Other parts of this series:

Insurance is the industry most susceptible to future disruption.

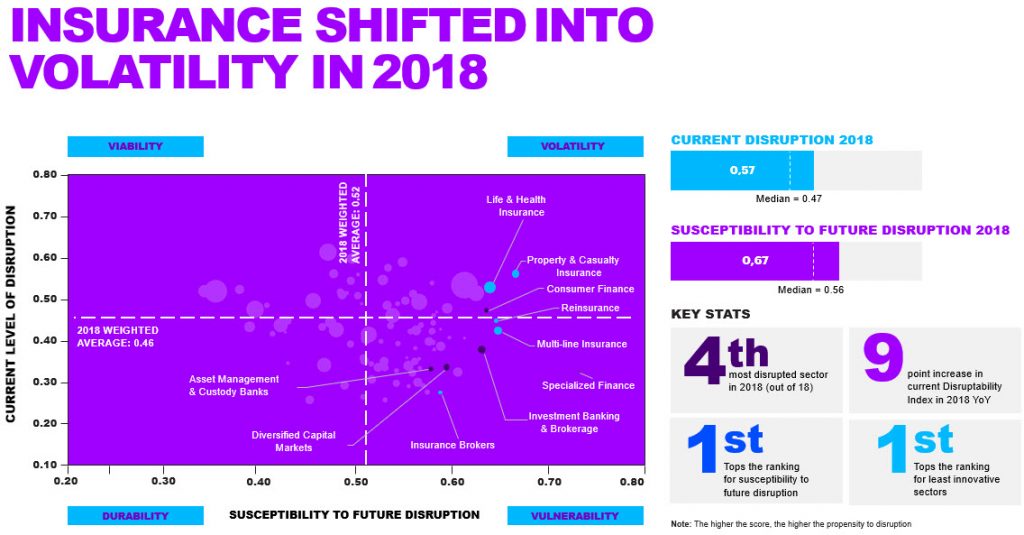

Now that the new year is underway, I thought it was a good time to share some recent research that has important implications for the insurance industry. Accenture Research recently updated its influential Disruptability Index. This cross-industry research, which surveyed more than 10 000 companies around the world, assesses the main factors that are causing disruption today, as well as those that are likely to drive it in the future. It builds on the lessons we have learned observing the acceleration of disruption across major industries over the past 10 years. The results of the new research are striking. Particularly for the insurance industry. Have a close look at the illustration below.

Insurance is the fourth most disrupted industry that we analyzed. What’s more, out of the 18 industries we studied, insurance is the most susceptible to future disruption. It scored 0,67 on the Disruptability Index for future disruption. This is ahead of both the banking sector (0,66) and capital markets (0,65). The future disruption index score, which has a maximum of 1.0, is calculated by assessing 38 indicators. They include the efficiency of capital expenditure, workforce productivity, corporate venture capital investment, brand prominence and market regulation.

The research behind the Disruptability Index shows clearly that the disruption that is currently shaking every major industry is long lasting. It does not happen in a short explosion. The insurance industry has shifted from what we call the Vulnerability stage of disruption to the Volatility Stage. In this stage, previously strong barriers to entry that once deterred new competitors have weakened and market incumbents are starting to see their traditional strengths challenged. Industry disruptors are likely to exploit these weaknesses to unlock value and put further pressure on incumbents.

“Workforce productivity has shown little improvement.”

The disruption that is sweeping the insurance industry, and is set to increase, is the result of several key factors:

Efficiency: The insurance industry has not been able to significantly improve its operating ratios. It still has a high operating cost base. Workforce productivity has shown little improvement. This is mainly because of low investment in the transformation of core operations.

Innovation: Modest spending on research and development and the narrow development of intellectual property has resulted in limited digitization of business systems and has restricted the application of digital technologies. Driven by banks, spending on digital technologies across the financial services industry has accelerated in recent years. Insurers, however, lag many of their peers in the financial services sector. For example, their venture capital investments, although much increased in recent years, are still far behind the spending of companies in many other industries.

Defenses: Insurers’ brands rarely enjoy strong consumer recognition and loyalty among their customers is often weak. As a result, insurance companies lack the brand prominence and brand experience built up by major consumer suppliers. They especially trail the big digital services companies, Google, Apple, Facebook and Amazon (GAFAs), that are shaping consumers’ expectations of convenience and experience. Furthermore, European insurance markets are often fragmented, giving new entrants plenty of opportunity to scale-up their activities and find their niche. The thorough regulation of the industry, however, remains a barrier to entry. So too do the high levels of liquidity maintained by traditional insurers. Insurers should be wary though of relying on the value of their intangible assets for protection against the threats posed by further innovation and disruption.

These factors were compounded in 2019. On-going low interest rates eroded the ability of life insurers to grow and enhance the value of their businesses. The aggressive growth of banks in the insurance business also knocked carriers, especially in continental Europe.

I’m sure many insurers, including some of my clients, will argue that insurance, particularly life insurance, is a long-term business. They’ll point out that commercial rates are raising again and claim that their main strategic challenge is to rebalance their portfolios by shifting from low-margin life savings towards higher-margin commercial and international risks insurance that is less vulnerable to competition from banks.

It’s true that none of the GAFAs have as yet entered the insurance industry, contrary to the speculations of many market watchers. We have also seen some major rebalancing of portfolios in the insurance industry. The most notable was at AXA. After acquiring XL, the company exited the US life insurance market and then took full control of its Chinese business, AXA Tianping .

However, I strongly believe that relying on active portfolio management, which is undoubtedly an important strategic lever, is not a viable strategy for insurers looking to thrive in an increasingly digital world.

In my next blog post, I’ll discuss how some carriers are meeting the challenge of industry disruption and using digital technologies to transform their business models and create new value propositions. Until then, have a look the links below. I think you’ll find them useful. Alternatively, send me an email. I’d like to hear from you.