Other parts of this series:

While the insurance industry is not known for being a technology pioneer and many insurers have been slow to embrace cloud technology, it’s clear they see the writing on the wall. In the past, key barriers to cloud adoption have been complexity in migrating legacy systems combined with privacy and security concerns. However, many insurers today recognize they have to overcome these stumbling blocks and transtition to cloud to stay competitive, especially as customer-facing applications continue to drive growth.

And the survey says…

To get a better understanding of the current insurer readiness landscape and help insurers define a path forward to cloud adoption, Accenture recently published an insurer cloud readiness report―based on a global survey of fifty insurance company executives.

Among the key findings are that:

- Most insurers have embraced the cloud and are beginning their transition.

- Many insurers still have a long way to go in migrating their core platforms to the cloud.

- Insurers are increasingly turning to the cloud for benefits such as cost savings, speed to market, capacity and flexibility.

- Almost all insurance executives envision a digitally transformed financial services industry over the next five years.

This is encouraging news, underscored by the following study results:

- Ninety percent of insurers have a coherent, long-term plan for technology innovation that reaches across their entire company.

- Nearly eleven percent of insurers’ average IT budget will be earmarked for the cloud over the next three years.

- More than half (56 percent) of insurers have developed and implemented a new IT operating model to support the transition to the cloud.

- More than two-thirds (68 percent) of insurers have completed formal planning and analysis of how to move legacy applications to the cloud.

Beyond making the case for change to actually making the change

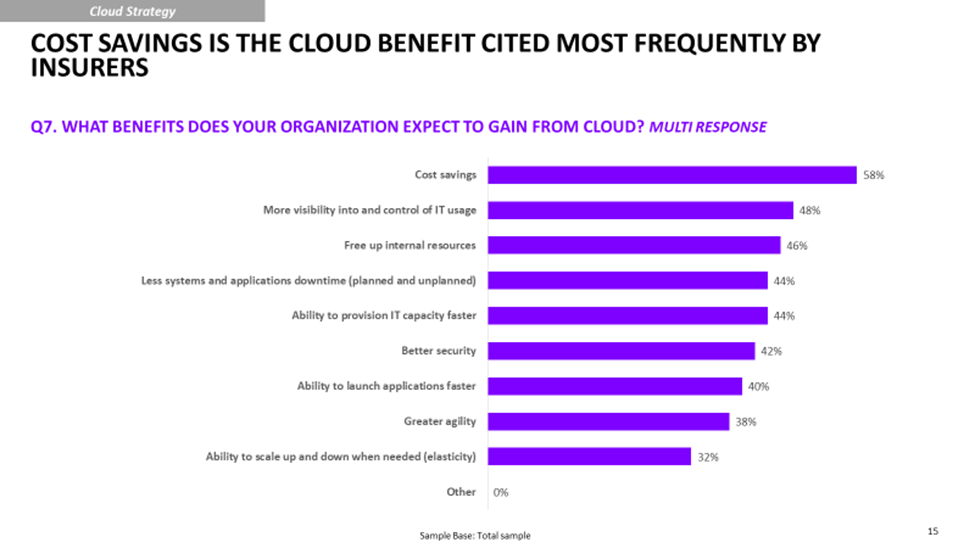

Our study also indicates the benefits of cloud adoption are very apparent to the insurance industry. Costs savings is the most frequently cited benefit (Figure 1). However, many insurers also believe cloud should accelerate their ability to bring new products and services to market, help with integrations following mergers and acquisitions, improve reliability, and result in a better customer experience. Geography and the current level of adoption both have an influence over which benefits insurers find most compelling.

Figure 1. Cost savings is the cloud benefit cited most frequently by insurers

Source: Accenture Cloud Readiness Report―Insurance, June 2019

The cloud as a market opportunity enabler

Accenture’s 2019 Technology Vision survey indicates that more than eight in ten insurance executives agree that digital demographics give their organizations a new way to identify market opportunities for unmet customer needs. Cloud provides a way of organizing, analyzing and accessing this digital insight. Learn more in Accenture’s Technology Vision 2019 report.

While insurers as a whole are further along in their cloud strategy and implementation than might have been expected, given the industry’s reputation for being relatively slow-moving in terms of innovation, there is still work to be done. In my next post, I’ll highlight key areas for you to consider when expanding and accelerating your cloud transformation as well as provide you with key steps you can take to improve your cloud transformation.

For more information about insurer readiness for the cloud, read the Accenture Cloud Readiness Report ―Insurance