Insurance CIOs look to these 3 essentials to drive their ecosystem strategy and accelerate innovation.

Insurance ecosystems have the potential to accelerate innovation and boost business for life and annuity providers. According to Accenture research, 81 percent of executives agree that the right ecosystem will allow their company to grow in ways that are not otherwise possible. The study also indicated that 58 percent of insurance industry executives are actively seeking to define and implement the right ecosystem. Why? They’re motivated by the opportunity for innovation, access to new markets and customers, and increased revenue growth.

The right technical environment that’s flexible and decoupled enables life insurers to capture opportunities and adapt along their varied digital journeys. As ecosystems push the boundaries of digital business from centralized to distributed systems, the following elements are essential to advance your ecosystem strategy and the opportunities it can enable.

1. Platform

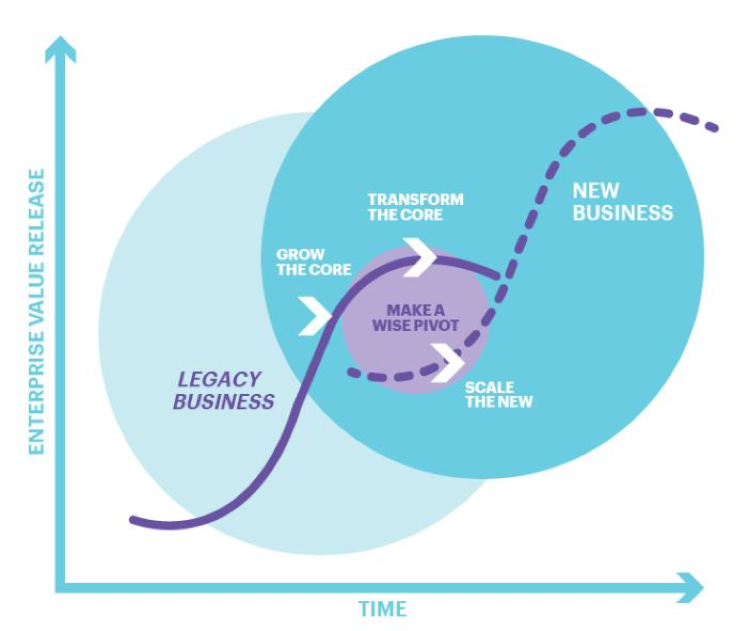

A modern, componentized new-business, underwriting and policy administration system is table stakes. It’s part of what we refer to as the “wise pivot” and fundamental to your digital transformation strategy. However, the platform’s underlying system architecture is what can dramatically accelerate ecosystem connectivity. The most effective platforms use smart integration and orchestration that apply AI, including machine learning and robotic process automation (RPA) technology, to power the ecosystem. This enables it to scale and adapt as your business and the market change.

2. Cloud & Microservices

Aside from its obvious ability to reduce operational cost, the cloud’s scope and scale are key to powering new business and processing data in ways once thought plausible only for popular online retailers, certainly not life and annuity carriers. Like many brick-and-mortar retailers, L&A carriers find themselves challenged to “keep the legacy lights on” while investing in the future. A plan to invest in microservices technology will enable you to more seamlessly adopt cloud. For example, we’ve repackaged software functionality into business services capable of running in the cloud or on-premise from a single code base. This provides a smooth transition to the cloud and leverages a modern architecture with extensive functionality to capture new business, accelerate underwriting and ease policy administration. As you move your processes to the cloud you must also reimagine them to optimize distribution strategies, minimize channel conflict and develop products that meet consumers’ needs and align with the right channel.

3. APIs

As the underpinning of the insurance ecosystem, APIs go beyond being simply a connection to other organizations or systems. They represent a partnership strategy that should deliver value to your business and your customers. Whether you’re looking for operational efficiency, new or expanded distribution channels, an enhanced customer experience or all of the above, the APIs should make it easy for you to seamlessly connect and have the support of a governance framework that adheres to performance and security best practices. Look for APIs based on standards such as ACORD and use flexible architecture such as REST and RESTful. Following a strategic approach to APIs can help you avoid lengthy integration projects and ensure greater flexibility to adapt as your needs and those of your customers change.

With 77 percent of executives agreeing that ecosystems will generate more than half of their organization’s revenues in the next five years[1], leading insurers should adopt an ecosystems mentality, using partnerships to augment their business models, filling capability gaps and strengthening their competitive position. Accenture can help with proven use cases based on extensive insurance industry experience.

Additional reading:

Microservices: A flexible approach to deployment

Evolution versus Revolution: Why native cloud is not the answer … yet.

How insurers can strengthen their ecosystem capabilities

1. Cornerstone of Future Growth: Ecosystems Research Connection, Accenture Strategy