their business’s innovation.

In turn, insurers need to recognize that their businesses are a powerful source of intelligence in their own right. With the right technology, resources and capabilities, insurers could see themselves as ecosystem leaders.

Waiting is not an option. To discuss how Accenture can help you innovate using ecosystems, please get in touch.

To learn more, I recommend exploring these resources:

Ecosystems: Cornerstone of future growth

Evolve to Thrive in the Emerging Insurance Ecosystem

Three Things Ecosystem Masters Get Right