Other parts of this series:

Understanding information across a wide spectrum is one of the key functions of Accenture research. We consistently publish reports based on surveys from top-tier organizations around the globe, as well as our own research. That information is used to help everyone in the organization, from senior executives to employees, better navigate an ever-changing business landscape.

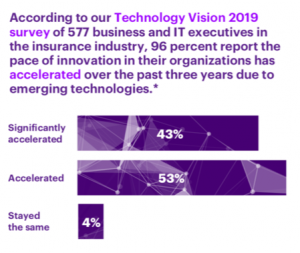

Recently, we published Accenture’s Technology Vision for Insurance 2019 report, which looks at the trends most likely to affect the industry over the next few years. As someone who spends a lot of time thinking about and facilitating innovation, I was excited to read this report. It shows the ways in which technology will collectively inform how enterprises build the next generation of business and create paths toward future growth.

From an insurance perspective, the 2019 Tech Vision shows that insurance organizations are in a new era—one in which offerings and experiences tailor themselves to fit every moment. Our future will be––and in many ways already is––hyper-personalized and responsive to customer behaviors. It is no longer a “one size fits all” world and customers are increasingly demanding individualized plans that adapt to context—from custom marketing and telematics-driven auto insurance that rewards safe driving, to parametric travel policies that instantly pay compensation when a flight is delayed for more than two hours.

From an insurance perspective, the 2019 Tech Vision shows that insurance organizations are in a new era—one in which offerings and experiences tailor themselves to fit every moment. Our future will be––and in many ways already is––hyper-personalized and responsive to customer behaviors. It is no longer a “one size fits all” world and customers are increasingly demanding individualized plans that adapt to context—from custom marketing and telematics-driven auto insurance that rewards safe driving, to parametric travel policies that instantly pay compensation when a flight is delayed for more than two hours.

This bold new era will look very different from the insurance landscape of the pre-digital decades, and insurance companies must figure out how they can shape their business around individual customers and tailor their products and services––or else struggle to compete.

POST-DIGITAL FOR A DIGITAL FUTURE

We are living in what some people are calling a “post-digital” era. The term is somewhat misleading, since the post-digital era doesn’t mean that digital is over. In fact, it means quite the opposite: most of the journey still lies ahead. But digital-born companies such as Google, Amazon, Facebook and Apple have shown consumers how digital products and services can be delivered in ways that make traditional approaches to business seem, at the very best, cumbersome––and at the very worst, obsolete. The post- digital world is one where technology is a key part of the fabric of reality, and insurance companies can use it to meet people wherever they are, at any moment in time.

We are living in what some people are calling a “post-digital” era. The term is somewhat misleading, since the post-digital era doesn’t mean that digital is over. In fact, it means quite the opposite: most of the journey still lies ahead. But digital-born companies such as Google, Amazon, Facebook and Apple have shown consumers how digital products and services can be delivered in ways that make traditional approaches to business seem, at the very best, cumbersome––and at the very worst, obsolete. The post- digital world is one where technology is a key part of the fabric of reality, and insurance companies can use it to meet people wherever they are, at any moment in time.

In this series, I want to explore the top five trends identified in our Technology Vision report and how they relate to insurance. In each trend, you’ll see how digital saturation is raising expectations, abilities, and risks across industries, and how insurance organizations are seeking new ways to differentiate themselves as the world moves rapidly into the post-digital era.

In my next post, I will explore the power of DARQ––and how distributed ledger technology, AI, extended reality, and quantum computing will help insurers reimagine the entire industry and its role in the world.

To read more about Accenture Technology Vision for Insurance 2019, you can download it here. If you’d like to read more of my posts, I encourage you to visit the Accenture blog, where I have several posts exploring everything from data veracity and how it’s reshaping insurance, to life insurance and the internet of thinking.