Other parts of this series:

Despite the insurance industry’s high vulnerability to disruption and its challenge to remain relevant to a new generation of potential customers, here at Accenture, we remain optimistic. Why? Because we are at a pivotal point in time. Technological advances, coming at breakneck speed, are changing the way we deliver value. They are redefining value … from the customer’s perspective.

And it’s not only the life and annuity industry. We see technology underpinning this pivotal point across nearly every sector Accenture serves. We refer to these technologies as SMAC and DARQ. SMAC, now considered table stakes, consists of social, mobile, analytics and cloud. These foundational technologies enable the hyper-personalized experiences customers expect. They enable us to innovate at scale.

Insurance leaders that have adopted SMAC are now turning to emerging technologies that we call DARQ: distributed ledger, artificial intelligence, extended reality and quantum computing. We believe they represent the next pivot point as our industry continues to seek value not only from within, but also beyond its organizational boundaries—a systems approach that is boundaryless, adaptable and radically human.

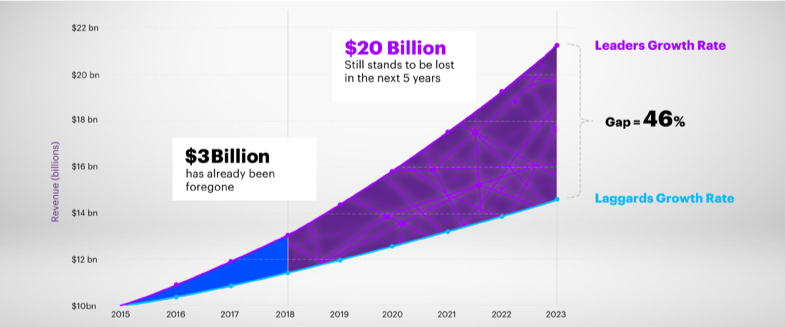

While that may sound aspirational, some organizations are already achieving value from this approach. Yet others that apply similar technologies, but do not have an enterprise-wide systems approach, limit the value they derive from their technology investments and quickly become disenfranchised with them. Accenture has identified this phenomenon as the “innovation achievement gap”—the gap that exists between innovation leaders and laggards relative to revenue growth from innovation. And the gap can be significant—as much as 46 percent!

One of the most poignant points from Accenture’s research of more than 8,300 global organizations is that technology is everywhere, value isn’t. While technology is a key enabler of innovation, the research indicates that leaders who apply it to build enterprise systems can scale innovation and easily adapt to deliver continuous value.

Every day, Accenture addresses the promise and peril of these technologies across numerous industries and organizations to help close the innovation gap. We’ve uncovered five key actions leaders take to derive greater and sustained value from their technology investments:

- Adopt technologies that make the organization fast and flexible

- Get grounded in cloud computing

- Recognize data as being both an asset and a liability

- Manage technology investments well—across the enterprise

- Find creative ways to nurture talent

In addition, leaders adopt an innovation mindset and build a culture of transformation within their organizations. Within the insurance industry, highly vulnerable to disruption, these five actions, along with the right mindset and culture are already delivering value to several innovative life and annuity carriers. In my next post, I’ll share an example of how one insurer is successfully applying this approach to create value for the organization, its associates and customers.