Other parts of this series:

The first part of this blog series introduced Accenture’s strategic resilience framework. In this blog, I will expand this introduction to take you through our framework step by step using the lens of sustainability and ESG (environment, social and governance).

Sustainability and ESG trends are huge impact drivers in insurance—they are also among the most complex, unknown and disruptive. Tackling this issue can feel overwhelming because of how unclear the future is: How will climate change accelerate the frequency and severity of catastrophic (CAT) events? How will climate change along with the call for more social justice impact the economy, and by extension, consumer finances and preferences? Will stakeholder capitalism profoundly alter the current economic system and political landscape?

Current trends impacting sustainability in insurance

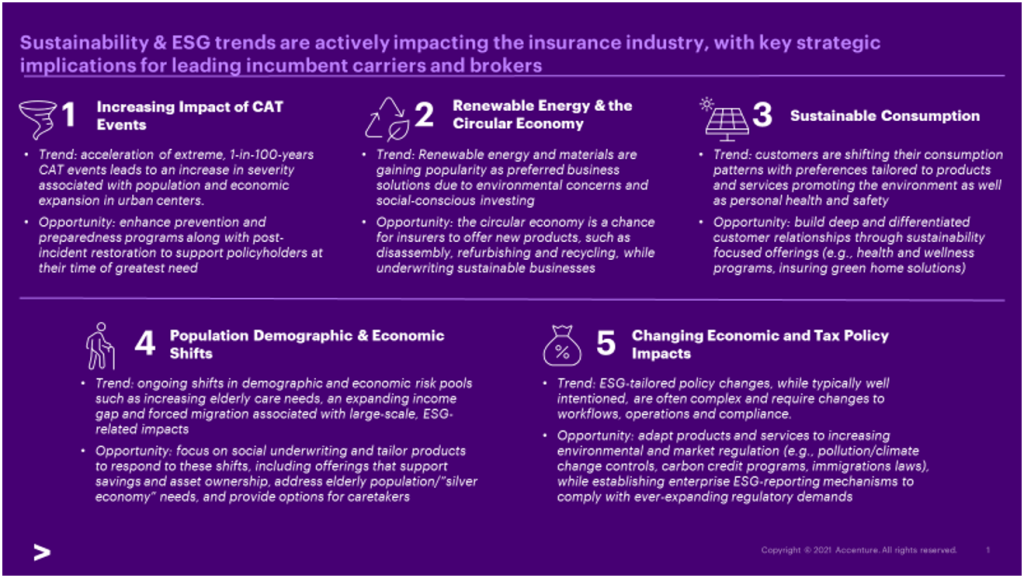

Some trends present opportunities for insurers, while others present challenges—both are important to prepare for. Below, I’ve outlined five sustainability and ESG-related trends currently impacting the insurance industry (and the world). This is a high-level, small snapshot of the potential impact of these trends.

Use the unknown to move from trends to scenarios

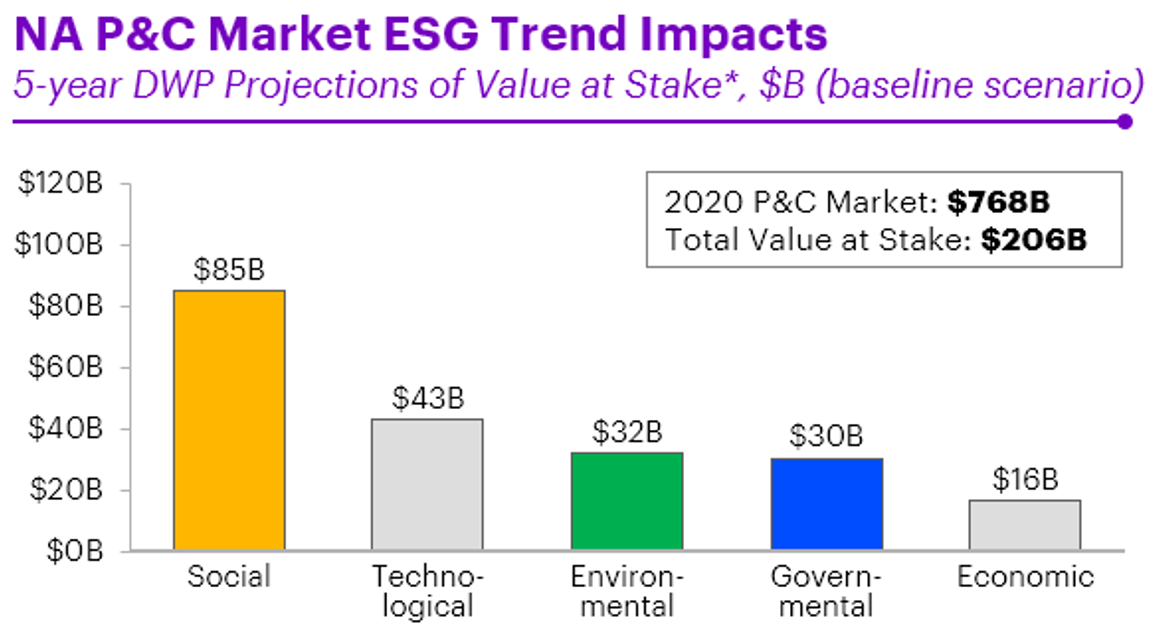

There is a real risk to ignoring these sustainability trends in insurance—and a real opportunity to respond to them. Looking at the opportunities in the North American P&C market, we found that ESG-related trends are projected to drive a $206 billion opportunity in the next five years. If these trends accelerate, that opportunity could increase to $385 billion.

*Value at stake includes both new premium opportunities entering the market and legacy premium shifting to new product offerings

If not responding to these sustainability and ESG trends isn’t an option, what is a business supposed to do when the future of these trends remains unknown? The answer is scenario planning through a strategic resilience framework.

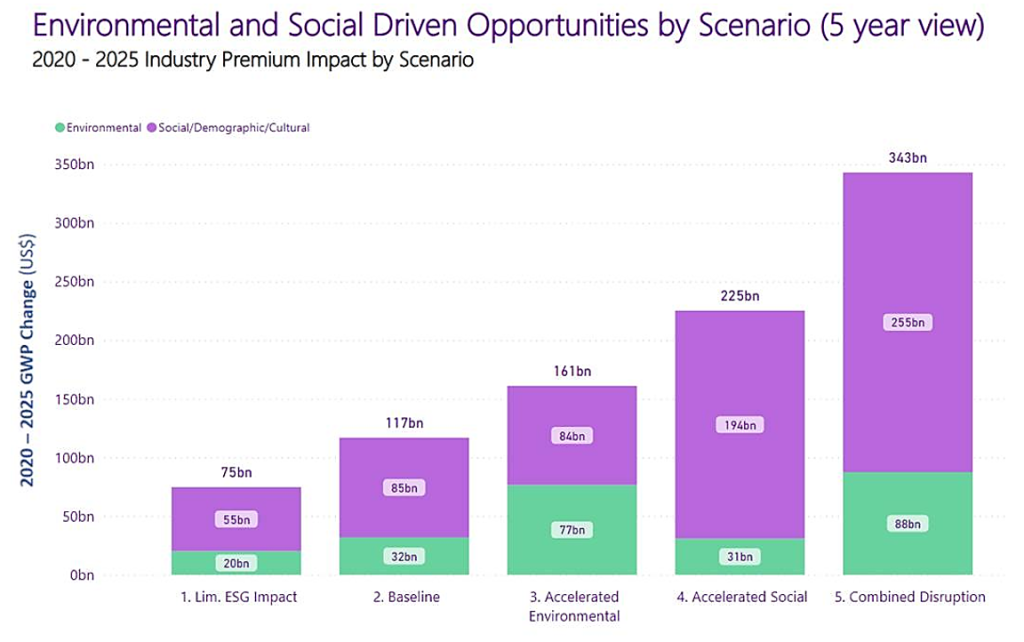

Since these trends are based on the “social,” “environmental” and “governance” pieces of the PESTEL framework, we can create a graph to understand what happens if these categories accelerate or decelerate. (Note: Governance combines political and legal, and is integrated into the social- and environmental-focused scenarios).

This really is the heart of strategic resilience. By their nature, trends are a high-level vantage point because the details of how they play out could change at any moment. Strategic resilience is designed to withstand this uncertainty. By looking at what will happen if these trends accelerate, businesses can make long-term decisions to build-in resiliency from the start of their strategy planning.

Turn scenarios into an actionable roadmap using Accenture’s strategic resilience model

The point of scenarios is to arm your business with knowledge. When you envision a world where a trend moves faster or slower, you give yourself a range of potential scenarios to work with when deciding on a strategic roadmap. So then how do you determine which scenario(s) to follow?

The future world is only one piece of the puzzle. You still have the current reality of the trend to contend with, and you also have the reality of your current business state that will influence your decision. In essence, you need to see how the different scenarios will impact your specific business and where the greatest opportunities lie. This is why we have built a strategic resilience model.

Using our strategic resilience model, we can determine the baseline—the financial impact of each trend on its current trajectory—and then the financial impact if a trend accelerates or decelerates in ESG-driven scenarios. For example, based on the chart below, our model predicts that there will be a $117B new business opportunity in the next 5 years driven by environmental and social trends. However, the combinatorial effect of high acceleration of these trends together could yield as much as $343B. Insurers need to have their plans in place to capitalize on these opportunities.

With this information, combined with industry expertise, you can make well-informed decisions about the future of your business. Looking into the future systematically in this way can help you to stay ahead of changing winds, allowing you to tap into opportunities that your competitors might not recognize.

We might not be able to predict the future, but we can predict the range of future possibilities. This is just one example of looking at a category—sustainability/ESG—and using our PESTEL framework and strategic resilience model to build a roadmap that is both durable and flexible. In the next blog of this series, we will analyze our strategic resilience framework from a different angle—an industry angle.

You can contact Nina Jais or Ravi Malhotra for help in developing your insurance ESG strategy and using our strategic resilience model to build you a long-term roadmap that will keep you competitive and agile.