Other parts of this series:

Learn about the four periods of disruption and what they mean for insurers.

There’s no question that insurance carriers are feeling the effects of disruption. However, while this disruption can be daunting, it doesn’t have to derail you.

To help insurers gain a clearer picture of the challenges they face, Accenture compared how industries are responding to current disruption and their level of susceptibility to future disruption.

Mapping disruption

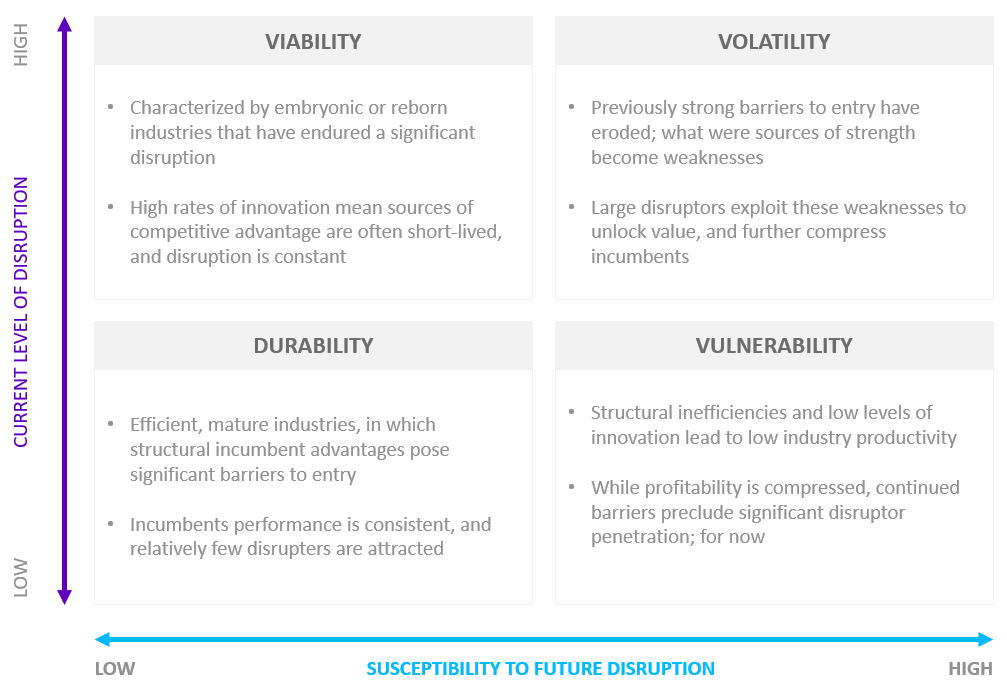

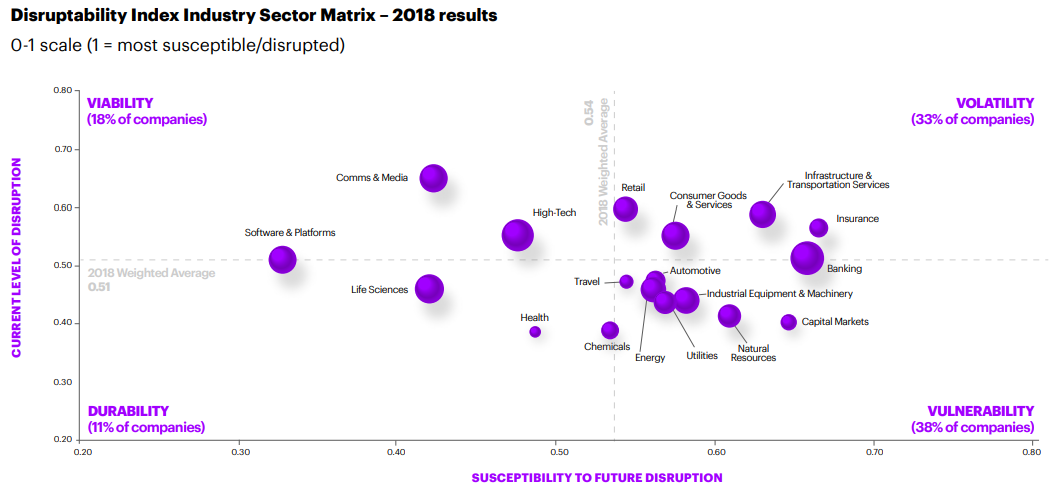

The Accenture Disruptability Index shows where industries fall on the scales of “current level of disruption” and “susceptibility to future disruption.” We’ve identified four periods—durability, viability, vulnerability and volatility.

According to our research, the insurance industry has oscillated back and forth between periods of vulnerability and volatility over the last six or seven years. Insurers have seen high levels of current disruption and high susceptibility to future disruption.

But they’re not alone. Most sectors currently find themselves in the vulnerability or volatility period. Only 11 percent of companies are in the durability period, where disruption is present but less of an immediate threat.

What does this mean for insurers? Will the industry experience this level of disruption in the long term? Or will there be an acceleration of disruption and a tipping point such as we’ve seen in the retail sector?

We’ve seen disruption have a huge effect on the bottom line. Between 2011 and 2018, 3,217 US companies in 18 sectors went bankrupt due to disruption. After sustaining a period of volatility from 2011 to 2018, the retail sector was hit especially hard with 43 corporate bankruptcies. In the same period, there was a 30 percent increase in disruption for the consumer goods and retail sectors. This was based on an almost 500 percent increase in the number of unique venture capital deals over that time, with total venture capital funding of almost $12 billion in 2018.

What can insurers do about it?

The insurance industry does have some inherent competitive barriers to entry that protect it. Specifically, regulation and the capital requirements to underwrite risk are factors. And as far as we can tell, these two barriers aren’t going anywhere soon. But this doesn’t mean you can be complacent. To take advantage of these near-term industry “protections,” you need to do better at meeting customer expectations.

For industries facing disruption, mindset makes a difference. Disruption can be the beginning of real, exciting change—but only if leaders see it as an opportunity rather than a hurdle. You have to embrace intellectual curiosity and new ways of thinking.

The health and high-tech sectors have seen the biggest improvements in recent years. They’ve built resilience by reducing operating costs and committing to innovation. For example, high-tech companies shaved an average of 2.6 percent off their cost of goods sold/revenue. They also increased the value of their cash and short-term assets by 40 percent. And they did this while experiencing more disruption and financial performance pressures and a continuous influx of disruptors.

When we asked CEOs what they thought the critical success factors would be for the next year, 76 percent of CEOs said customer trust was a priority. Interestingly, they noted that consumers and employees are influenced more and more by trust. Even how committed a company is to sustainable business practices can make a difference.

Other figures in our research support this. Over 70 percent of insurance customers want to buy goods and services that reflect their own personal values. And 83 percent want to see more transparency into the integrity of a company’s operations and treatment of staff.

Competitive agility is also going to be key. Insurers that can develop their agility muscle appropriately throughout the organization will be able to respond more quickly to the changing market. I’ll explore this concept of agility in more depth in a coming post.

In my next post, I’ll take a closer look at how insurers can get better at countering disruption.