Other parts of this series:

New release – Tech Vision 2019 explores how insurers can find new pathways to the future with DARQ technologies

In my previous post, I spoke about how the emergence of a post-digital world is one where technology is the fabric of reality—and how insurance organizations can use technology to meet people’s needs instantly.

New technologies are catalysts for change, offering extraordinary new business capabilities. In this post, I’ll look at one of the five emerging trends that will shape insurance over the next three years—as highlighted in the newly released Accenture Technology Vision for Insurance 2019—DARQ Power.

What is DARQ?

Our survey found that a large cohort of insurance executives—82 percent—agree that SMAC technologies (social, mobile, analytics and cloud) should form the core technology foundations for their organizations.

So, if SMAC is our present, what will be the next set of new technologies to spark a step change and allow businesses to reimagine entire industries?

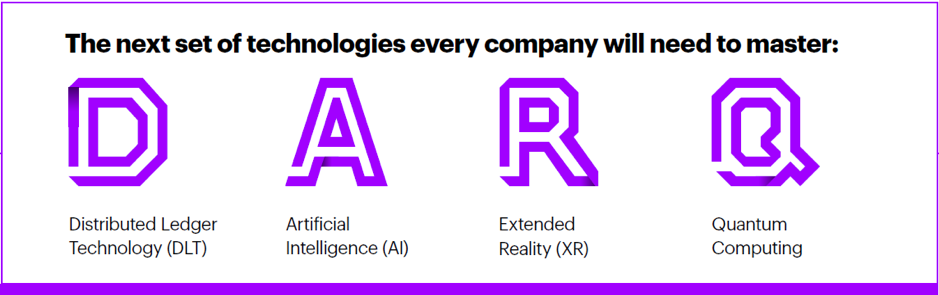

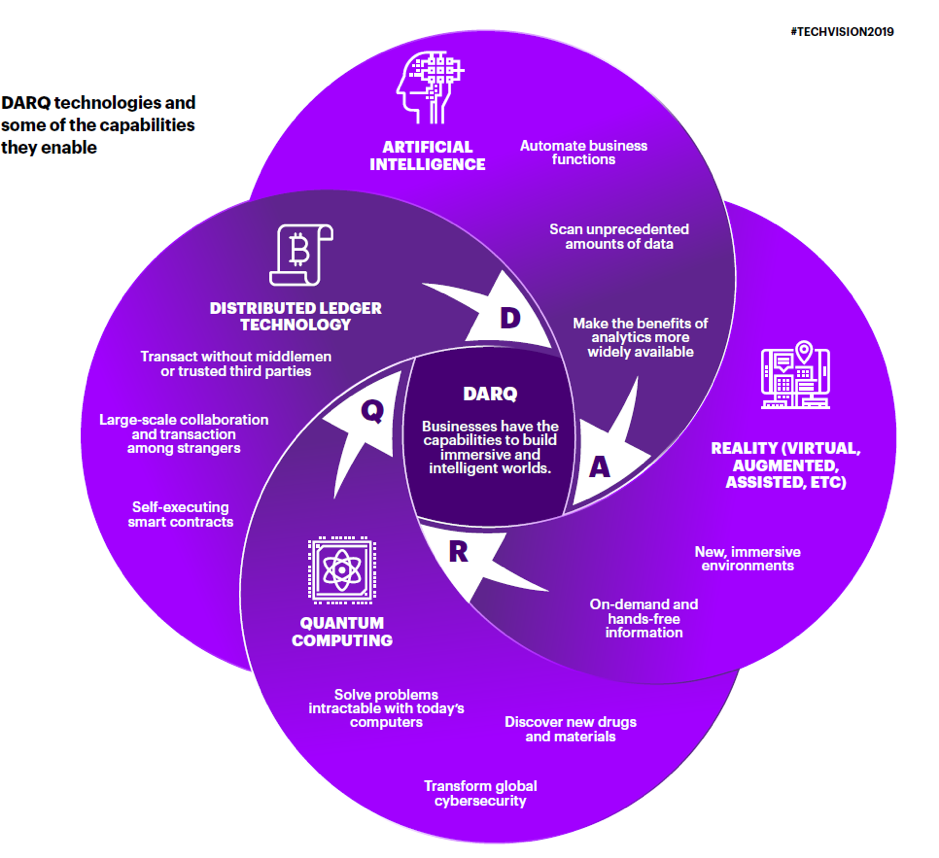

Welcome to the era of DARQ power, or distributed ledger technology (D), artificial intelligence (AI), extended reality (XR) and quantum computing. These technologies are poised to become the foundation for next-generation products and services.

Insurers leading the way with DARQ

Individually, these four technologies represent opportunities for businesses to differentiate their products and services; together, they will open new pathways to the future.

Leading insurance organizations are already using DARQ technologies to create new business opportunities:

Last year, Accenture and Zurich Benelux launched a blockchain-based solution, an example of distributed ledger technology, to help customers manage surety bonds. Customers can now manage their bonds—for example check their status, get history records, complete new requests or view bond forecasts—online instead of going through a cumbersome process over the phone.

Sompo Japan Nipponkoa Insurance plans to shorten the gap between an auto accident and insurance payout from two months to two weeks or less—by using AI to recreate vehicle collisions from GPS, dashcam and historical accident data. With AI, the insurer can analyze vehicle speed, the position of related objects and the environment at the time of the accident to get the full picture of what happened.

AXA XL is creating a pilot using AI and natural language processing software that has the potential to free underwriters from tedious, manual chores. The solution automates the production of the engineering survey reports used to provide appropriate insurance cover and accurate pricing.

Then there’s Ping An Insurance. The Chinese financial services giant is getting the most out of the combinatorial effect of several emerging technologies to transform its industry and core business. Ping An is using AI, blockchain, cloud, big data and security to drive its ‘finance + technology’ and ‘finance + ecosystem’ strategies.

Ping An’s platform-driven ventures are also blurring the lines between multiple industries. For example, the Smart City ‘1+N’ platform supports medical insurance, finance, education, elder care and real estate services and was built on intelligent cognition, AI, blockchain and cloud technology.

When asked to rank which of the DARQ technologies will have the greatest impact on their organization over the next three years, 42 percent of executives ranked AI number one. Some DARQ technologies may seem more impactful today, but exploring all four will be crucial to take advantage of combinatorial effects.

Insurers that want to transform their core business and industry with DARQ technologies can start by asking the following key questions:

- Is my digital foundation ready for DARQ?

- How will we access the DARQ technologies that are relevant for our business, keeping in mind their different levels of maturity?

- How are we adding DARQ skills to our current workforce?

- How can we use DARQ to shape the future of our industry?

In my next post, I’ll explore how insurers can use digital insights to create hyper-personalized experiences. Until then, have a look at the Accenture Technology Vision for Insurance 2019, or get in touch with me here.