Consumers are wearing their hearts on their sleeves, their wrists and a host of other body parts, thanks to current and nascent wearable technologies. At an estimated $84 billion by 20221, wearables, combined with AI and its ability to glean insights from an abundance of disparate data, present an opportunity for life and annuity carriers to address common strategic business areas: growth and customer focus.2

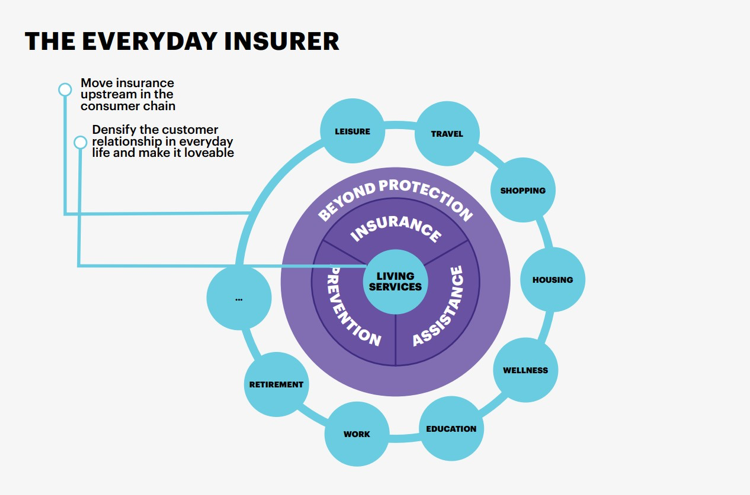

The opportunity to address these strategic imperatives lies in the carrier’s ability to remain relevant to policyholders by increasing the number of touchpoints throughout the moments that matter in a policyholder’s life. Accenture calls this “living services.” If insurers are to keep pace with evolving consumer expectations, these services must be frictionless, hyper-personalized and enjoyable. Living services and the health wealth convergence provide life insurers an opportunity to create new revenue streams from products and services beyond insurance.

Become an “everyday insurer” to win new customers

As the lines between life, health and wealth protection blur, insurers must connect further upstream with customers and throughout the policy lifecycle through alliances and partnerships with complementary protection and prevention services. The chart below identifies key touchpoints in a consumer’s life that, with relevant partnerships, can bring new opportunities for insurers and their partners.

Take wellness, for example. The insurance industry can access many more sources of third-party wellness data—some in real time—including wellness scores and risk engines that enable underwriters to provide even more accurate pricing for a greater number of discrete segments. Technology exists today that makes it possible to leverage wellness data to provide incentives for consumers to improve their overall health and financial wellbeing. According to Gartner Inc., the industry will move increasingly toward proactive health monitoring over the next two to five years, after which it will set its sights on interactive life / health management. To get there, the research house claims, insurers will need to shift not only their business focus but also their digital and technology focus.3

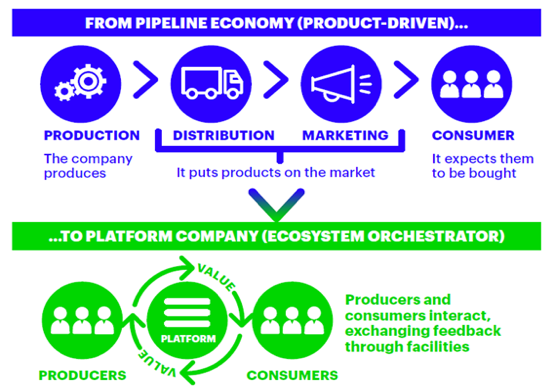

What’s required to succeed in the new world of connected health and wealth is a digital insurance strategy that leverages Internet of Things (IoT) platforms and a combination of technologies ranging from hyper-personalization and intelligent enterprise to intelligent automation and predictive disruption. These technologies, integrated with a digital insurance platform, enable more complex interactions at scale than simply selling insurance alongside other products and services. This consumer-centric strategy shifts the opportunity from selling products to delivering outcomes such as better health and wealth protection by reducing risk to both.

Consider the John Hancock Vitality® program that rewards policyholders for healthy living and includes the use of fitness trackers to verify healthy behavior. Policyholders on the Vitality program engage with John Hancock nearly 600 times per year. John Hancock claims Vitality customers generate 30 percent lower hospitalization costs than the rest of the insured population. The program has also shown its ability to significantly reduce customers’ morbidity and mortality rates. The intense engagement, together with a steady flow of rewards, builds customer loyalty and satisfaction. The wealth of data that Vitality provides also allows the insurer to assess risks and price insurance with more precision than carriers using coarser aggregate data, therefore potentially becoming more competitive and profitable. John Hancock has now integrated Vitality into all of its life insurance policies. (Source: AccentureTechnology Vision for Insurance 2019)

Insurers must shift to a collaborative digital business model and connect with consumers where they are digitally present and engaged, such as with a fitness tracker, telehealth platform or shopping on an ecommerce platform. Through APIs, insurers connect the digital insurance platform to data from the fitness or ecommerce platform, and vice versa. They then apply AI to build digital personas for specific individuals at specific moments in time, at which point they deliver relevant advice. As these touchpoints increase over the policyholder’s life, insurers and producers alike deepen their relationship with the customer, which can lead to profitable new business. In fact, our Accenture 2017 Global Distribution & Marketing Consumer Study found that consumers are asking for this type of service—and they’re willing to pay more for it. In the study, 46 percent of consumers not only indicated that they would pay more for personalized, real-time services, but also that they’re willing to share more personal data to get them.

Image Source: Accenture Research based on Accenture paper “Evolve to Thrive in Emerging Insurance Ecosystem”; Accenture Financial Services’ Global Distribution & Marketing Consumer Survey, 2017

We believe that insurers who connect health and wealth will gain a significant competitive advantage. The technology exists today to make the connection. Accenture is helping carriers adopt a digital insurance platform that seamlessly connects with a variety of ecosystems to uncover profitable opportunities, unlock trapped value and breathe new life into life insurance.

Learn how Accenture can help your insurance business innovate and grow.

References:

- Gartner, Forecast: Wearable Electronic Devices, Worldwide, 2018, Alan Antin, Ranjit Atwal, Tuong Nguyen, Oct. 24, 2018.

- Ibid

- Gartner,The Convergence of Life and Health Insurance Requires Interdependent Ecosystems, Richard Natale, Kimberly Harris-Ferrante, Bryan Cole, May 22, 2018.

Fitness trackers, home IoT devices record our day-to-day lives and insurance companies can surely aid to such data by providing policy rewards to help people live sustainable lives…