Other parts of this series:

Blockchain has great potential to create value for insurance organizations. But these are the three questions to ask before you make the investment.

In my last post, I spoke about why teamwork is the key to unlocking blockchain’s true value. Today I want to talk about the key things to consider before pulling the trigger on investing in blockchain. Not because I want to deter you, but because it might not be the right solution for you at this time.

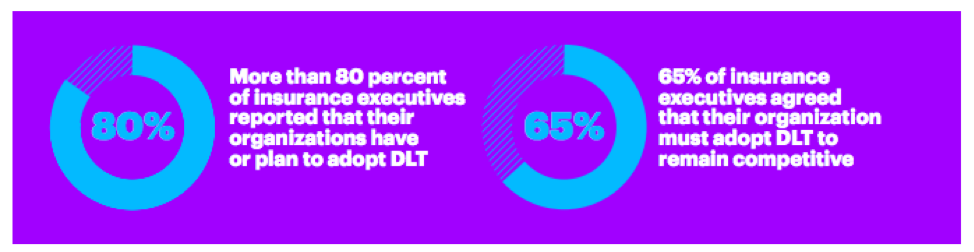

With most (80 percent) organizations adopting or planning to adopt DLT and 65 percent agreeing that DLT is a must to remain competitive, the insurance industry has the appetite for it. But as with any new technology, it’s important to step on the “fast-follower” brakes and look past the bright and shiny to the challenges and risk that come with blockchain.

When my clients approach me about blockchain and DLT, I always ask them three fundamental questions:

1. What do you want to use blockchain for?

Your answer determines whether blockchain is the right solution for your organization. Why? Because blockchain and DLT are solutions to a limited set of problems. If you have no need for transferable information and simply want to store data, it makes no sense to invest in blockchain. The cloud would be more beneficial. Key point: DLT isn’t the only solution available. It’s one of many that can work together or be a foundational technology.

2. Do you have a strong foundation for blockchain to succeed?

Even foundational technologies need a base from which to start. While blockchain may benefit your company, you must also be able to meet certain challenges:

Privacy – Blockchain records ALL transactions. Is your organization ready for that level of transparency?

Immutability – One of the benefits of blockchain may also cause a snag. Removing a link from a blockchain is not easy—and if you change one thing, you change everything.

Scalability – A blockchain can become quite lengthy, so technology stacks should be designed for the long haul.

Workforce – Are your workforce and organizational culture ready to support the specific technologies for DLT?

Governance – DLT requires a robust governance structure that can be better achieved through collaboration within an ecosystem.

3. Are you ready to be a team player?

As I wrote in my last post, teamwork makes the blockchain dream work. DLT is a team sport and I’ve found that blockchain especially shines when applied in a network and with companies working together—even when those companies include competitors. Whether it’s as a market leader or as part of a peer network, if blockchain is the right solution for an organization, the value will come from more than the technology. It will be from cross-industry collaboration to build trust and create efficiencies for everyone involved—that is, the team.

I want to share one last story with you. I have a client who decided not to move forward with blockchain implementation after initial proofs of concept. They realized they would need to invest a lot of time and effort into ushering their selected platform into the industry and sign on fellow insurers to make it work. Although a market leader, the organization realized they weren’t yet prepared to drive the required efficiencies to bring the industry along for the ride.

As I would with any of my clients, I encourage investment in a solution that will create value for your organization—but the reality is that blockchain might not be it… yet. For more insight on blockchain as insurance’s team sport, click here or connect with me directly.