Other parts of this series:

- Agile insurers see innovation as critical for their survival

- Zurich sets the pace in insurance innovation

- Savvy insurers are getting up close to their customers

- Agile insurers move quickly to deliver on-demand services

- Innovative insurers unleash the power of big-scale AI

- Smart insurers reap big returns from swift AI roll-out

Seven key trends emerge at this year’s Efma-Accenture Innovation in Insurance Awards.

“Insurance remains extremely susceptible to future disruption. Innovation—and the ability to do so in a sustained manner and at scale—holds the key to future survival”.

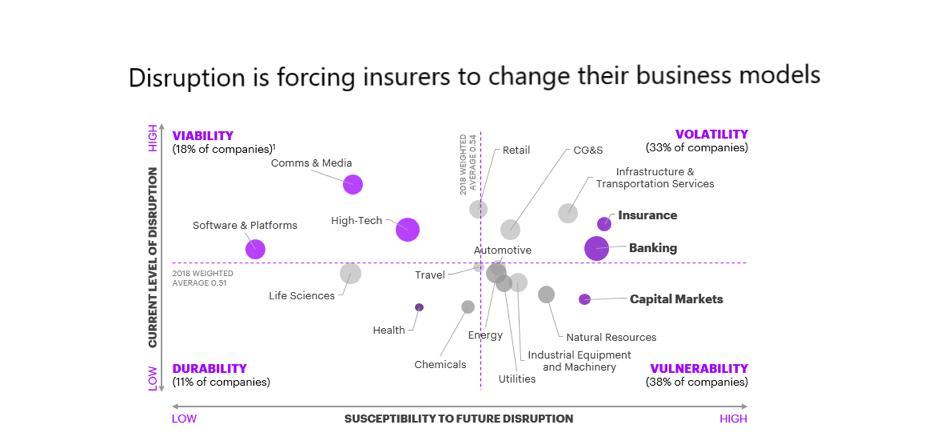

My colleague Piercarlo Gera hit the nail on the head when he spoke at the recent Efma-Accenture Innovation in Insurance Awards ceremony in Amsterdam. Unless insurers commit themselves to innovation, throughout their organizations, they’re putting their survival in jeopardy. Insurance is one of the industries that is most vulnerable to disruption. This is shown clearly in the latest release of our Disruptability Index.

The success of the 2019 Efma-Accenture Innovation in Insurance Awards shows that many insurers are recognizing the importance of the huge challenge that’s facing them. Carriers across the world are allocating substantial resources to improve innovation in almost every facet of their organizations. Zurich Insurance, for example—the winner of this year’s Global Innovator of the Year award—has rolled out an array of impressive innovations across its multinational business. I’ll provide more details of these in my next blog post.

Insurers and insurtech firms submitted close to 400 innovations for this year’s awards—up 23 percent on 2018. They ranged from intelligent underwriting and fraud-spotting systems to wellness apps that use facial recognition to assess life expectancy, AI-driven tablets that help salespeople improve the service they give to customers, emergency services for bicyclists and insurance for users of ride-hailing services eager to avoid price surges caused by rain storms. A total of 287 companies, from 54 countries, took part in the awards—an increase of 25 percent. What’s more, around 2 800 online voters participated in the awards by nominating the innovations they believed were the most creative, likely to have the greatest impact and offered the widest application. These votes were consolidated with the choices of the awards’ judges, a panel of 30 leading figures in the insurance industry, to select this year’s best innovations.

Many start-ups are working with big insurers to accelerate innovation.

Nearly a third of the companies that participated in the awards are start-ups. Many of them are working closely with big insurers, such as AXA, BNP Paribas, CNP Assurances, Baloise and Zurich Insurance to name a few, to accelerate the development of their innovations. Such co-operation is going to benefit the industry substantially in the years ahead.

Aside from acknowledging exceptional commitment to innovation in the insurance industry, the Efma-Accenture Innovation in Insurance Awards perform another important function. They’re an excellent pointer to the major technology trends that are shaping the industry. It’s clear, for example, that insurers are recognizing the huge potential of artificial intelligence (AI) and are applying smart technologies to innovate many facets of their businesses. Large numbers of insurance providers are also looking beyond their traditional markets and are using insurtech partnerships and ecosystem alliances to seize new opportunities. Close examination of all the submissions to this year’s awards reveals seven key trends that are likely to shape the insurance industry in the next few years.

Get to know me: Many insurers are looking to unlock customer value and identify new business opportunities by cultivating a much deeper understanding of the needs and preferences of their policyholders.

My market: By forging close ties with their customers, several innovative carriers can now offer a variety of enticing digital experiences, or momentary markets, that are available in an instant.

Smart automation: The roll-out of AI systems, on a big scale, is enabling progressive insurers to transform their core operations while also boosting the customer experience they provide.

Human+ Worker: A growing number of carriers are recognizing that when AI is employed as an ally to their workforce, not a substitute, the opportunities for improved efficiency and innovation are almost endless.

Beyond boundaries: Digital ecosystems are enabling insurers to team up with a variety of business partners from a broad range of industries to develop innovative products and services.

DARQ Power: Distributed ledgers, AI and extended reality are the first “DARQ” technologies that are insurers are starting to adopt but quantum computing applications are likely to follow.

Insurtech partnerships: Insurance companies are increasingly partnering with start-ups, through venture funding, business alliances or incubator programs, to better identify and accelerate innovation opportunities.

In my next blog post, I’ll discuss some of the eye-catching innovations that Zurich Insurance, the 2019 Global Innovator of the Year, has introduced in readiness for the disruption of many its traditional markets. You can learn more about the Efma-Accenture Innovation in Insurance Awards at https://www.efma.com/innovationininsurance/.