Other parts of this series:

A recent Accenture study indicates insurers recognize the many benefits of cloud adoption and, as I explained in my previous blog post, are ready to get started on their transformation. While that’s good news, readiness is only one part of the equation. Successfully migrating to the cloud and reaping the benefits require both thoughtful planning and taking the right steps.

The benefits of cloud are clear

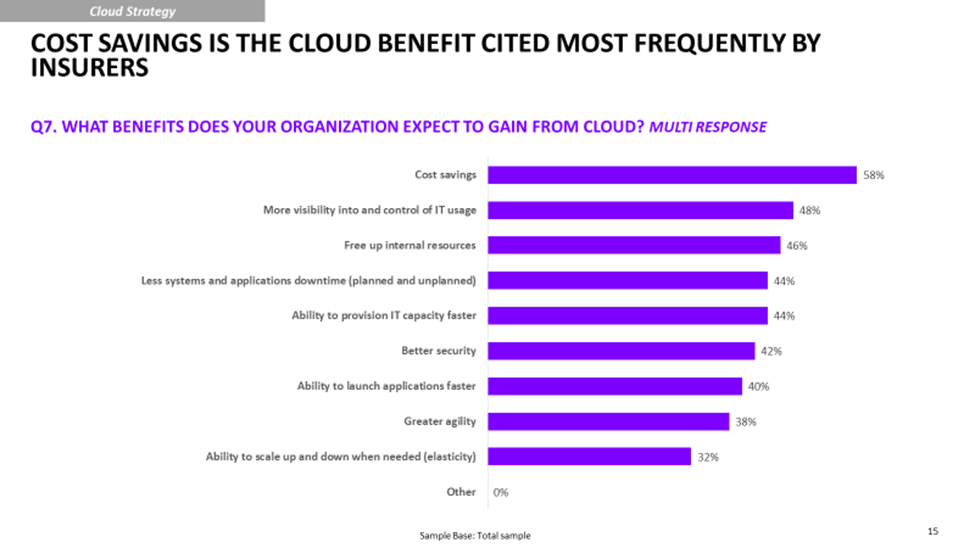

The benefits of cloud adoption are very apparent to insurers. While costs savings is the most frequently cited benefit (Figure 1), many insurers also believe cloud will boost their ability to bring new products and services to market, facilitate integration following mergers and acquisitions, improve product reliability, and help create better experiences for customers.

The cloud enables market opportunities

More than eight in ten insurance executives agree that digital demographics gives their organizations a new way to identify market opportunities for unmet customer needs. Cloud is an enabler in organizing, analyzing and accessing this digital insight. Learn more in Accenture’s Technology Vision 2019 report.

Four areas for expanding and accelerating cloud adoption

By focusing on the following four key areas, you can help ensure your cloud adoption will deliver the greatest benefits with the least disruption.

- Designing a cloud strategy. Cloud capabilities are now foundational to every area of the business, including product development, operations and customer service. Thus, organizational success depends on developing a cloud strategy as an enterprise-wide endeavor, rather than piecemeal.

- Tackling cloud applications. Many insurers have begun migrating applications that may be considered non-core to the Cloud while holding off on core systems. Core insurance platforms such as policy or claims remain the most difficult to migrate. Some Insurers are choosing to partner with platform providers themselves or other vendor partners to determine the scope and approach for moving these core systems into the target state cloud environments.

- Organization and talent. Only half of all insurers feel confident that their organization has the talent and skills required for full-scale cloud adoption. Most are addressing this issue by establishing a dedicated team for managing cloud strategy. However, upskilling and reskilling should remain a high priority.

- Managing the cloud. Proper planning for and ongoing management of cloud adoption are critical success factors. A comprehensive cloud use inventory is a must and should be completed at the outset. Cloud security also remains a top concern for most insurers, as it should be. Although the cloud offers investments in security that are more than most carriers have in-house, there still are risks that the organization must fully support and agree upon with the cloud providers.

Once you’ve addressed these cloud transformation focus areas, you’ll be in a very good position to take the right steps toward optimizing your cloud transformation. I’ll explain those in my next blog post.

For more information about insurer readiness for the cloud, read the Accenture report: Take Insurance to New Heights.