Other parts of this series:

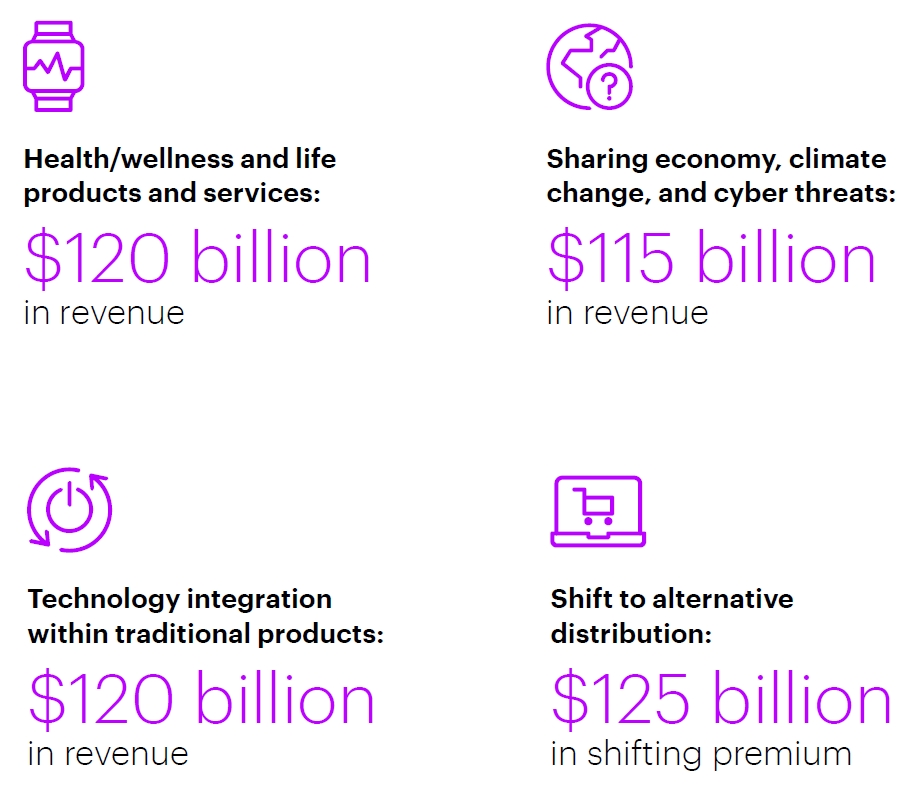

The insurance revenue landscape is shifting in a myriad of fast-acting, unexpected ways. In our recent Insurance Revenue Landscape 2025 study, we were able to analyze customer demands to understand the trends shaping global revenue pools. Based on this research, we predict that the insurance industry will be influenced by the following four areas of innovation.

Source: Accenture Insurance Revenue Landscape 2022

Health/wellness and life products and services

Insurers are increasingly tailoring their insurance value propositions to encompass areas of health and wellness. This is made possible through technologies such as telematics, AI and complementary ecosystems with mental and physical healthcare providers. Rising target markets such as aging populations and millennials are particularly ripe for relevant insurance interventions.

For example, Sanitas Seguros of BUPA Group in Spain has introduced the health telematics solutions BluaU for the digital monitoring of vital signs, as well as the real-time follow-up of pathologies. COVID, obesity, asthma and heart disease were the first diseases constantly monitored through digital tools by Sanitas doctors. With BluaU, the company takes a further step in the development of a more humane medicine facilitated by technology, a more accurate and personalized medicine, based on data, which allows professionals to diagnose and treat patients with continuously updated information. Through various wearables or devices, such as a digital scale, pulse oximeter or thermometer, the Health Promotion Service (SPS) team within Sanitas digitally monitors each patient through Sanitas app. The monitoring by the medical team is carried out through data that is collected automatically, sent by the devices that are connected with the app via Bluetooth. Thanks to the real-time monitoring, Sanitas medical team can detect any alteration and react accordingly.

Sharing economy, climate change and cyber threats

While many emerging risks will impact insurance revenues, we see three as particularly relevant now: climate change, the sharing economy, and increasing cyber threats. Environmental catastrophes and damage linked to climate change are becoming a growing risk to insurers and challenging previously reliable P&C risk models.

Insuring in a way that addresses the needs of the sharing economy will help insurance carriers connect with younger demographics that do not necessarily own, but rather share, their assets.

Tapoly in the UK, for example, uses technology at all customer touchpoints to offer commercial line insurance products to micro SMEs and freelancers.

As work and personal lives intersect—many times on shared devices—cyber threats to personal data and digital assets have grown into an important risk to be mitigated. Chubb is an example of an insurer who is rising to the challenge. Their personal cyber insurance supplies a variety of services to their customers, which will help them mitigate risks, keep safe online, and avail of practical support if they fall foul of certain cyber-related incidents.

Insurance Revenue Landscape 2025: Our report examines 4 key areas of innovation that offer revenue opportunities for insurers over the next 5 years.

Learn moreTechnology integration within traditional products

Technology is changing the way insurers do business, as well as the products and services they offer. From telematics devices to data-driven AI, technology allows for increased personalization of products, services and rates.

Consider the examples of Hippo. Hippo offers protection services including virtual home inspection/maintenance services, and accident prevention services which can also include eligibility for discounts upon the installation of smart monitoring devices. Hippo recently partnered with ADT and handdii to improve the security and home repair services it offers policyholders.

Shift to alternative distribution

Insurers need to innovate to stay relevant and compete with tech-centric players who are also targeting the insurance value chain. Tesla, for example, provides behavior-based auto insurance coverage to Tesla owners in California through their in-vehicle platform. Thankfully, there are opportunities for insurers to partner with peers in different markets to offer fresh, relevant value propositions. In Spain, telecom company Orange has partnered with Zurich to offer home, life, and small commercial insurance to its customer base.

In conclusion, these four areas of innovation will challenge insurers to think beyond the boundaries of their historic insurance offerings. However, with strategic plays and deep customer knowledge, change – and success – is possible.

For further insights read the Insurance Revenue Landscape 2025 report.

Get in touch to discuss your innovation strategy.