Other parts of this series:

A radically new approach to deploying digital technology can help insurers overcome rising industry disruption and growing competition.

As I discussed in my previous post, the insurance industry is facing an unprecedented wave of threats to its traditional business and huge technology-driven disruption. The good news is that the poison can also be the remedy. Wise and deliberate use of technology can provide insurers with new defenses that will protect them in an increasingly competitive and disrupted marketplace.

These new defenses will not only ward off rising competition. They’ll also enable insurers to seize some of the new business opportunities that are likely to emerge from further disruption. To successfully implement such defenses, insurance providers need to adopt a radically new approach to deploying digital technology. They must be able to implement innovative digital systems and solutions, systematically and sequentially, throughout their organizations.

An approach that many insurers would be wise to consider is what we call a Future Systems strategy. This strategy enables organizations to scale innovation across their businesses and quickly revise their product and service offerings. Such technology-driven agility would substantially increase insurers’ competitiveness and is likely to deliver strong revenue and profit growth. It would also help insurers generate far better returns on their technology investments.

Firms that have adopted a Future Systems strategy are already reaping big benefits.

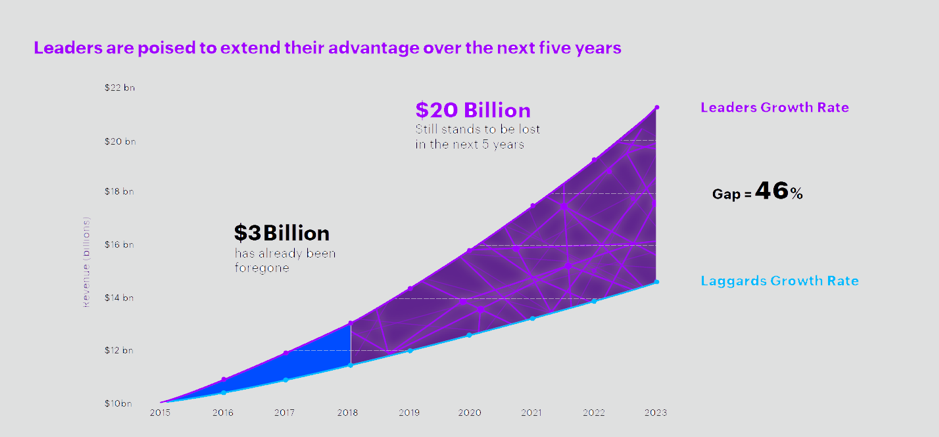

Our research shows that companies that have adopted a Future Systems strategy are growing their revenues much faster than firms that are still deploying technology in pockets or silos within their organizations and are not scaling innovation. We surveyed senior executives at more than 8,300 companies in 20 industries across the world and found that the 10 percent of organizations that are applying technology most successfully recognize the importance of scaling innovation throughout their businesses. They’re already reaping big benefits from this insight. These Leaders, companies that have adopted a Future Systems approach, are generating revenues more than twice as fast as the 25 percent of organizations that were least successful in applying technology. The poor performers, or Laggards, have already forgone US$3 billion in lost revenues because of their inability to scale innovation across their businesses. This shortfall is expected to increase dramatically in the next five years to an estimated US$20 billion as the gap between Leaders and Laggards grows (See illustration below).

Leaders set themselves apart from Laggards, and other companies struggling to implement technology effectively, in several ways. They:

Leaders set themselves apart from Laggards, and other companies struggling to implement technology effectively, in several ways. They:

- Focus on systems instead of individual technologies. They evolve Future Systems that cross organizational boundaries, are highly adaptable and combine the skills and capabilities of workers and intelligent machines.

- Adopt new technologies more quickly than their competitors. Ninety-five percent of Leaders have adopted sophisticated cloud services such as serverless computing compared with only 30 percent of Laggards.

- Concentrate not only on technology adoption but also on its penetration across the enterprise. For example, Leaders target three-times more business processes with the technologies they adopt than Laggards.

- Consider how new technology will affect people and processes within the organization and constantly develop their workforces and equip them with new skills. Ninety-one percent of Leaders are extremely effective at working with cross-department teams that combine IT and business resources to create customer-centric solutions, compared with only 41 percent of Laggards.

In my next blog post, I’ll discuss how insurers can improve their returns on technology investments and become more agile by using a Future Systems strategy. In the meantime, take a look the links below. They provide more information about what I’ve been discussing. Alternatively, send me an email. I’d like to hear from you.