Other parts of this series:

The Agile Enterprise is a new variation of insurance company. It’s dynamic, adaptable and customer-centric. It recognizes that in the face of digital disruption, business as usual no longer works. And that technology is an enabler of change.

Enterprise agility is an organization’s ability to respond rapidly and effectively to opportunities and disruption. Developing this ability starts from within. As insurers evolve their business models and adopt new technologies, their workforces must reorganize as well. They must shift their mindsets to embrace continuous change and improvement.

At Accenture, we see a trend in companies shifting their focus from their products to their customer experience. As customer expectations continue to change, an insurer’s products and services, and the technology underlying them, will need to follow suit. In this three-part series, I’m going to explore these new Agile Enterprises and the IT strategies behind them. I’ll also share some of the common missteps companies take on this journey and how they can be avoided.

From “doing agile” to “becoming agile”

“Doing agile” is an iterative IT process used initially for delivering software and, more recently, for a wider and more complex range of change programs. “Becoming agile” means rewiring the enterprise for speed and stability. And if agile methodologies are to be used (firms can become truly agile without using Agile methods), it means scaling them across the organization. Flexible operating models and innovation become a way of life. Firms adapt to changing market environments, and to customer expectations that are largely driven by big technology companies like Amazon and Google, as well as insurtech startups. Updated products are delivered as and when needed.

Change comes from within

Currently, many insurers still have a traditional mindset focused on risk avoidance. Their hierarchical structures and siloed operations have a bias towards command and control, with a focus on compliance and cost reduction. Their legacy products and IT systems are likewise outdated and inflexible.

To shift to becoming an Agile Enterprise, organizations must innovate the front office with support from an agile and responsive back office. In Accenture Operations’ research, over 50 percent of executives stated that it takes months or even years for their support business functions to make changes in response to evolving business needs. Approximately 80 percent said siloed internal processes are preventing them from achieving their business goals.

Further to this, Accenture’s 2017 Financial Services Change Survey found that the biggest barriers to an organization’s ability to drive change are:

- Conflictings priorities;

- Availability of resources and appropriate skill sets;

- Employees’ inability to adapt to change.

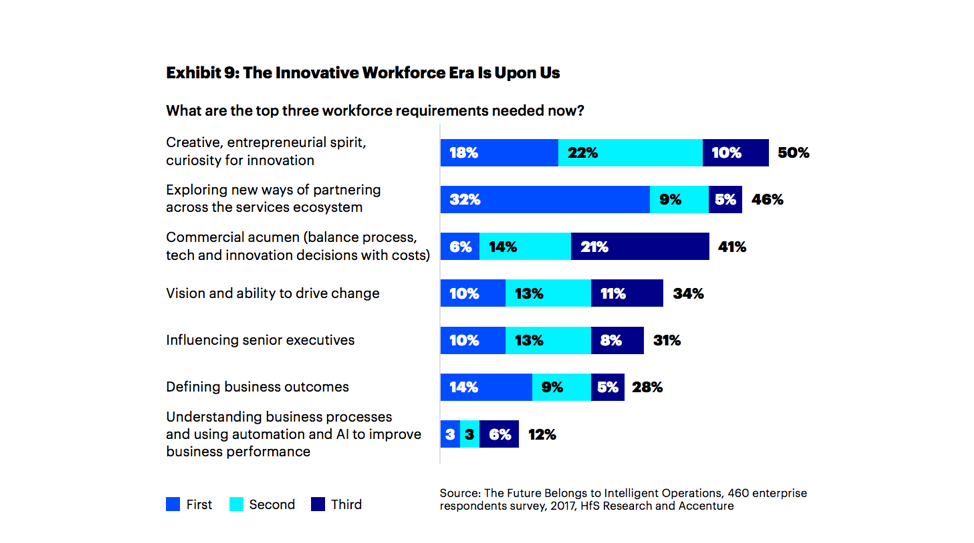

To empower the workforce to enhance the enterprise’s agility, leaders and people managers must shift their focus from business processes and labor management systems to the people themselves. They will need to accelerate education and reskilling, and expand product management and digital teams to enable the company to change and innovate at speed and scale. Human-centricity, creativity and an entrepreneurial spirit will be key to this change.

Leaders will also need to develop a compelling change vision that can be effectively translated into action, investment priorities and a business strategy. Real-time analytics will help with quick decision-making.

Insurers that don’t embrace change and enterprise agility may find themselves disrupted, losing customers to nimble competitors that are more relevant and customer-centric. In my next blog, I’ll explain how these Agile Enterprises develop products differently—and delight customers in the process.

Further Reading: