Like the bankers in 2008, insurers risk going down as the bad guys of the COVID-19 pandemic.

As thousands of small UK businesses – faced with empty town centres, absentee staff and mandated closures – turned to them for support, insurers fell back upon their pandemic exclusions. In response, the FCA ultimately took a Business Interruption (BI) test case to the Supreme Court, winning a ruling with potential to impact 370,000 policyholders for the better.

What matters here are not the technical merits of insurers’ case – and these are certainly real, for it’s hard to envisage exactly how insurers could foot the bill for an event like COVID-19. The simple truth is that the BI controversy has further damaged the industry’s image, an image that was hardly in a good place to begin with.

Consumer animosity towards the sector is well documented. Insurers are perceived to make their money denying claims and penalising loyal customers with higher renewal prices – recently the subject of another FCA intervention, following a super-complaint from the Citizens’ Advice Bureau. Add to this endemic concerns around data privacy, and you have a good picture of the low standing insurers currently enjoy with much of the public.

In earlier times, this kind of brand damage could have been shrugged off. After all, the insurance industry has not survived over three centuries by having thin skin. However, poor reputations are really hurting insurers. Even as we enter what some have heralded as the “post-brand era” – an era of total commoditisation – brand is more important than ever.

Why brand is the fulcrum of digital change

We hear – and indeed say! – a lot about insurers’ need to digitally transform themselves: delivering customers a personalised service on their chosen device, via their chosen channel, 24/7. But all of this is powered by customer data, which represents a potential source of friction.

Insurers are of course moving closer to customers’ data – via APIs and Open Insurance for example – but this doesn’t quite bring them all the way.

Even if sharing data is as simple as one click, customers must still consent, they must still trust in the security of the process, and they must be confident they will receive in exchange the personalised service that’s being promised. Brand will always be the last mile of the last mile – as a deal closer if nothing else.

When customers lack trust in a provider, they are less likely to share their data. This in turn limits that provider’s ability to develop and roll out next-gen personalised services – because these services live through data, customer engagement and rapid iteration.

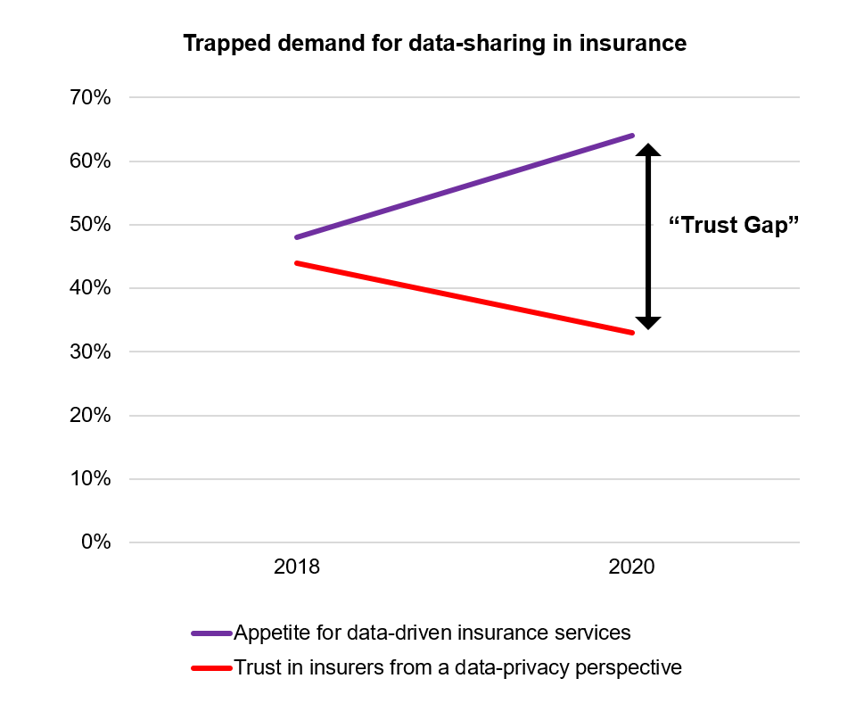

Brand can therefore become firms’ hidden superpower as they battle for data-driven advantage. And the amount of trapped demand for data-driven services in insurance will only increase, with consumer appetite growing at the same time as consumer trust in sharing data is falling:

Source: Reinventing UK Insurance for Today’s Consumer, 2021

Our recent consumer study, Reinventing UK Insurance for Today’s Consumer, shows a 16-ppt increase from 2018 to 2020 in UK consumers who “would share significant data on health, exercise and driving habits in exchange for lower insurance prices”. Meanwhile, the share of consumers who “put a lot of trust in insurers from a data-privacy perspective” fell by 11 ppts. We are left with a ballooning “trust gap”.

Digital transformation, as ever, runs on digital technologies. But it’s through a brand that insurers will gain maximum leverage from their digital investments – closing the trust gap and unlocking the customer data to power the next generation of digital services.

So, what makes a strong insurer brand in the age of data-driven everything? Two things: purpose and delivery.

Technology Vision for Insurance 2021: We outline five emerging technology trends that will impact the insurance industry in 2021 and beyond.

LEARN MOREPurpose-driven insurance brands

Once upon a time, consumers expected products to do what they said on the tin, and insurers existed to provide one thing: insurance cover. Nowadays, when they shop, customers are buying more than just a product, they’re buying into a set of values – a social, environmental or lifestyle purpose. By mirroring these values, through actions rather than words, insurers can win the trust of upcoming generations of buyers.

Insurers are no strangers to lifestyle values, since these directly impact risk, especially in health insurance. Social and environmental values on the other hand are less closely tied to risk, but this doesn’t stop them from weighing heavily on customer buying decisions.

By being socially and environmentally responsible organisations, insurers can avoid negative PR and the accompanying consumer penalty. Furthermore, they can actively court the attention of ESG-minded customers through targeted products, both on the underwriting and the investment side.

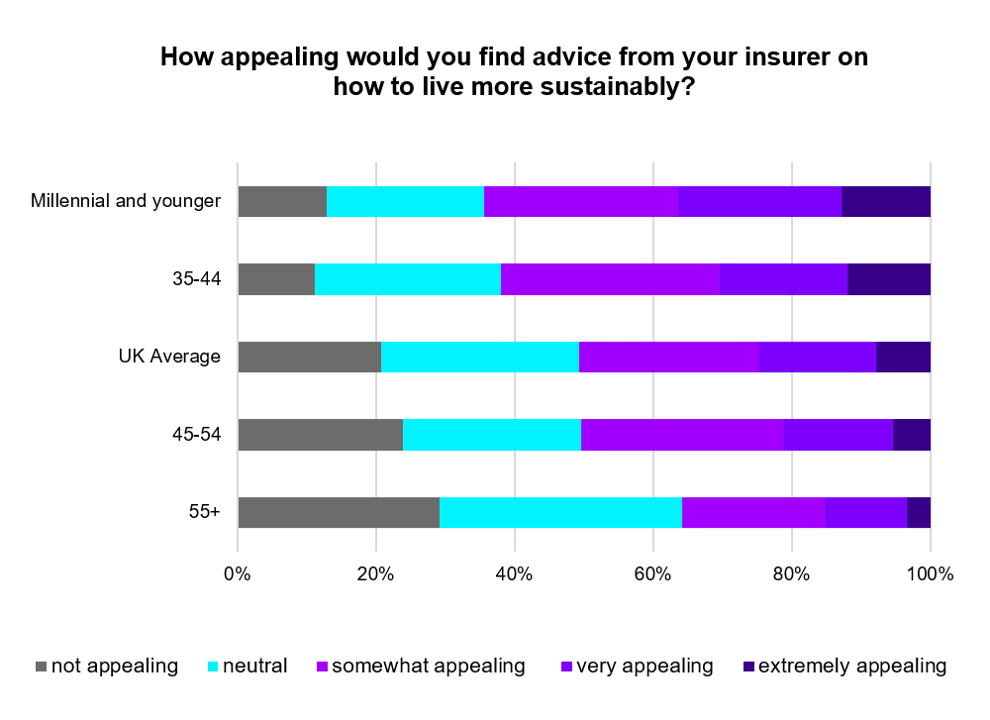

For a start, insurers can use their investment pool for good, financing sustainable real estate for instance, or offer green investment products to customers directly. They can also underwrite the green economy – things like solar and wind farms – or provide social insurance, including schemes to protect the financially vulnerable. We even find appetite among consumers – especially younger generations – for advice on sustainable living:

Source: Reinventing UK Insurance for Today’s Consumer, 2021

Some of these ESG-focused opportunities may appear small in themselves, but this needs to be understood in the wider context of business in 2021: a context where firms propose and customers dispose, and a little bit of brand uplift can go a long way.

Bad brands promise, good brands deliver

Purpose-driven brands are winning consumers’ attention and approval – but is this the same as winning their trust and, with it, the chance to offer a more data-driven, personalised service?

Fundamentally, trust is backed by experience. You trust a lock that has never failed, just like you trust a friend who has never let you down. For as long as customers receive poor value from the sharing of their data – or worse, badly mis-personalised experiences – insurers will fail to grow trust, irrespective of how well their wider values align.

The mismatch between promise and delivery in insurance goes deeper still. Policies are complex and customers seldom insurance experts. Often, the cover they think they’ve got is not the cover they’re actually getting. This means that, even when insurers have legitimate grounds to deny a claim, many claimants are left feeling cheated and distrustful – just as we saw during the recent BI controversy.

To combat this, insurers must promote greater awareness of what a policy covers and what it does not. A multitier communications strategy – involving easily digestible web content, chatbots and customer service agents – can drive better customer education, fewer denied claims and higher levels of trust.

New FCA rules banning dual pricing are the further wind in the sails of brand-conscious insurers.

By its very nature, dual pricing is a misalignment of promise and delivery – and therefore kryptonite to customer trust. They waken from the dream of onboarding discounts – too good to be true, one might say – to the bitter reality of renewal pricing. And insurers have only been incentivised to maintain this sorry misalignment, since these fierce price hikes for loyal customers are precisely what funds the fierce competition for new business.

In this sense, the insurance market has become a machine for mistrust, with insurers effectively selling long-term reputations for short-term advantage. The FCA’s ruling turns that dynamic on its head: rather than competing on how much toxicity they can endure, firms will instead be rewarded for actively cultivating good reputations. And it’s those that have looked after their brands that now have the head start.

So, perhaps insurers aren’t the bad guys after all. At least, it doesn’t have to be that way. As is so often asserted, the industry has a chance to radically transform the role it plays in consumers’ lives. But this won’t come principally through tech. First and foremost, it’s about doing the basics well: building purpose and delivering on promises. In a world fixated on digital innovation and digital innovators, good old-fashioned brand strength may yet win the day for incumbents.

For the latest consumer trends in UK insurance, and how providers can make every component of their business serve the customer via a “business of experience” approach, download our new report, Reinventing UK Insurance for Today’s Consumer. If you’d like to get in touch or to discuss any of these ideas further, please reach out to me.