Other parts of this series:

Insurers are adapting their products and services in new and exciting ways

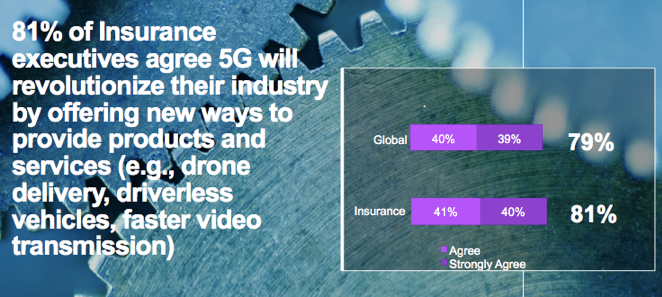

It’s a new age for insurance, one in which insurers are adapting products and services to better serve their customers in new and exciting ways. For example, 81 percent of the insurance executives we surveyed agreed that 5G will revolutionize their industry by offering new ways to provide products and services.

What does this mean in an industry that is likely to shift under the influence of technical development and innovation in the future? Accenture’s just-released 2019 Technology Vision for Insurance highlights this year’s big trends in tech, and provides guiding strategies to succeed in the post-digital era.

Defining the post-digital era

As digital becomes all-pervasive, the way we speak about it has evolved. People no longer say we live in the age of electricity, for example, because power is a central part of how we live and work. Similarly, digital is no longer seen as new or innovative within the insurance industry, but is the key to becoming more relevant to customers. It’s time for insurance leaders to strategize what’s next.

Our Technology Vision for insurance

Accenture’s Technology Vision highlights the emerging developments in IT that will have the greatest impact on the industry in the next three to five years. These trends are relevant, immediate and likely to have an impact on insurers’ strategy in the future.

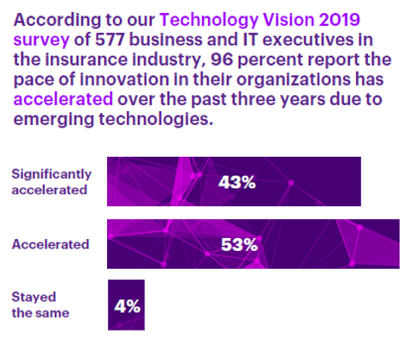

The research as it relates to insurers is extensive. We consulted a group of over two dozen individuals from the public and private sectors, academia, venture capital and entrepreneurial companies, as well as more than 100 Accenture business leaders. We also interviewed 577 insurance executives.

How insurance organizations are preparing themselves for the post-digital era

At a glance, insurers are taking the following steps to get ready for the post-digital environment:

- Doubling down on the use of digital technology, using it to simplify core processes and enhance efficiencies.

- Turning a strategic eye toward the future, adopting technology that has longevity in the business’s growth trajectory. Insurance leaders are acutely aware that a digitized organization constitutes the foundation on which all future innovation will be built.

- Looking to customer behavior and ecosystems to develop increasingly relevant new offerings and experiences.

Insurers that find a place in the digital ecosystems of the future, and invest in the next wave of emerging technologies, will gain a head start in an era when customer expectations will only increase.

Read the full report here, or get in touch to discuss how to prepare your business for the post-digital world.