Other parts of this series:

Let’s explore the what, how and why of APIs and how to get started with open insurance ecosystems for your business.

In my last post, I looked at industry trends started by open insurance pioneers embracing ecosystems.

The recent open insurance report from Accenture shows that 75 percent of insurers believe that half or more of their revenues will come from ecosystems and the application programming interfaces (APIs) that support them.

But first, you might be saying, “Okay, but what is an API?” and that’s what I’ll be covering today—the what, why and how. These are common questions I’ve received from clients and I’ll break it all down here, with a few examples for context.

What is an API?

An API is a way for two (or more) companies to communicate information in a secure and standardized way. This creates a mutually beneficial partnership. For instance, you may choose to give your API partner a piece of the profit margin that its API is helping you grow.

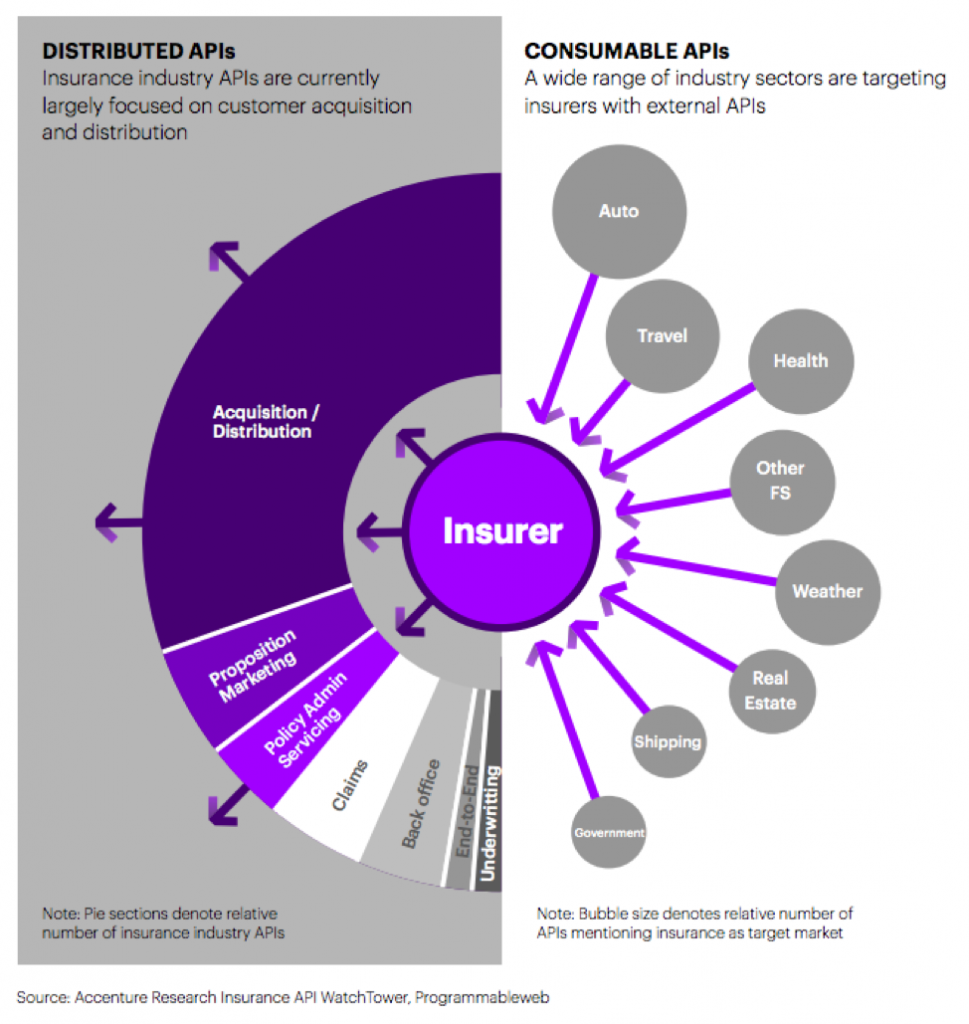

The majority of APIs in the insurance sector are distributed APIs focused on acquisition and distribution. But there are many opportunities for consumable APIs from other sectors to enhance insurance provider offerings. Examples include smaller products aimed at specific risks and the ability for an insurer to connect with a repair shop to send a mechanic to the site of a customer car accident.

How do APIs work?

APIs use automated forms to enable another party to, for example, sell your services through shared, permission-based access to data. You would provide your partner with an API key that allows access to the information they need to provide the service you have agreed upon. Or vice versa.

The APIs from US startup Lemonade are a nice example of how open insurance can provide new routes to market and shake up distribution channels. Lemonade targets real-estate companies and financial advisors that want to complement their offerings with homeowner and tenant insurance products through their own digital channels. For example, a realtor’s website would have a customized Lemonade form in their website sidebar.

What are the benefits of APIs for my customers and my business?

As I mentioned earlier, APIs are a standardized and secure way to communicate information. This is an especially important benefit in the financial services sector. APIs also enable more effective and streamlined processes that make space for:

- Innovative customer propositions

- Operational benefits

- New revenue

- New partnership models

Specific to insurance, here are a few examples of the benefits of APIs and open insurance across the industry:

Does my company need to develop an API?

My answer to this question is always with another question: What do you want to do?

Depending on the answer to the above and your current capabilities, you may or may not need or want to develop an API—or go beyond development. This is where partnerships come in.

Like blockchain, connected ecosystems and open insurance are all about teamwork. For instance, I have a startup client who saw a gap in the market and wanted to start selling ASAP. To do this, the company decided to build the API and find another party to build the front end (website, etc.). By working with a partner—who will receive the API key—my client will get the product into the market sooner.

Another scenario might see your company choose a consumable API from an external sector. As an example, a travel insurance provider might partner with booking.com to have the accommodation site’s API on its website.

How should my organization go about creating an API program?

Key areas for insurers to focus on as they start to experiment with and make friends with open insurance are:

- Technology—Complete decoupling and build API-enabled, data-rich (open) architecture. The right technology infrastructure is key to enabling insurers to plug into or architect ecosystems, while managing the security risks associated with open data exchange.

- Organization—Assess and understand your current enterprise capabilities and gaps. Where can partners help you?

- Partnerships—Develop new strategies, capabilities and models.

Though we face uncertainty with COVID-19, there’s no better time for companies to think outside the box. The insurance sector is known to be tentative with new technologies, but open insurance and its enabling APIs are the future of the industry. Whether you want to be an ecosystem architect, partner, or commodity provider, now is the time to get started.

For more information on APIs and open insurance, download the full report or feel free to connect with me directly.